In Arizona’s competitive housing market, many homebuyers are looking for a more affordable and flexible path to ownership. Modern mobile homes, often referred to as manufactured homes, offer a compelling solution with features and amenities that rival traditional homes, all at a significantly lower cost. Crucially, manufactured home lenders in Arizona specialize in a variety of financing options, from traditional mortgages to chattel loans, making it easier than ever for a new generation of buyers to realize their dream of homeownership.

Common Loan Types:

- Land-Home Loans: For homes on land you own, treated as real estate.

- FHA Loans: Government-backed loans with low down payment options.

- VA Loans: 100% financing for qualified veterans.

Arizona’s manufactured housing market is expanding rapidly, driven by economic growth and the demand for homes and land. These homes offer lower purchase and maintenance costs, making them an attractive option for first-time buyers and downsizers.

The key financing distinction is whether your home is on owned land (eligible for traditional mortgages) or leased land (requiring specialized chattel financing). Lenders typically require homes built after 1976 that meet HUD standards, a credit score of at least 620, and a debt-to-income ratio under 43%.

Modern manufactured homes also offer unique benefits like customization, energy efficiency, and quality control enforced by HUD standards.

Understanding Your Options: Manufactured and Modular Homes

Terms like manufactured and modular may be confusing at first, but these distinctions are crucial because they directly impact your financing options.

Manufactured homes are factory-built homes constructed after June 15, 1976. They must adhere to the strict federal HUD Code, which governs everything from structural integrity to energy efficiency. When manufactured home lenders in Arizona discuss financing, they are almost always referring to these modern homes.

Homes built before 1976 are technically “mobile homes.” Lacking HUD certification, they are very difficult to finance and often require cash purchases.

Modular homes are also factory-built but must meet state and local building codes, the same as traditional site-built houses. Once assembled on a permanent foundation, they are treated as real property for financing purposes.

