The appeal of these features is simple: they make daily life easier. Imagine being able to adjust the temperature before you get home, or checking security cameras while on vacation. For many homeowners, these upgrades provide both peace of mind and energy savings, making them a win-win investment.

From a mortgage perspective, improving your home’s value through smart upgrades can pay off down the road. Higher value means more equity, and more equity can open up opportunities for refinancing, future upgrades, or even funding a new property. It’s a small step today that can have big financial benefits tomorrow.

Smart homes aren’t just for tech enthusiasts—they’re becoming the new standard. If you’re curious about how investing in upgrades today can strengthen your financial future, visit our website to schedule a consultation today.

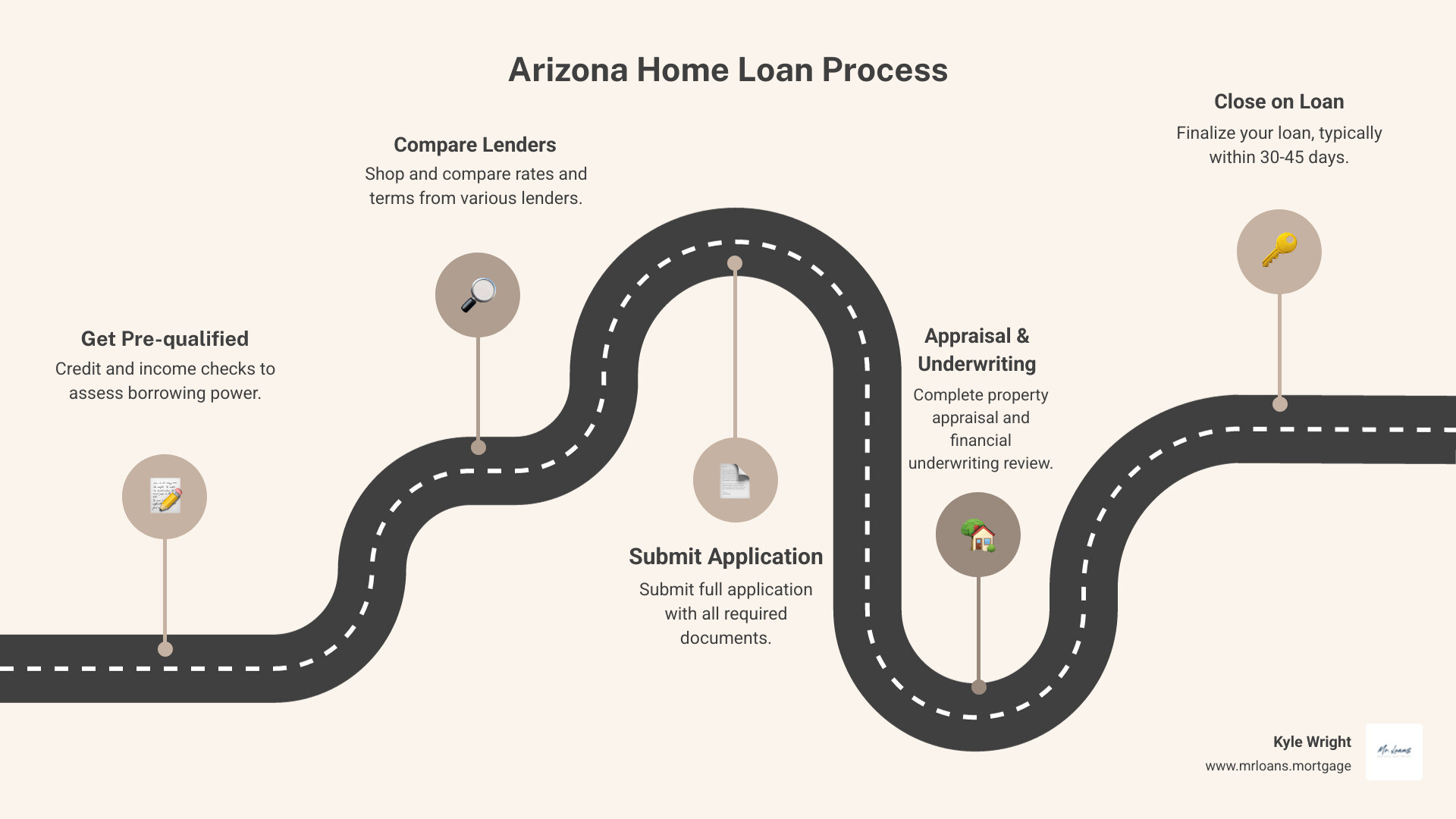

Smooth Sailing: How to Make Your Loan Process a Breeze

What Makes a Loan Process “Easy”?

An easy loan process transforms what used to be a months-long paperwork nightmare into a streamlined digital experience. Here’s what defines a truly easy loan process:

Key Features of an Easy Loan Process:

- Digital applications you can complete in minutes

- Online document upload instead of fax machines

- Fast pre-qualification without affecting your credit score

- Faster closing timelines

- Transparent terms with no hidden fees

- Mobile-friendly tools you can use anywhere

The days of taking time off work to visit a bank branch are ending. Modern lenders empower you to apply in minutes and find out how much you could qualify for, often closing your loan much faster than traditional institutions.

Traditional vs. Easy Loan Process:

| Traditional Process | Easy Process |

|---|---|

| Weeks to months | Days to weeks |

| Paper applications | Digital forms |

| Branch visits required | 100% online |

| Complex paperwork | Simplified steps |

| Unclear timeline | Real-time updates |

Whether you’re looking for a new mortgage, a home equity loan, or to refinance your current home, the best lenders now prioritize speed and simplicity. As one satisfied customer noted, they were approved when other lenders couldn’t help, highlighting the power of a modern, flexible approach.

The key difference? Easy loan processes focus on getting you answers fast while traditional methods focus on internal procedures that slow everything down.

Your Guide to a Truly Easy Loan Process

Getting a loan doesn’t have to feel overwhelming. Think of it like planning a road trip – with the right preparation and a good map, you’ll reach your destination smoothly. That’s exactly what an easy loan process should feel like, and we’re here to guide you every step of the way.

Step 1: Preparing for an Easy Loan Process

Just like packing for that road trip, preparation is everything. The beauty of an easy loan process is that once you have your documents ready, everything else flows naturally.

Getting Your Documents in Order

The paperwork might seem daunting, but it’s really just about telling your financial story. Lenders need to understand who you are and whether you can comfortably repay the loan – it’s responsible lending that protects both you and them.

You’ll need your government ID (driver’s license or state ID works perfectly), your two most recent pay stubs to show steady income, and your last 90 days of bank statements to demonstrate your financial habits. If you’re self-employed, you’ll typically need your last two years of tax returns. Don’t forget a recent utility bill or bank statement for proof of address. Having everything ready before you start your application makes everything smoother.

The Magic of Online Prequalification

Here’s where modern lending really shines. Online prequalification lets you peek behind the curtain without any commitment. You can see how much you might qualify for and what rates to expect, all without affecting your credit score.

During this step, we’ll look at your income and existing debts to calculate your debt-to-income ratio. It’s like getting a sneak preview of a movie – you’ll know if it’s worth watching the whole thing. Plus, we can tailor our offers specifically to your situation.

Want to dive deeper into what comes next? Check out more info about the loan process to see the full picture.

Step 2: Applying Online and On-the-Go

Remember when applying for a loan meant taking time off work and sitting in a stuffy bank office? Those days are gone. Today’s easy loan process brings everything to your smartphone or laptop.

Your Digital Application Experience

Modern digital application forms are designed to feel intuitive. Our APM mobile app makes it even simpler – you can apply from your couch whenever you’re ready.

The mobile-friendly process guides you through each section step by step. Instead of hunting for a scanner or fax machine, just snap photos of your documents with your phone and upload them directly. When it’s time to sign, e-signatures handle everything securely – no printing, no mailing, no hassle.

The Co-Applicant Advantage

Sometimes two heads (and two incomes) are better than one. Adding a co-applicant to your application can work wonders for your approval odds and may even help you secure a lower interest rate.

Whether it’s a spouse, family member, or trusted friend, a co-applicant shares responsibility for the loan but can help you qualify for better terms and larger amounts. Our digital system makes adding them as simple as filling in their information alongside yours.

Ready to experience the digital difference? Learn about the digital loan process to see how straightforward modern lending can be.

Step 3: Navigating Underwriting and Approval

Once you hit submit, our team springs into action. This underwriting phase might sound intimidating, but in an easy loan process, it’s surprisingly quick and transparent.

Behind the Scenes with Our Review Team

Think of underwriting as a friendly fact-check. Our lender review team verifies your income using those pay stubs you uploaded, confirms your assets through your bank statements, and runs a full credit score check to complete the picture.

Unlike that earlier prequalification soft check, this credit pull does appear on your report – but it’s a necessary step to finalize your approval and get you the best possible terms.

From Application to Approval in Record Time

Here’s where an easy loan process really proves its worth. While traditional banks might keep you waiting for weeks, we focus on speed. Our streamlined process means many customers close their loans significantly faster than the industry average.

Once approved, you’ll receive a clear loan offer showing your amount, interest rate, term, and repayment schedule. No confusing jargon, just straightforward numbers.

Getting Your Money Fast

After you accept our offer, fast funding kicks in. For a home purchase, the funds are sent to the closing agent or attorney on the designated closing day. For a refinance, the money is typically sent directly to your bank account after the mandatory waiting period. It’s amazing how quickly approved funds can travel from our systems to your account.

Step 4: Closing Your Loan with Confidence

You’ve made it to the finish line! The final step of your easy loan process is closing – where you review everything one last time and officially receive your funds.

Final Document Review Made Simple

Even though the process is easy, the documents matter. Take time to review your closing disclosure and understand your loan terms completely. We want you feeling confident, not confused.