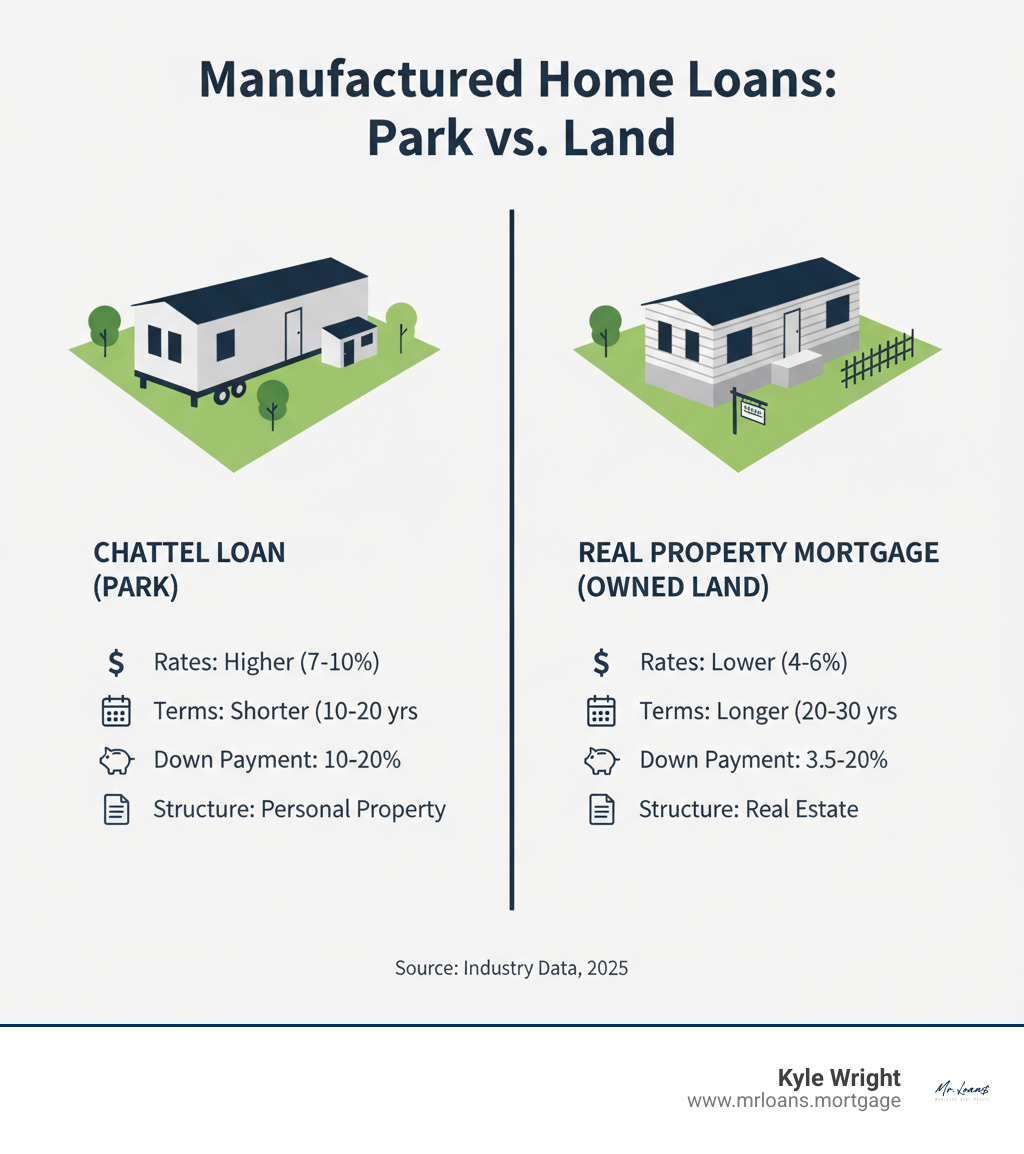

Real Property vs. Chattel

How your manufactured home is legally classified determines the type of loan you can get.

- Real Property: When a manufactured home is on land you own and permanently attached to a foundation, it becomes real property. This qualifies you for traditional mortgage financing with better rates and terms.

- Chattel (Personal Property): If the home is in a park on leased land, it is considered chattel. Chattel loans typically have higher interest rates and shorter terms because the land is not part of the collateral.

Understanding this distinction is vital, as it can save you thousands over the life of your loan.

Advantages of Manufactured Homes in Arizona

Arizona’s climate and growing population make it an ideal location for manufactured home living.

- Affordability: They cost significantly less to purchase and maintain than site-built homes.

- Energy Efficiency: Modern standards ensure lower utility bills, which is crucial in Arizona’s heat.

- Customization: Today’s models offer a wide range of floor plans, finishes, and features.

- Faster Construction: The factory-building process avoids weather delays and ensures consistent quality.

The popularity of these homes has led to more financing options from manufactured home lenders in Arizona, making homeownership more attainable.

Types of Manufactured Home Loans Available in Arizona

Finding the right loan for your manufactured home is simpler once you understand the options. Manufactured home lenders in Arizona offer several programs, especially for HUD-compliant homes built after 1976 that are classified as real property (permanently affixed to land you own).

Loan Programs Offered by Mr. Loans

At Mr. Loans, we connect Arizona homebuyers with programs that fit their circumstances. Here are the main options we work with for manufactured homes treated as real property:

FHA-Insured Loans: These government-backed loans are great for buyers who need flexibility. They feature a low down payment of just 3.5% for those with a credit score of 580 or higher. Loan terms can extend up to 30 years. Learn more on our FHA Loans page.

VA-Eligible Loans: For military families and veterans, VA loans are an unbeatable option. They offer 100% financing for qualified veterans, meaning no down payment is required. Most lenders look for a credit score of at least 580, and repayment terms can go up to 30 years. We are proud to help veterans access these benefits via our VA Loans and VA Loan Programs pages.

Conventional Loans: If you have solid credit (typically 620 or higher) and can make a 5% down payment, conventional loans offer competitive rates and flexible terms up to 30 years.

USDA Loans are another option for homes in eligible rural areas, offering 100% financing to qualified buyers. While we don’t directly handle these, they are worth exploring if you’re buying in a designated rural zone.

Our expertise lies in analyzing your financial picture to guide you toward the loan that makes the most sense for your manufactured home purchase in Arizona.

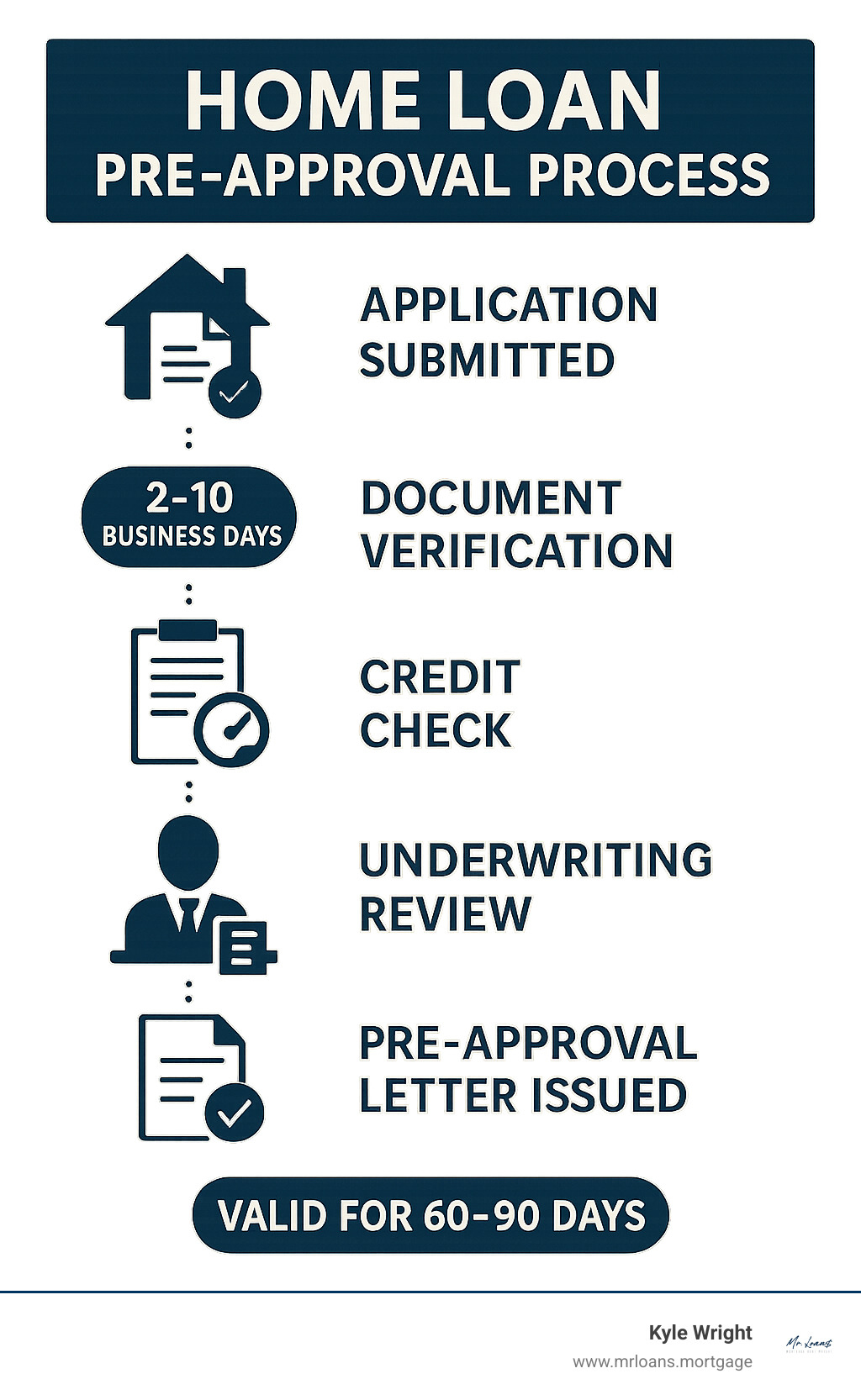

Qualifying for a Loan: What Arizona Lenders Require

Getting approved for a manufactured home loan is straightforward when you know what manufactured home lenders in Arizona are looking for. The process begins with your application and moves to underwriting, where your financial health is assessed. We guide you through every step.

Key Eligibility Requirements

While lender standards vary, some criteria are universal:

- Credit Score: Most lenders prefer a minimum score of 620. However, FHA loans offer flexibility, accepting scores as low as 580 with a 3.5% down payment, or even 500-579 with 10% down.

- Debt-to-Income (DTI) Ratio: This ratio compares your monthly debt to your gross monthly income. Lenders typically want to see it below 43% to ensure you can comfortably afford your payments.

- Down Payment: This varies by loan. VA loans require 0% down for qualified veterans. FHA loans require as little as 3.5% down, and conventional loans usually need around 5%. Chattel loans for homes in parks often require 10-20% down.

- Home Specifications: The home must be built after 1976 and comply with HUD standards. For most mortgage programs, it must be on a permanent foundation and be considered real property. The original HUD data plate and certification label must also be present.

How to Find the Right Manufactured Home Lenders in Arizona

Securing the right financing is just as important as finding the perfect home. Knowing how to choose among manufactured home lenders in Arizona can save you time and money.

Types of Lenders to Consider

- Specialty Lenders: These companies focus on manufactured home loans and understand their unique challenges, from title issues to foundation requirements.

- Local Lending Options: Credit unions and community banks can offer a personal touch and may have special programs for members.

At Mr. Loans, we combine the expertise of a specialty lender with access to multiple loan products, including FHA, VA, and Conventional loans. This allows us to shop for the best loan that matches your financial profile and home choice.