Look closely at your interest rate and APR, your loan term (typically 15 or 30 years for most mortgages), and your repayment schedule. The good news? Most of our loans have no prepayment penalties, so you can pay them off early and save on interest.

Setting Up for Success

Consider autopay setup to make your life even easier. Automatic payments help you avoid late fees, build positive credit history, and give you one less thing to remember each month. It’s the perfect finishing touch to an easy loan process.

Need help with any loan terminology? Our glossary explains everything in plain English.

Navigating Different Types of Easy Loans

An easy loan process isn’t just for one type of financing—it applies across the spectrum of home loans. Whether you’re buying your first home, refinancing for a better rate, or tapping into your home’s equity, the goal is a simple, streamlined experience. Think of it as having a single, reliable map for different destinations—the journey feels familiar and straightforward, even if the goal changes.

Home Loans and Equity

Your home isn’t just your castle – it’s potentially your most valuable financial tool. At Mr. Loans, we’ve turned accessing this asset into an easy loan process that doesn’t require multiple trips to stuffy bank offices.

Let’s start with the basics. If you’re buying a home, our Purchase loans guide you from that first “I think I’m ready to buy” moment all the way to getting your keys. Our APM mobile app keeps everything organized, and our online prequalification helps you make confident offers in competitive markets.

Already own a home? Refinance options might be your best friend. Maybe interest rates have dropped since you bought your home, or perhaps you want to access some of that equity you’ve built up. A cash-out refinance replaces your current mortgage with a larger one, giving you the difference in cash for whatever you need.

For our veterans, VA Loans offer incredible benefits like no down payment and no private mortgage insurance. We’re honored to help make homeownership easier for those who’ve served our country.

Now, here’s where it gets really interesting – leveraging your home’s equity. If you own your home outright or have substantial equity built up, we can often lend up to 80% of what your home is worth. That’s potentially serious money for serious goals.

A HELOC works like a giant credit card backed by your home. You get a maximum credit line that you can use repeatedly, paying interest only on what you actually borrow. It’s perfect when you’re not sure exactly how much you’ll need – like during a renovation where costs can change.

Home equity loans give you a lump sum upfront, perfect when you know exactly what you need. Planning a $30,000 kitchen renovation? A home equity loan gets you that money immediately, and you’ll repay it over a fixed term, usually 5 to 15 years. You can borrow up to $400K for home projects, education expenses, or debt consolidation.

For homeowners 62 and older, Reverse Mortgages flip the script entirely. Instead of making monthly payments, your home pays you! You can convert part of your home equity into cash without selling your home or making monthly mortgage payments. The loan gets repaid when the last borrower moves out or passes away.

The beauty of leveraging home equity through an easy loan process is the flexibility. Whether you’re consolidating debt, funding education, or finally building that dream deck, your home can help make it happen.

The Fine Print: Understanding Potential Risks

While we love helping people through an easy loan process, we’d be doing you a disservice if we didn’t talk about the fine print. “Easy” doesn’t mean “without responsibility.” Every loan comes with obligations and potential pitfalls, but being informed gives you the power to make smart decisions.

Reading Between the Lines of Your Loan Offer

Your loan offer might look straightforward, but the devil is often in the details. Let’s decode what really matters.

Interest Rates vs. APR: The Real Story

Here’s where things get interesting. The interest rate is the percentage charged on your loan amount. But the APR (Annual Percentage Rate) tells the whole story. The APR includes your interest rate plus any additional fees like origination costs and mortgage insurance.

Think of it this way: if the interest rate is the sticker price of a car, the APR is the total cost after taxes and fees. Always compare APRs when shopping around – it’s your most accurate picture of what you’ll actually pay.

The Prepayment Penalty Question

Here’s some great news about most mortgages in today’s market: you can usually pay them off early without penalty. This means if you get a bonus or tax refund, you can knock down that balance and save on interest. However, always confirm this detail in your agreement – it could save you thousands down the road.

Watching Out for Hidden Fees

A truly easy loan process should be transparent about costs. It’s still smart to keep your eyes peeled for potential fees like late payment charges or administrative costs. One major red flag? Upfront fees. Legitimate lenders don’t ask for money before giving you a loan. If someone wants an “application fee” or “processing fee” before approval, that’s your cue to walk away. Our loan applications, for example, have no upfront fees.

Loan Insurance: Do You Really Need It?

Some lenders offer loan insurance to cover your payments if life throws you a curveball – things like job loss or disability. While this sounds helpful, it’s usually optional and adds to your cost. Take time to consider whether you truly need it and understand what it covers before saying yes.

How to Avoid Predatory Lending and Scams

Unfortunately, the rise of easy online lending has attracted some bad actors. But don’t worry – spotting the red flags isn’t rocket science.

The “Guaranteed Approval” Myth

If someone promises to approve your loan before even looking at your application, run. No legitimate lender can guarantee approval sight unseen. Real lenders need to verify your income, check your credit, and ensure you can repay the loan. It’s not just good business – it’s the law.

The Upfront Fee Trap

We mentioned this earlier, but it bears repeating: legitimate lenders don’t ask for money upfront. If someone demands a fee to “process” your application or “release” funds, you’re looking at a scam. Real lenders get paid from the loan proceeds, not from your pocket before you even get approved.

High-Pressure Tactics

Good lenders want you to understand what you’re signing. If someone is rushing you through documents, refusing to answer questions, or pressuring you to “act now before this offer expires,” that’s a major warning sign. A trustworthy easy loan process gives you time to read, understand, and feel comfortable with your decision.

When Terms Don’t Add Up

If the interest rate seems too good to be true, the fees are vague, or the repayment schedule is unclear, something’s wrong. Legitimate lenders are required to provide clear, detailed information about all loan terms. If you can’t get straight answers, keep looking.

The “No Credit Check” Red Flag

While some lenders offer more flexible credit requirements, be very cautious of “no credit check” promises for mortgages. These often hide extremely high interest rates or predatory terms. Responsible lenders need to verify your ability to repay – it protects both you and them.

If something feels off, trust your instincts. You can report issues to the Consumer Financial Protection Bureau (CFPB) if you suspect you’ve encountered a predatory lender or scam.

The bottom line? A legitimate easy loan process should feel transparent, pressure-free, and focused on finding the right solution for your needs. When in doubt, take your time and ask questions. The right lender will appreciate your diligence.

Frequently Asked Questions about the Easy Loan Process

Let’s be honest – when you’re looking for financing, you probably have a million questions swirling around in your head. We get it! Over the years, we’ve heard the same concerns from countless people seeking an easy loan process. So let’s tackle the big three questions that keep coming up.

How can I speed up my loan application?

Want to know the secret to a lightning-fast loan application? It’s all about being prepared and embracing the digital tools that make modern lending so much smoother.

Start with your paperwork ready to go. Before you even think about clicking “apply,” gather your government ID, recent pay stubs, the last 90 days of bank statements, and proof of address. Think of it like packing for a trip – the more organized you are upfront, the smoother your journey will be.

Go digital from day one. Our APM mobile app and online applications aren’t just convenient – they’re speed machines. You can fill out forms, snap photos of documents, and e-sign everything without leaving your couch.

Get prequalified first. This is like getting a sneak peek at what you might qualify for, and it usually won’t affect your credit score. It’s a quick way to understand your options before diving into the full application process.

Here’s a pro tip: respond to lender requests immediately. If we need additional information or clarification, getting back to us within 24 hours keeps everything moving at top speed. Delays on your end mean delays in approval.

Consider adding a co-applicant if your financial profile could use some strengthening. Not only can this improve your approval chances, but it might also help you secure a better interest rate. Plus, it can speed up the approval process since it reduces the lender’s perceived risk.

Can I get an easy loan with bad credit?

Here’s the good news – yes, it is possible to get a mortgage even with a less-than-perfect credit history. An easy loan process should be accessible, and we believe a credit score shouldn’t be the only factor that determines your ability to own a home.

While a lower credit score might mean a higher interest rate initially, a mortgage can be a powerful tool for building long-term wealth and improving your financial standing over time. Making consistent, on-time payments on a mortgage is one of the best ways to build a positive credit history.

Government-backed loans can be your friend. Programs like FHA loans are specifically designed to help borrowers with lower credit scores and smaller down payments. They offer more flexible qualification requirements.

Your steady paycheck matters more than you think. Many lenders, including us, look at your entire financial picture. A stable income and a manageable debt-to-income ratio can often be more important than a credit score alone.

Joint loans can be game-changers. Bringing in a co-applicant with stronger credit or stable income can dramatically improve your approval odds and potentially secure better rates for a mortgage.

The key is working with transparent lenders who clearly explain all terms and options available for your situation.

What’s the difference between a loan and a line of credit?

This question comes up constantly, and honestly, the confusion makes perfect sense because both put money in your hands – just in different ways. This is especially relevant when considering home equity products.

Think of a loan as getting everything upfront. You receive a specific lump sum—for example, a home equity loan to fund that kitchen renovation you’ve been dreaming about. You know exactly how much you’re getting, exactly what your monthly payments will be, and exactly when you’ll be done paying it back. Once it’s paid off, the account closes.

A line of credit is more like having a financial safety net that’s always there. Imagine getting approved for a $50,000 HELOC (Home Equity Line of Credit). You can draw $5,000 this month for home repairs, pay some back, then draw $3,000 next month for unexpected expenses. You only pay interest on what you’ve actually borrowed, and the line stays open for future use as long as you’re in good standing.

The payment structures are different too. Loans give you predictable monthly payments that include both principal and interest. Lines of credit typically require minimum monthly payments based on your outstanding balance, giving you more flexibility in how much you pay each month.

Both can absolutely be part of an easy loan process, but they serve different financial strategies. A loan is perfect when you know exactly what you need the money for and want predictable payments. A line of credit shines when you want ongoing access to funds for multiple projects or as an emergency cushion.

Conclusion: Your Next Steps to a Hassle-Free Loan

You’ve made it to the end of our journey together, and hopefully you’re feeling a lot more confident about what an easy loan process really looks like. It’s not just marketing speak – it’s a real change of how lending works in the modern world.

Think about where we started: those old-school loan processes that felt like running a marathon through molasses. Now you know there’s a better way. An easy loan process puts you in the driver’s seat with digital tools, clear timelines, and transparent terms that actually make sense.

Your preparation is your superpower. Having those documents ready – your pay stubs, bank statements, and ID – transforms you from a hopeful applicant into someone who’s ready to move fast when the right opportunity comes along. It’s like showing up to a job interview with your resume already in hand.

Embracing digital tools isn’t just trendy – it’s practical. When you can complete an application from your couch, upload documents with your phone camera, and get pre-qualified without affecting your credit score, you’re working smarter, not harder. Our APM mobile app exists for exactly this reason: to put the power of home financing right in your pocket.

But here’s something we can’t stress enough: easy doesn’t mean careless. Reading those terms, understanding your APR versus your interest rate, and knowing exactly what you’re signing up for – that’s not boring fine print. That’s you taking control of your financial future. The smartest borrowers are the ones who ask questions and take their time with the details.

Taking control of your finances means different things to different people. Maybe you’re looking to buy your first home, refinance to get a better rate, or tap into your home’s equity for that dream renovation. Whatever your goal, the modern lending landscape has options that can work for you.

At Mr. Loans, we’ve built our entire approach around making your experience as smooth as possible. We specialize in purchase and refinance loans because we know how important your home is – whether you’re buying one or leveraging the one you already own. Our online prequalification process helps you understand your options upfront, so you can make confident offers in today’s competitive market.

Ready to see what an easy loan process feels like firsthand? Get started with your purchase or refinance journey today and let us show you how straightforward home financing can actually be. Your future self will thank you for taking that first step.

From Primary to Paradise: How to Use a Cash-Out Refi to Buy Your Vacation Home

Why Homeowners Are Choosing Cash-Out Refinancing for Their Dream Getaways

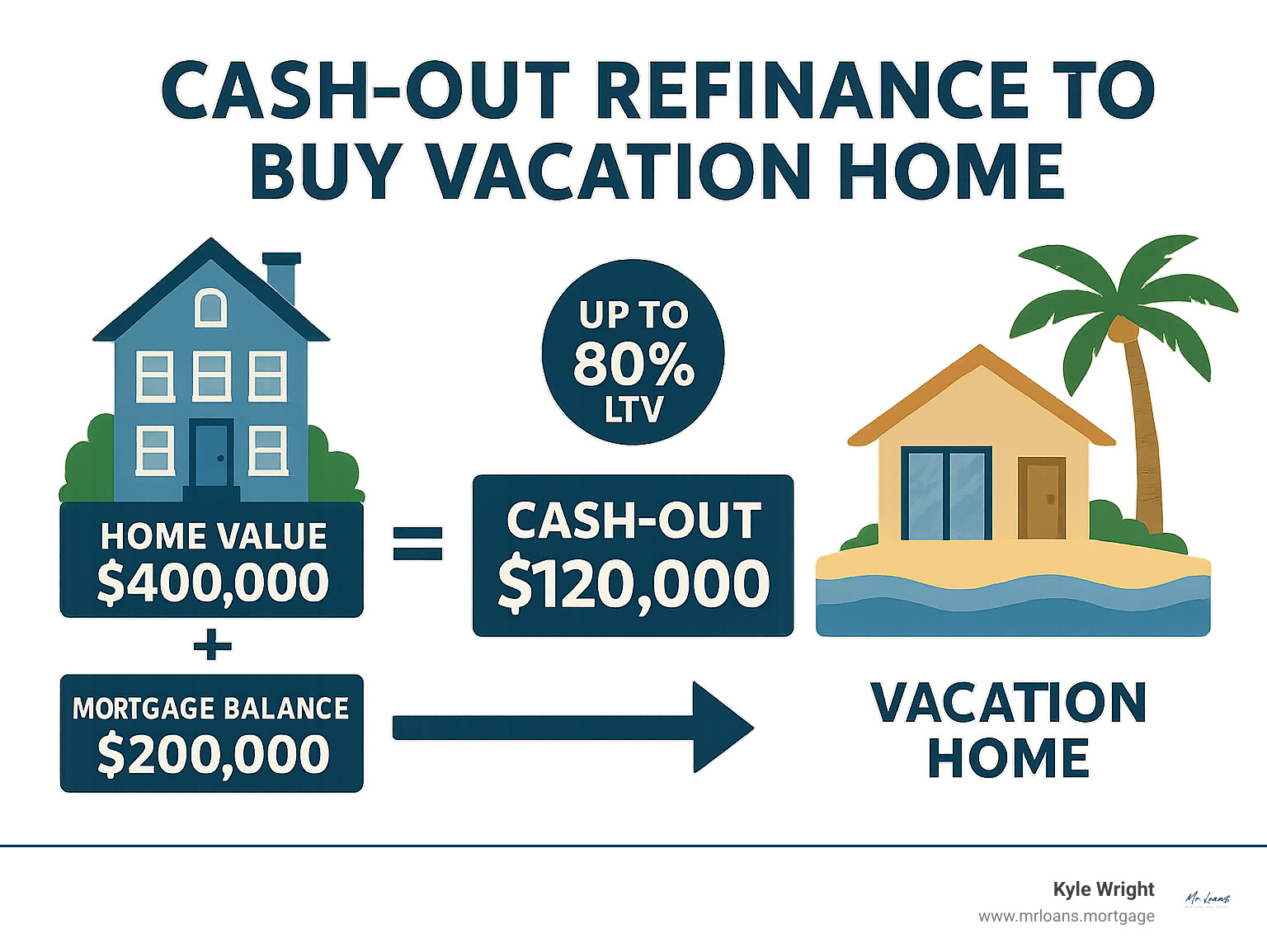

Cash out refinance to buy vacation home has become one of the most popular strategies for homeowners who want to turn their primary residence’s equity into a second property. Instead of saving for years or taking out high-interest loans, you can tap into the wealth you’ve already built in your home.

Here’s how it works in simple terms:

- Replace your current mortgage with a larger loan

- Receive the difference in cash (typically up to 80% of your home’s value)

- Use that cash for a down payment or to buy your vacation home outright

- Keep one monthly payment on your primary residence

This strategy makes sense when you have significant equity in your home and want to avoid depleting your savings or retirement accounts. With homeowners sitting on an estimated $11 trillion in home equity nationwide, many are finding they already have the key to their vacation home dreams.

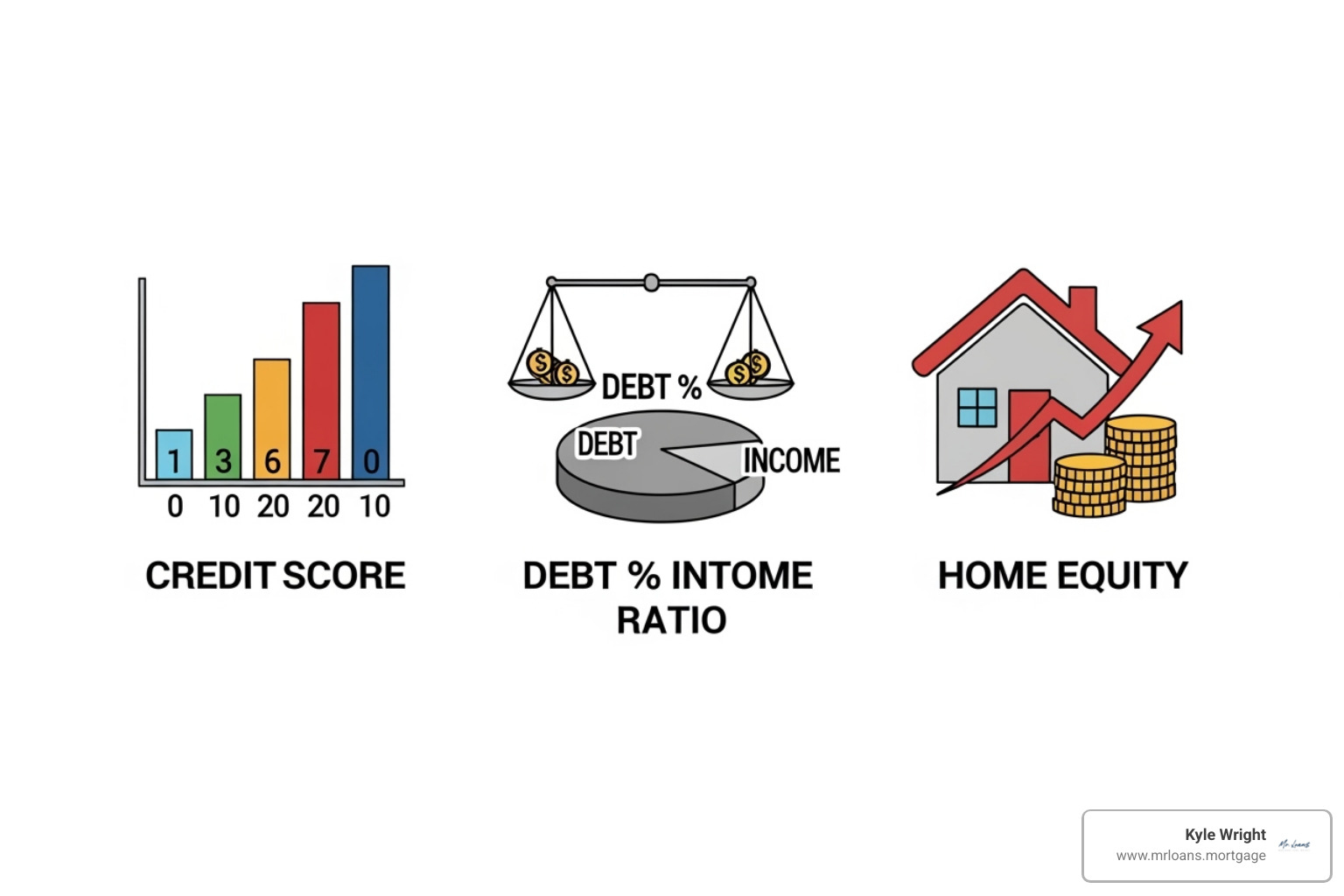

The process isn’t right for everyone though. You’ll need at least 20% equity in your primary home, a credit score of 620 or higher, and the ability to handle a larger monthly mortgage payment. The biggest advantage? You’re essentially using your home’s appreciation to fund your next real estate investment.