Finding Lenders for Leased Land (In a Park)

If your home is on leased land, you’ll need a specialized chattel (personal property) loan.

- In-Park Financing: This requires a lender who understands personal property loans, where only the home itself serves as collateral.

- Loan Terms: Expect shorter repayment periods (10-20 years), higher interest rates, and larger down payments (often 10-20% or more) compared to traditional mortgages.

Finding Lenders for Owned Land

If you own the land your manufactured home sits on, you can access traditional mortgage options.

- Real Property Financing: When the home is on a permanent foundation and legally merged with the land, it qualifies as real property. This opens the door to FHA, VA, and conventional loans.

- Better Rates and Terms: This scenario typically offers lower interest rates, longer repayment periods (up to 30 years), and lower down payment requirements.

Frequently Asked Questions about Arizona Manufactured Home Loans

We’ve compiled answers to the most common questions about financing a manufactured home in Arizona to help you make informed decisions.

What is the minimum down payment for a manufactured home in Arizona?

The down payment depends on the loan program and your finances:

- VA Loans: 0% down for qualified veterans.

- FHA Loans: As low as 3.5% down with a credit score of 580+.

- Conventional Loans: Typically 3-5% down for buyers with good credit.

- Chattel Loans (for homes in parks): Often require 10-20% down or more.

A higher credit score generally leads to lower down payment requirements and better interest rates.

Can I get a loan for an older manufactured home built before 1976?

Unfortunately, financing a manufactured home built before June 15, 1976, is extremely difficult. These homes were built before the federal HUD Code established safety and construction standards. Lenders view them as high-risk, so a cash purchase is usually the only option. We recommend focusing your search on homes built after 1976 to ensure access to good financing options.

How does financing a manufactured home differ from a traditional home?

The main differences stem from how the property is classified and the specific requirements for the home itself.

- Chattel vs. Real Estate: A traditional home is always real estate. A manufactured home can be either chattel (personal property, if on leased land) or real property (if on a permanent foundation on owned land).

- Title Elimination: To qualify for a traditional mortgage (FHA, VA, etc.), the home’s title must be legally merged with the land deed, making it real property.

- Home Specifications: The home must be built after 1976 and have its original HUD data plate to prove it meets federal standards.

- Lender Specialization: Fewer lenders handle manufactured home loans compared to traditional mortgages. Working with a specialist like Mr. Loans is crucial to steer the process smoothly.

Begin Your Arizona Homeownership Journey

Arizona’s growing communities and the modern appeal of manufactured homes have made homeownership more attainable than ever. For many hopeful buyers, this is a realistic path to building equity and finding a place to call their own.

Your homeownership dream is within reach, but the key is having the right guidance. That’s where the expert guidance from Mr. Loans comes in. We understand the nuances of dealing with manufactured home lenders in Arizona and can help you steer the process, whether your home is on owned land or in a community.

The financing landscape for manufactured homes has never been better. Ready to take the next step? Our team knows the Arizona market and will help you find the financing solution that fits your unique situation.

Contact us today to start your journey toward homeownership in Arizona. Let’s turn your dream into an address.

For many homebuyers, student loans are a big part of their financial picture. The good news is that having student loan debt doesn’t automatically prevent you from getting a mortgage. Lenders look at how your student loan payments impact your overall debt-to-income ratio, rather than the total balance you owe. This means that managing your payments wisely can still make homeownership possible.

For many homebuyers, student loans are a big part of their financial picture. The good news is that having student loan debt doesn’t automatically prevent you from getting a mortgage. Lenders look at how your student loan payments impact your overall debt-to-income ratio, rather than the total balance you owe. This means that managing your payments wisely can still make homeownership possible.

Many homeowners consider paying extra on their mortgage as a way to get ahead financially. While this strategy can be smart for some, it’s important to weigh both the advantages and the potential drawbacks before committing.

Many homeowners consider paying extra on their mortgage as a way to get ahead financially. While this strategy can be smart for some, it’s important to weigh both the advantages and the potential drawbacks before committing.

Buying a home isn’t just about finding the right property—it’s also about timing. Different seasons bring unique opportunities and challenges for homebuyers, and understanding these can help you make smarter decisions. For example, spring is often known as the busiest time of year, with more homes hitting the market. That means more choices, but also more competition.

Buying a home isn’t just about finding the right property—it’s also about timing. Different seasons bring unique opportunities and challenges for homebuyers, and understanding these can help you make smarter decisions. For example, spring is often known as the busiest time of year, with more homes hitting the market. That means more choices, but also more competition.