Think of it this way: your primary home has been working for you, building value over the years. A cash-out refinance lets you put that appreciation to work immediately, rather than waiting until you sell.

Understanding the Cash-Out Refinance Process

When you’re ready to cash out refinance to buy vacation home, understanding exactly how this financial tool works is your first step toward that dream getaway. Think of a cash-out refinance as open uping the treasure chest that is your home’s equity – except instead of gold coins, you’re getting cold, hard cash to fund your next real estate trip.

Here’s what actually happens: You’re not taking out a second loan or adding another monthly payment to your budget. Instead, you’re replacing your current mortgage with a brand-new, larger one. The difference between what you owe now and your new loan amount? That comes to you as cash at closing.

Let’s say your home is worth $500,000 and you still owe $200,000 on your mortgage. With a cash-out refinance, you could potentially take out a new mortgage for $400,000. After paying off your existing $200,000 loan, you’d walk away with $200,000 in cash – enough for a serious down payment or maybe even buying that lake house outright.

The magic number here is your Loan-to-Value ratio, or LTV. Most lenders stick to the 80% LTV rule for primary residences. This means you can typically borrow up to 80% of your home’s current value, leaving you with 20% equity as a safety cushion.

Calculating your available cash is straightforward: Take your home’s appraised value, multiply by 80%, then subtract your current mortgage balance. The result is your potential cash-out amount. It’s like your home saying, “Hey, I’ve been working hard to appreciate in value – here’s your reward!”

How a cash-out refinance to buy a vacation home works step-by-step

The journey from application to keys-in-hand might seem overwhelming, but we’ve streamlined the process to make it as smooth as possible. Here’s your roadmap to vacation home ownership:

The home appraisal kicks everything off. A professional appraiser visits your primary residence to determine its current market value. This isn’t just a quick walk-through – they’re looking at recent comparable sales, your home’s condition, and local market trends. Think of it as getting a financial report card for all those years of homeownership.

Next comes the loan application phase. This is where our team really shines. We’ll help you gather all necessary documents – income verification, employment history, bank statements, and asset information. Our APM mobile app makes this step much easier than the old days of endless paperwork. You can upload documents right from your phone and track your progress in real-time.

During underwriting, our financial detectives get to work. They’re reviewing your credit score, calculating your debt-to-income ratio, and ensuring everything adds up. It might feel like they’re scrutinizing every financial decision you’ve ever made, but they’re actually working to get you approved. For a detailed look at what happens behind the scenes, check out The Loan Process on our website.

Closing day is when the magic happens. You’ll sign your new loan documents, officially replacing your old mortgage with the new, larger one. Yes, there will be closing costs involved – typically 2-5% of your loan amount – but you’re also walking away with a substantial sum of cash.

Within a few business days of closing, the funds hit your account. Now you’re holding the keys to your vacation home dreams, whether you’re making a strong cash offer or putting down a hefty down payment that sellers can’t ignore.

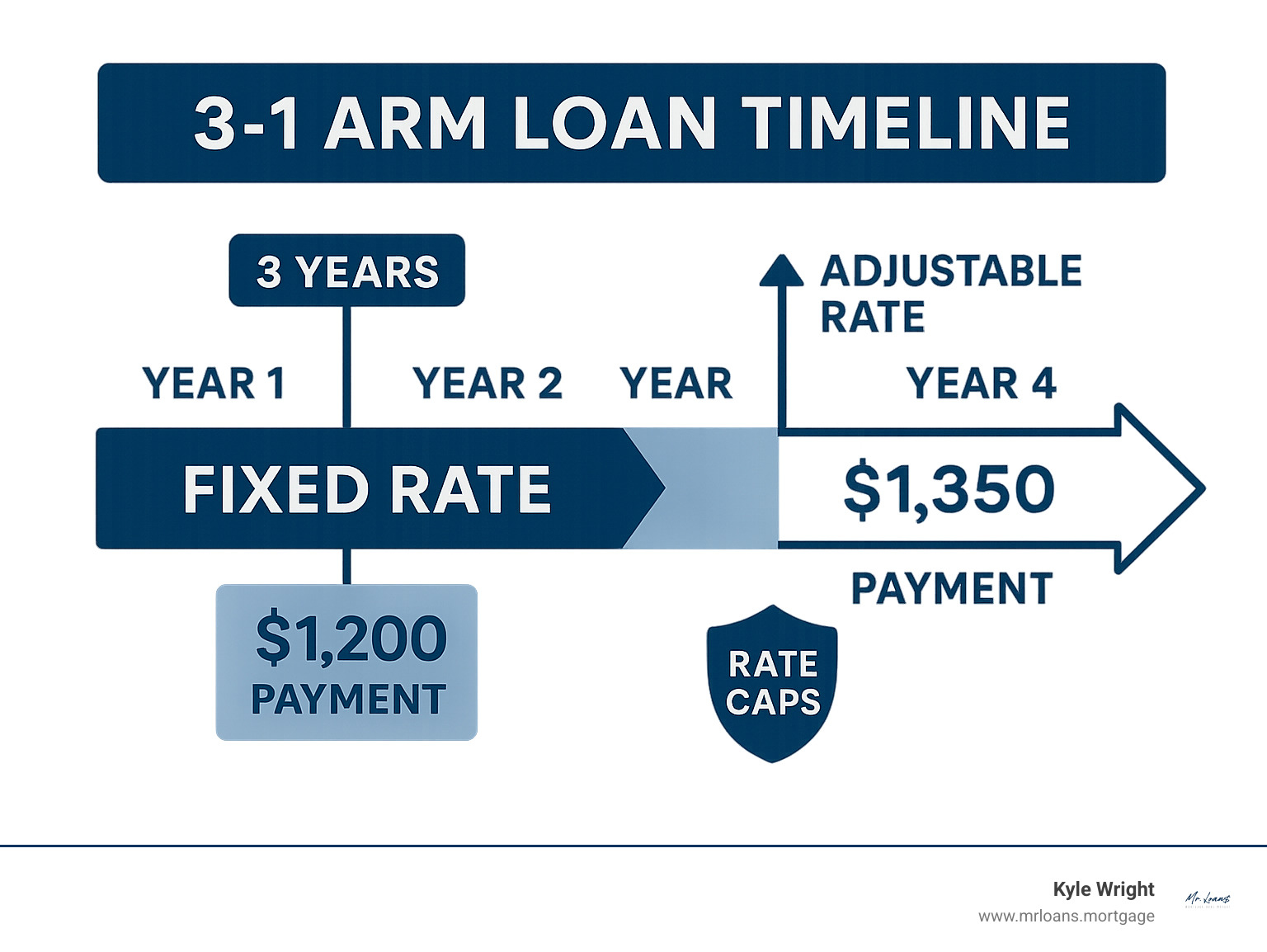

Primary Residence vs. Second Home Refinancing

Here’s where things get a bit more complex – and why using your primary residence for the cash-out makes so much financial sense. When lenders look at second homes, they see dollar signs, but not necessarily in a good way.

Second homes come with stricter requirements across the board. Lenders know that when financial trouble hits, homeowners prioritize their primary residence over their vacation getaway. This reality translates into higher interest rates – often 1-2% higher than what you’d get on your main home. Your beach house mortgage might carry a rate that makes you wince a little.

The occupancy rules matter more than you might think. For your property to qualify as a “second home” rather than an investment property, you need to actually use it. The IRS requires you to occupy it for at least 14 days per year or 10% of the days it’s rented out, whichever is greater. If you’re purely buying for rental income, you’ve crossed into investment property territory – which means even tougher lending requirements.

LTV limits reflect this increased caution. While you might access up to 80% of your primary home’s value through a cash-out refinance, second home cash-out refinances typically max out at 75% LTV. Lenders want to see you have more skin in the game when it comes to non-primary residences.

This is exactly why using your primary residence’s equity to fund your vacation home purchase is such a smart strategy – you get the better rates and terms on the cash-out, then use that money to buy your second home with more favorable positioning.

Do You Qualify? Key Requirements for Approval

Ready to find out if your dream vacation home is within reach? The good news is that qualifying for a cash out refinance to buy vacation home isn’t as complicated as you might think. We just need to check a few key boxes to make sure you’re in great shape for this exciting financial move.

Think of these requirements as your roadmap to paradise. Each one builds on the others to create a complete picture of your financial readiness. Let’s walk through what lenders are looking for so you can confidently move forward with your plans.

Equity and Loan-to-Value (LTV)

Your home’s equity is the foundation of this entire strategy. It’s what makes the magic happen! To qualify for a cash-out refinance, you’ll need at least 20% equity in your primary home. This cushion protects both you and the lender, ensuring your home retains value even after you’ve tapped into it.

Here’s how the math works: most lenders follow an 80% LTV rule for primary residences. This means your new mortgage can’t exceed 80% of your home’s current value. So if your home appraises for $500,000, you could potentially borrow up to $400,000 total.

Calculating your available cash is straightforward once you know these numbers. Take that maximum loan amount ($400,000 in our example), subtract what you currently owe (let’s say $200,000), and you’re left with $200,000 in cash. Not bad for equity you’ve been building without even thinking about it!

The appraisal is crucial here because it determines your home’s current market value. Your home might have appreciated significantly since you bought it, which could mean more available cash than you initially expected. It’s like finding hidden treasure in your own backyard.

Credit Score and Debt-to-Income (DTI) Ratio

Your credit score tells the story of how you handle money, and lenders pay close attention. The minimum credit score is typically 620, but that’s just the starting line. If you want the best rates and smoothest approval process, aim for 680 or higher. Think of it this way: a higher credit score is like having VIP access to better loan terms.

Your debt-to-income ratio needs to stay under 43% for most lenders. This ratio shows how much of your monthly income goes toward debt payments. To figure out your DTI, add up all your monthly debt payments (including your current mortgage, car loans, and credit card minimums) and divide by your gross monthly income.

Let’s say your monthly debts total $2,500 and you earn $6,000 per month. Your DTI would be about 42% – right in the sweet spot. Your new mortgage payment will be higher after the cash-out refinance, so factor that into your planning. Our What Will My Monthly Payment Be Calculator can help you see exactly how this affects your budget.

Income, Employment, and Waiting Periods

Lenders want to see that you have stable, reliable income to handle your new mortgage payment. They’ll typically look for steady employment history – usually two years or more in the same job or field. This doesn’t mean you can’t change jobs, but consistency shows you’re a safe bet.

There’s also something called a seasoning period you need to know about. Most lenders require you to wait at least six months after your last mortgage transaction before you can do a cash-out refinance. If you just bought your home or recently refinanced, you’ll need to be patient a bit longer.

Here’s an important detail that surprises some homeowners: there’s typically a one-year occupancy requirement after your cash-out refinance. This means you need to continue living in your primary home for at least a year after closing. You can’t immediately pack up and move to your new vacation home full-time – though weekend getaways are definitely encouraged!

The documentation process is thorough but straightforward. You’ll need to provide income verification, tax returns, bank statements, and employment history. It might feel like a lot of paperwork, but it’s all designed to make sure you’re set up for success with your new financial arrangement.

Weighing the Pros and Cons of This Financial Strategy

Let’s be honest – using a cash out refinance to buy vacation home isn’t a decision you should make over your morning coffee. Like any major financial move, it comes with both exciting opportunities and serious responsibilities that deserve your full attention.

Think of it this way: you’re essentially asking your primary home to help fund your dream getaway. Your house has been quietly building value over the years, and now you want to put that equity to work. But just like lending money to a friend, there are benefits and risks to consider.

| Pros of Cash-Out Refinance for a Vacation Home | Cons of Cash-Out Refinance for a Vacation Home |

|---|---|

| Access to a large lump sum of cash | Larger mortgage on your primary home |

| Funds a down payment or outright purchase | Higher monthly mortgage payment |

| Potentially lower interest rates than other loans | Significant closing costs (2-5% of loan) |

| Builds wealth through new asset appreciation | Primary home used as collateral |

| Potential for rental income from vacation home | Risk of foreclosure if payments are missed |

| Keeps savings intact for other needs | Can extend your loan term, increasing total interest |

| Streamlined with one primary mortgage payment | Interest rates can be higher than rate-and-term refis |

The Benefits of Using a Cash-Out Refinance

The biggest advantage? Access to a large sum of cash without depleting your savings account or touching your retirement funds. Instead of waiting years to save up for a vacation home down payment, you can tap into the wealth you’ve already built in your primary residence.

This strategy opens doors you might not have considered. Maybe you can fund a down payment on that mountain cabin, or if you have substantial equity, perhaps even buy the property outright in cash. Imagine walking into a real estate negotiation with cash in hand – sellers love that confidence, and you might even score a better deal.

Here’s something many homeowners don’t realize: cash-out refinance rates are often potentially lower than other loan options. While they might be slightly higher than a simple rate-and-term refinance (we’re talking maybe 0.25% to 0.5% more), they’re typically much lower than personal loans or credit cards. You’re essentially borrowing at mortgage rates, which is pretty smart money management.

The wealth-building potential is real too. Your vacation home isn’t just a place to relax – it’s building wealth through appreciation while potentially generating rental income when you’re not using it. Your primary home helped you buy an asset that could work for you financially. That’s what we call making your money work harder, not just harder work for your money.

The Risks and Considerations

Now for the reality check. The most immediate change you’ll notice is a larger mortgage on your primary home, which means a higher monthly payment. This isn’t Monopoly money – it’s a real financial commitment that needs to fit comfortably in your budget, even during leaner months.

Closing costs are another reality that catches some homeowners off guard. We’re talking about 2% to 5% of your loan amount in fees. On a $400,000 loan, that could be anywhere from $8,000 to $20,000. You can learn more about what these costs include and who typically pays them through the Consumer Financial Protection Bureau’s guidance on closing costs.

Here’s the big one that keeps me up at night for our clients: your primary home becomes collateral for this larger loan. If life throws you a curveball and you can’t make payments, you’re not just risking your vacation home – you’re risking the roof over your family’s head. That’s serious stuff, and it’s why we always stress the importance of having stable income and emergency savings.

The risk of foreclosure isn’t something we mention to scare you, but rather to ensure you’re making this decision with your eyes wide open. Your dream vacation home should improve your life, not threaten your financial security.

Tax Implications to Consider

The tax side of things can get a bit tricky, so let’s break it down simply. The good news? The cash you receive from your refinance isn’t considered taxable income because it’s technically a loan, not earnings.

The mortgage interest deduction is where things get more complex. For the interest to be tax-deductible, the IRS requires that you use the funds to “buy, build, or improve” the home that secures the loan. The IRS provides detailed rules for deductibility that spell out exactly what qualifies.

When you use cash-out refinance funds to buy a second home, the deductibility rules can vary depending on how you use that property. Is it purely for family vacations, or will you rent it out part of the year? The IRS treats these situations differently, and the rules can affect your tax benefits.

Here’s my strongest recommendation: consult a tax professional before you move forward. Tax laws change, everyone’s situation is unique, and you want to make sure you’re maximizing any benefits while staying compliant. A few hundred dollars spent on professional tax advice could save you thousands down the road.

Frequently Asked Questions

We get these questions a lot, and honestly, they’re great ones! Let’s explore the details so you can move forward with confidence.

How much cash can I get from a cash-out refinance for a second home?

The magic number here is 80% of your primary home’s value, minus what you still owe on your current mortgage. That difference becomes your cash to pursue that dream vacation property.

Let’s walk through a real example to make this crystal clear. Say your home just appraised for $400,000 (congratulations, by the way!). You can typically borrow up to 80% of that value, which equals $320,000 for your new mortgage. If you currently owe $150,000 on your existing mortgage, you’d receive $170,000 in cash after paying off the old loan.

Here’s the simple math: New loan amount ($320,000) minus current mortgage balance ($150,000) equals your cash-out ($170,000). That’s a substantial chunk of change that could either cover a hefty down payment on your vacation home or, depending on the market you’re shopping in, potentially buy the property outright.

The actual amount you qualify for depends on your home’s current market value, which is why that appraisal is so important. Your home might have appreciated more than you think!

Can I use rental income from the new vacation home to help me qualify?

This is where we have to deliver some not-so-great news, but it’s important to be upfront about it. Generally, no – lenders won’t consider future or potential rental income from your new vacation home when qualifying you for the cash out refinance to buy vacation home.

Think about it from the lender’s perspective: that rental income is purely speculative at this point. There’s no guarantee you’ll find reliable tenants, that they’ll pay on time, or that the property will stay rented consistently. Lenders need to see proven, stable income streams.

Your qualification will be based entirely on your current financial picture – your regular job income, credit score, and existing debt-to-income ratio. It’s actually a good thing in some ways because it ensures you’re not overextending yourself based on optimistic projections.

The one exception? If you already own rental properties with a documented history of rental income (shown on your tax returns), lenders might consider that established income. But for a brand-new vacation home purchase, you’re on your own financially until you build that rental track record.

How long does the cash-out refinance process take?

Plan for 30 to 45 days from the time you submit your application until you’re holding those keys to your vacation home. That’s pretty standard across the industry, though we always aim to move things along as quickly as possible.

Several factors can influence this timeline, and knowing them helps you plan better. The appraisal is often the biggest variable – it needs to be scheduled, completed, and reviewed, and busy markets can sometimes create delays. Your documentation plays a huge role too. The faster you can provide all the required paperwork, the smoother everything flows.

Market conditions can also impact timing. During busy refinance periods, everyone’s working at capacity, which might add a few extra days here and there. The complexity of your financial situation matters as well – straightforward applications move faster than those requiring extra underwriting review.

Our advice? Give yourself a little buffer time when planning your vacation home purchase. While 30-45 days is typical, having a 60-day window ensures you’re not stressed if any small delays pop up. We’ll keep you updated throughout the entire process so you always know where things stand.

Ready to Find Your Paradise?

Congratulations! You’ve now got all the pieces to understand how a cash out refinance to buy vacation home can work for you. It’s not just about getting cash from your home’s equity – it’s about creating a smart financial strategy that turns your primary residence into the key to your dream getaway.

Think about it: your home has been quietly building value over the years. Now you know how to put that appreciation to work, whether it’s funding a down payment on that mountain cabin or buying a beach house outright. The process might seem complex at first, but it really comes down to leveraging what you already own to get what you want.

The key takeaways are straightforward. You need at least 20% equity in your home, a credit score of 620 or higher (though 680+ gets you better rates), and the financial stability to handle a larger mortgage payment. The 80% LTV rule means you can typically access a significant chunk of your home’s value, and the whole process takes about 30-45 days from start to finish.

Remember the golden rule: your primary home becomes the collateral for this strategy. That’s why careful financial planning isn’t just smart – it’s essential. You want your vacation home dreams to improve your life, not create stress about your primary residence.

At Mr. Loans, we’ve helped countless homeowners steer this exact journey. We understand that every situation is unique, and that’s why we take the time to understand your specific goals and financial picture. Our APM mobile app and online prequalification tools make it easier to explore your options without the pressure.

Whether you’re dreaming of weekend getaways or planning for rental income potential, we’re here to help you make informed decisions. Ready to see what your home’s equity could do for you? Contact Us to speak with one of our experienced loan officers who can walk you through your specific situation.

Or if you’re ready to dive in, Start your refinance journey today with our online tools. Your paradise might be closer than you think – and it might already be sitting in your home’s equity, just waiting to be open uped.

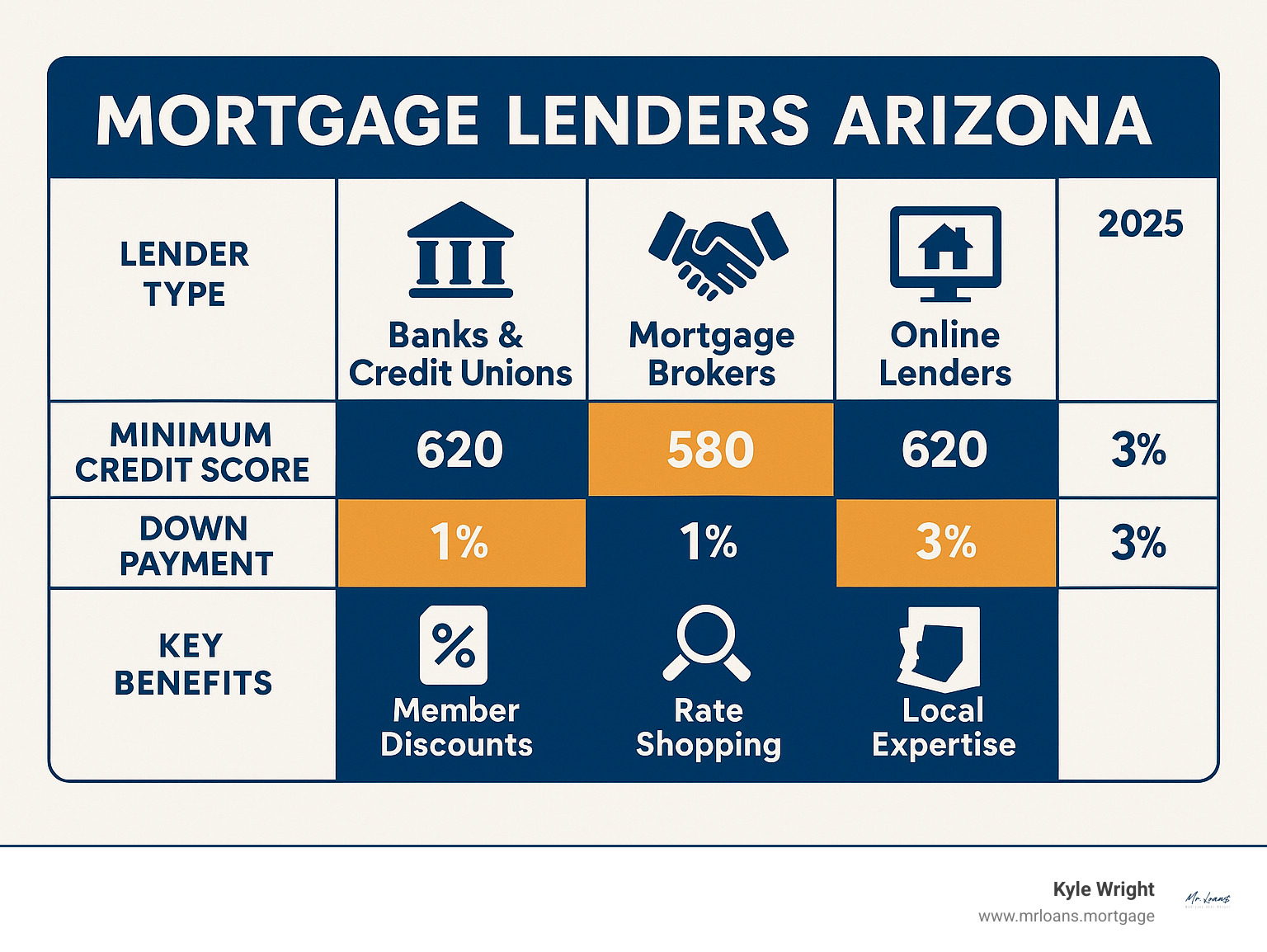

Arizona’s Best Home Lenders: Where to Get Your Loan

Why Finding the Right Home Lender in Arizona Matters

Finding the best home lenders arizona has to offer can save you thousands of dollars and weeks of stress during your home buying journey. With Arizona’s homeownership rate at 68.7% and a median housing value of $376,369, choosing the right lender is more important than ever.

When searching for a top lender, you’ll find many options with high customer satisfaction ratings. The best lenders often provide flexible terms, such as minimum down payments as low as 1-3% and credit score requirements that accommodate a wide range of buyers, often starting in the 580-620 range.

Arizona offers unique advantages for homebuyers, including the HOME+PLUS program that provides up to 5% in down payment and closing cost assistance for eligible buyers with credit scores of 640 or higher and income limits of $112,785.

The mortgage landscape in Arizona includes everything from traditional banks and credit unions to online lenders and mortgage brokers. Each type offers different benefits – banks provide established relationships, brokers shop multiple lenders for you, and online lenders often offer faster processing times.

Whether you’re a first-time buyer looking for an FHA loan with just 3% down or a veteran seeking a VA loan with zero down payment, understanding your options will help you make the best choice for your financial situation.

Understanding the Types of Home Lenders in Arizona

Choosing the right lender for your Arizona home purchase doesn’t have to feel overwhelming. Think of it like picking the right partner for a big trip – you want someone who understands your needs and has your back throughout the journey.

The good news is that Arizona has plenty of excellent home lenders arizona buyers can choose from. Each type brings something different to the table, so understanding your options will help you find the perfect fit for your situation.

You’ll encounter direct lenders like banks and credit unions that use their own money to fund loans. These institutions often have local branches where you can sit down face-to-face with loan officers. Then there are mortgage brokers who act as your personal shopping assistant, comparing options from multiple wholesale lenders. Finally, online lenders handle most of their business digitally, often offering streamlined processes and competitive rates.

Direct Lenders: Banks and Credit Unions

Banks and credit unions represent the traditional path to homeownership financing. If you’ve been banking with the same institution for years, there’s something comforting about walking into a familiar branch and discussing your home loan with someone who knows your financial history.

These direct lenders offer in-house loan products using their own funds. Banks typically provide a wide range of mortgage options and have established relationships with their customers. You might appreciate having local branches where you can ask questions or get updates on your loan status in person.

Credit unions deserve special mention here because they’re member-owned cooperatives. This structure often translates to member benefits like slightly better rates, more flexible terms, or waived fees. They tend to take a more personal approach to lending decisions.

The trade-off with direct lenders is potentially limited options. Since they’re only offering their own loan products, you won’t see the full range of what’s available in the marketplace. It’s like shopping at one store instead of comparing prices across multiple retailers.

Mortgage Brokers: Your Personal Loan Shopper

Here’s where things get interesting – and where we at Mr. Loans come into the picture. Mortgage brokers don’t lend their own money. Instead, we have access to multiple lenders and act as your advocate in finding the best possible deal.

Think of it this way: instead of calling dozens of lenders yourself, we do all that rate shopping for you with one application. We submit your information to our network of wholesale lenders and let them compete for your business. This competition often results in better rates and terms than you’d find going directly to a single lender.

The expert guidance we provide goes beyond just finding low rates. We help you understand different loan programs, steer complex paperwork, and avoid common pitfalls that can delay your closing. Want to learn more about how smooth we make this process? Check out more info about the loan process on our website.

One thing to understand about broker compensation – we’re typically paid the same amount regardless of which lender you choose. This means our incentives align perfectly with yours: finding you the best possible deal. We succeed when you succeed, and there’s no financial reason for us to steer you toward one lender over another.

How to Choose and Compare the Best Home Lenders Arizona Offers

Finding the right mortgage lender is like finding the perfect dance partner – you need someone who moves in sync with your rhythm and won’t step on your toes when things get complicated. It’s about much more than just snagging the lowest interest rate (though that’s certainly nice!).

When you’re evaluating home lenders arizona has available, think of yourself as a detective gathering clues. You want to look at the complete picture, not just the shiny number on the interest rate. The best lender for your neighbor might not be the best fit for your unique situation.

Your due diligence now will pay off big time later. A few hours of research can save you thousands of dollars and countless headaches down the road. Let’s explore what really matters when making this important decision.

Key Factors Beyond the Interest Rate

A low interest rate makes your heart sing, but there’s so much more to consider when choosing among the home lenders arizona offers. Think of the interest rate as just one ingredient in a complex recipe.

Loan products offered should be your first consideration. Does this lender actually offer what you need? Maybe you’re eyeing an FHA Loans because you’re working with a smaller down payment, or perhaps you’re a veteran looking into VA Loans. Some lenders specialize in certain types of loans while others offer a buffet of options.

Customer service and communication can make or break your experience. You want a lender who treats you like a real person, not account number 47,382. Look for lenders who explain things clearly, return your calls promptly, and make you feel comfortable asking questions. Trust us – you’ll have plenty of questions during this process.

Technology and online tools matter more than ever. Can you upload documents easily? Do they have a mobile app to track your progress? We’ve found that borrowers love being able to check their loan status at 11 PM in their pajamas. At Mr. Loans, our APM mobile app lets you manage everything from your phone, because who has time to drive to a bank branch these days?

Closing speed guarantees can be a game-changer, especially in Arizona’s competitive market. Some lenders promise specific timelines, which gives you confidence when making offers. Fast closings aren’t just convenient – they can help you win bidding wars against other buyers.

Ready to win? Contact my team today!

How to Compare Mortgage Rates and Fees from Arizona Lenders

Here’s where things get a bit tricky, but stick with us. Don’t just look at that interest rate and call it a day. The Annual Percentage Rate (APR) is your real friend here – it includes the interest rate plus fees, giving you the true cost of borrowing.

When you apply for a mortgage, lenders must give you a Loan Estimate document within three business days. This little piece of paper is pure gold for comparison shopping. It breaks down everything in black and white.

Pay close attention to origination fees – that’s what the lender charges to process your loan. Some lenders have low rates but high fees, while others might be the opposite. Discount points let you pay money upfront to lower your interest rate, but only do this if you plan to stay in the home for several years.

Don’t forget about closing costs – these include appraisal fees, title insurance, and other necessary expenses. And here’s a red flag to watch for: prepayment penalties. These nasty little fees punish you for paying off your mortgage early. They’re less common now, but always ask about them.

Get Loan Estimates from several different lenders so you can compare apples to apples. Some lenders make you jump through hoops to see their rates, but the good ones are upfront about their pricing.

Verifying a Lender’s Legitimacy and Reputation

In the age of online reviews, you have a powerful tool at your fingertips. Customer reviews and online ratings tell the real story about what it’s like to work with a lender. Don’t just look at the star rating – dig into the actual comments to see what people loved and what drove them crazy.

Look for patterns in the testimonials. Do people consistently praise their communication? Do they complain about surprise fees? These patterns tell you what to expect from your own experience.

Now here’s the really important part: make sure your lender is legitimate. Every mortgage lender must have an NMLS ID (that’s the Nationwide Mortgage Licensing System). This unique number is like their license plate in the mortgage world.

Licensing verification is simple but crucial. Head over to the official site and Verify a lender’s license here. Just plug in their NMLS ID and you’ll see their licensing status, any disciplinary actions, and other important details. It takes two minutes and could save you from a nightmare.

The Arizona Mortgage Gauntlet: Requirements, Programs, and Timelines

Getting a mortgage in Arizona doesn’t have to feel like running an obstacle course blindfolded! While the process involves several steps – from application to underwriting to final approval – understanding what’s expected can turn this “gauntlet” into a manageable journey. Arizona’s strong housing market and robust job growth actually work in your favor, giving home lenders arizona confidence in the local economy.

The current economic climate in Arizona is actually pretty favorable for homebuyers. While national trends like Federal Reserve decisions set the baseline for rates, Arizona’s healthy job market and continued population growth help keep lending standards reasonable and programs available.

What are the requirements for obtaining a mortgage with home lenders arizona?

Most home lenders arizona residents work with look for similar things when reviewing your application. The good news? The requirements aren’t as scary as they might seem at first glance.

Credit scores typically need to be in the 580-620 range depending on the loan type. FHA loans are the most forgiving, accepting scores as low as 580, while conventional loans usually want to see 620 or higher. If you’re looking at a jumbo loan for a pricier Arizona home, expect lenders to want 680 or better.

Down payment requirements have become much more reasonable over the years. You can get started with as little as 1-4% down on many loan programs. FHA loans need just 3.5% down, conventional loans often accept 3%, and if you’re a veteran, VA loans require zero down payment. Even jumbo loans, while requiring more, typically ask for 10-20% rather than the old standard of 20% across the board.

Your debt-to-income ratio is another key factor lenders examine closely. This compares your monthly debt payments to your gross monthly income. Most lenders want to see this ratio below 43% for conventional loans, though FHA loans can be more flexible, sometimes accepting ratios up to 50%.

Employment history matters too – lenders typically want to see two years of stable work history. They’re not necessarily looking for you to have stayed at the same job, but they want to see consistent income and career progression.

The paperwork requirements include recent pay stubs, tax returns from the past two years, bank statements, and documentation of any other income sources. It sounds like a lot, but your loan officer will walk you through exactly what’s needed for your situation.

My team excels with paperwork and we are here to make your mortgage experience seamless.

Arizona-Specific Homebuyer Assistance Programs

Here’s where Arizona really shines for homebuyers! The state offers some fantastic programs that can make homeownership much more achievable, especially for first-time buyers.

The star of the show is the HOME+PLUS Program, which provides down payment and closing cost assistance that can be a real game-changer. This program offers up to 5% of your loan amount to help cover these upfront costs – money that many buyers struggle to save while also paying rent.

To qualify for HOME+PLUS, you’ll need a credit score minimum of 640 and meet certain income limits (currently around $112,785 for most areas). The assistance typically comes as a forgivable second mortgage, which means if you stay in the home for three years, you won’t have to pay it back. However, if you sell or refinance within that period, you’ll need to repay the assistance.

This program pairs beautifully with FHA, VA, or conventional first mortgages, essentially allowing many buyers to get into a home with very little money out of pocket. You can learn more about the specifics at the HOME PLUS Down Payment Assistance Program website.

What are the typical closing times for mortgages in Arizona?

Most Arizona mortgages close within 30-45 days from the time you submit your complete application. This timeline has actually improved over the past few years as lenders have streamlined their processes and acceptd better technology.

Several factors can influence how quickly your loan closes. The appraisal process can sometimes create delays, especially during busy seasons when appraisers are backed up. Underwriting conditions – additional documentation or clarifications the underwriter needs – can also extend the timeline if not addressed quickly.

Here’s where you have real control: buyer responsiveness makes a huge difference. The faster you provide requested documents and answer questions, the smoother your process will be. Being organized from the start and staying on top of your loan officer’s requests can easily shave a week or more off your closing time.

Different loan types can also affect timing. FHA and VA loans sometimes take slightly longer due to additional government requirements and inspections, while conventional loans often move a bit faster.

At Mr. Loans, we pride ourselves on making the closing process as fast and stress-free as possible. Our APM mobile app helps you track your loan’s progress and upload documents quickly, keeping everything moving smoothly toward your closing day.

If you’re already a homeowner looking to tap into your equity or lower your rate, you can learn how to refinance your home with us as well. The refinance process is often even faster than a purchase loan since there’s no purchase contract timeline to meet.

Frequently Asked Questions about Arizona Home Lenders

We know you’ve got questions about choosing home lenders arizona, and we’re here to provide clear, straightforward answers that actually make sense.

What is the difference between a mortgage broker and a retail lender in Arizona?

This is probably the most important question you can ask, and honestly, it’s one that can save you thousands of dollars once you understand it!

A retail lender (that’s me) is like a restaurant buffet that only serves a variety of options. We use our own money to make loans with in-house and specialty programs. Where APM is different, is we also have the option to broker loans—so you get the best of both words—innovative mortgage solutions AND the ability to get the best rate and term.

A mortgage broker doesn’t lend their own money. Instead, they connect you with a network of wholesale lenders, shopping your loan to find a lender that will work with your specific scenario.

Here’s why this matters: when we shop your loan to multiple lenders, they compete for your business. This competition often results in better rates and terms than you’d get walking into a single bank. Plus, you only fill out one application and get one credit pull, which protects your credit score while still giving you access to hundreds of loan options.

How does the current economic climate in Arizona affect mortgage rates?

Mortgage rates are influenced by both national trends and what’s happening right here in Arizona, and understanding both can help you time your home purchase better.

On the national level, the Federal Reserve’s decisions set the stage for mortgage rates. When they adjust the federal funds rate or make announcements about economic policy, it ripples through the entire lending market. Things like inflation, job growth, and economic uncertainty all play a role in where rates land.

But Arizona has its own economic personality that affects mortgage rates too. Our state has a strong job market and continues attracting new residents, which creates high housing demand. This local demand can influence how lenders price their loans and what products they offer.

The good news? Arizona’s robust economy often works in borrowers’ favor. Lenders see our state as a stable market, which can translate to competitive rates and more loan options for buyers like you.

What online tools can help me find and compare home lenders in Arizona?

The internet has made comparing lenders so much easier than it used to be! You don’t have to drive from bank to bank anymore, and you can do most of your research in your pajamas if you want to.

Mortgage calculators are your first stop. These help you estimate monthly payments and see how different interest rates affect your budget. Most lender websites offer these, and they’re incredibly helpful for setting realistic expectations.

Pre-qualification tools let you see how much you might qualify for without hurting your credit score. We offer online prequalification that gives you a clear picture of your borrowing power, so you can shop for homes with confidence.

Review sites and directories like those found through various online platforms provide ratings and real customer experiences. Reading what other borrowers say about their experience can give you valuable insights into how a lender actually treats their clients.

Mobile apps have become game-changers in the mortgage world. Our APM mobile app lets you manage your entire loan process from your phone – check your loan status, upload documents, and stay connected throughout the process.

One crucial step: always verify any lender’s credentials through the NMLS Consumer Access website. Every legitimate mortgage lender has an NMLS ID that you can look up to confirm they’re properly licensed in Arizona. This simple check can save you from potential headaches down the road.

While these tools are fantastic for research, nothing replaces having a knowledgeable mortgage professional guide you through the process and answer your specific questions.

Your Next Step to Arizona Homeownership

You’ve made it through the complete guide to finding the best home lenders arizona has to offer – and that’s no small feat! From understanding the different types of lenders to comparing rates and fees, from Arizona-specific assistance programs to typical closing timelines, you now have all the tools you need to make an informed decision.

The most important thing to remember is that research is your best friend. Don’t just go with the first lender who gives you a quote. Take the time to compare your options, and remember that the lowest interest rate isn’t always the whole story. Look at the bigger picture – customer service, technology, closing speed, and overall experience matter just as much.

Understanding the process is half the battle. When you know what to expect at each stage, from pre-qualification to closing day, the whole journey becomes much less stressful. You’ll be prepared for the documentation requests, the appraisal process, and even those last-minute underwriting conditions that sometimes pop up.

Here’s the thing – we know that shopping for a mortgage the traditional way can feel overwhelming and frankly, a bit broken. That’s exactly why we created Mr. Loans. We believe that getting a home loan should be simple, transparent, and maybe even a little exciting.

Our approach is different. We use expert guidance combined with smart technology to make your mortgage journey as smooth as possible. With tools like our APM mobile app, you can track your loan progress, upload documents, and stay connected throughout the process. Our online prequalification gets you started quickly, so you can make confident offers when you find that perfect Arizona home.

Whether you’re buying your first home, moving up to something bigger, or looking to leverage your home equity, we’re here to simplify what can otherwise be a complex process. We serve communities throughout Arizona and beyond, always with the same goal – making home financing easy and stress-free.

Ready to turn all this knowledge into action? Your Arizona homeownership dreams are closer than you think.

August Market Watch

Rising inventory is reshaping buyer and seller behavior across the country. There are now over 1.1 million active listings nationwide, the highest level since before the pandemic. This uptick is giving buyers more options, increasing average days on market, and prompting many sellers to offer concessions and price cuts to remain competitive. New construction is playing a pivotal role as well, with builders cutting prices and buying down rates to move inventory, especially in regions where building has ramped up over the past few years.

On the financing front, mortgage rates remain elevated but stable: 30-year fixed rates are hovering around 6.7%, with little relief expected in the near term. While this continues to strain affordability for many first-time homebuyers, modest rate declines could still arrive later in the year if inflation cools further. For now, most markets remain balanced rather than swinging decidedly in favor of buyers or sellers. However, those looking to purchase may find slightly better negotiation leverage than last summer, particularly in markets with rising inventory.

7 Painless Ways to Compare Arizona Mortgage Lenders

Why Finding the Right Arizona Mortgage Lender Matters

Mortgage Lenders Arizona offer a wide range of options for homebuyers, from large national banks to local credit unions and mortgage brokers. With Arizona’s median home value at $376,369, choosing the right lender can save you thousands of dollars and reduce stress during your home buying journey.

Top Arizona Mortgage Lender Options:

- Banks & Credit Unions – Many offer member discounts and closing guarantees.

- Mortgage Brokers – Shop your loan with hundreds of wholesale lenders to find competitive rates.

- Online Lenders – Often feature streamlined applications and low down payment options.

- Local Specialists – Provide deep market expertise and knowledge of state programs.

Key Requirements:

- Credit scores typically 580-620+ depending on loan type

- Down payments as low as 1-4%

- Income verification and debt-to-income ratios under 45%

Shopping for a mortgage in Arizona means comparing more than just interest rates. You need to evaluate loan programs, closing costs, customer service, and local market knowledge. Some lenders offer specialized programs like the HOME PLUS Down Payment Assistance Program that provides up to 5% assistance for qualified buyers.

Instead of visiting multiple lender websites and submitting separate applications, smart borrowers use strategies that create competition among lenders while protecting their credit scores.

1. Understand the Different Types of Lenders

Choosing the right Mortgage Lenders Arizona isn’t just about hunting for the lowest interest rate. It’s about finding the right match for your unique situation. In Arizona’s lending landscape, you’ll encounter different types of lenders: some use their own money to fund your loan, while others act as matchmakers, connecting you with the best deal from a network of partners.

Banks and credit unions are direct lenders who originate and fund loans with their own capital. Mortgage brokers, on the other hand, work as your personal shopping assistant, taking your application to multiple lenders to find the best deal. This creates competition that typically works in your favor.

Direct Lenders (Banks & Credit Unions)

Direct lenders handle everything in-house. If you have a long-standing relationship with your bank, this can feel like a natural next step. Credit unions deserve special attention, as they often prioritize member benefits, offering interest rate discounts or closing time guarantees. The trade-off with direct lenders is variety. Since they only offer their own loan products, you’re shopping at a single store. To compare options, you’ll need to visit multiple institutions individually, which can be time-consuming.

Mortgage Brokers

Mortgage brokers act as your advocate in the lending world. Instead of being tied to one lender’s products, we work with a vast network of wholesale lenders. The beauty of this approach is the competition we create on your behalf. We take your single application and shop it to our entire network, which often results in better interest rates and lower fees as lenders compete for your business.

Our compensation structure aligns our interests with yours; our goal is finding you the best possible deal, not pushing a specific bank’s products. This process simplifies your life considerably: one application, one credit pull, and we handle the rest. We can steer complex financial scenarios and find creative solutions that might not fit the rigid formulas of traditional banks. Plus, we understand Arizona’s unique market dynamics and can guide you through the loan process with local expertise.

2. Compare Loan Options, Rates, and Fees

That shiny low interest rate you see advertised isn’t the whole story. While a lower rate is great, the real number to focus on is the Annual Percentage Rate (APR). The APR is the “true cost” of your loan because it includes the interest rate plus other charges like origination fees and discount points.

Your game plan: ask at least three lenders for an official Loan Estimate form. The government requires all lenders to use the same standardized format, so you can compare apples to apples. When you get these Loan Estimates, pay special attention to the origination fees, mortgage points, and third-party charges, as these can vary dramatically between Mortgage Lenders Arizona.

Common Loan Programs for Arizona Homebuyers

Arizona homebuyers have access to several excellent loan programs designed for different situations.

- FHA Loans are fantastic for first-time buyers or those with less-than-perfect credit, requiring a minimum credit score of 580 and down payments as low as 3.5%.

- VA Loans are unbeatable for qualified veterans, active-duty service members, and eligible surviving spouses, offering zero down payment and no private mortgage insurance.

- Conventional loans are the most common type. They typically require credit scores of 620 or higher, but you can put down as little as 3%. With 20% down, you’ll avoid PMI entirely.

- Jumbo loans are for homes above the conventional loan limit of $766,550, requiring excellent credit and larger down payments.

- HELOC options let existing homeowners tap into their home’s equity for renovations, debt consolidation, or other major expenses.

Using Online Tools to Your Advantage

The internet has revolutionized mortgage shopping. Start with mortgage calculators to determine how much house you can afford. Rate comparison websites give you a starting point for market trends, but your actual rate will depend on your specific financial situation.

Online reviews offer valuable insight into a lender’s communication, closing times, and overall customer experience. Online applications have also made the process more convenient. Our APM mobile app, for example, lets you apply anytime, track your loan progress, and upload documents right from your phone. The key is to use these tools strategically to set your budget and understand your options before working with a trusted lender.

3. Evaluate Lender Reputation and Customer Service

A mortgage is a long-term relationship, so excellent customer service is non-negotiable when choosing from Mortgage Lenders Arizona. A reputable lender will communicate clearly, answer your questions promptly, and guide you through the process without adding unnecessary stress.

The best lenders are your advocates. They explain complex terms simply, keep you updated, and are available when you need them. Look for lenders with a strong history of success and a local presence in Arizona. Some lenders even offer closing time guarantees, which can be a major advantage in a competitive market.

At Mr. Loans, we believe getting a home loan should be easy, fast, and exciting. We act as your advocate, simplifying the process and ensuring consistent communication every step of the way.

How to Vet Reputable Mortgage Lenders in Arizona

Before committing to a lender, do your homework. Here are the key steps:

- Verify Licensing: Use the NMLS Consumer Access database to check a lender or loan officer’s license and disciplinary history. Any legitimate lender will have an NMLS ID.

- Read Reviews: Dive into online testimonials on Google, Zillow, and the Better Business Bureau. Look for patterns in feedback regarding responsiveness, transparency, and closing on time.

- Check the BBB: The Better Business Bureau website can provide insight into how a company handles customer issues and their commitment to satisfaction.

- Ask for References: A confident, reputable lender will be happy to provide references from recent clients.

- Meet the Team: Get to know the people you’ll be working with. Check out Our Staff at Mr. Loans. Our executive team brings over 28 years of mortgage experience, ensuring you’re in capable hands.

4. Seek Out Local Expertise and Arizona-Specific Programs

When you choose Mortgage Lenders Arizona with deep local roots, you get a partner who understands the nuances of the state’s communities. A lender who lives and works here knows local property values, neighborhood trends, and the quirks of Arizona’s real estate market. With a median home value of $376,369, that local insight is invaluable.

We’re proud to have local offices in Chandler, giving us a front-row seat to the market. But where local knowledge really pays off is with Arizona-specific homebuyer programs. These programs can save you thousands, but many out-of-state lenders don’t know they exist. A local expert will ensure you don’t miss out.

Key Assistance Programs for Arizona Homebuyers

Arizona has fantastic programs to make homeownership more accessible. The trick is knowing about them.

The HOME PLUS Down Payment Assistance Program is Arizona’s premier homebuyer assistance program. It offers eligible buyers up to 5% for down payment and closing costs. This assistance is a second mortgage that may be completely forgiven over three years. To qualify, you’ll typically need a credit score of 640 or higher and meet household income limits.

Beyond HOME PLUS, Arizona offers other down payment and closing cost assistance programs through local housing authorities, often as grants or other forgivable loans. Some lenders also offer their own innovative programs, like 0% down payment options for qualified buyers, sometimes with no income limits. Many of these programs also feature reduced mortgage insurance, making your monthly payments more manageable.

We are committed to exploring every available option to make your Arizona homeownership dream a reality. We know these programs inside and out and will work to get you every dollar of assistance you qualify for.

5. Get Pre-Approved to Strengthen Your Offer

In Arizona’s competitive market, a pre-approval letter is essential. It tells sellers you’re not just window shopping—you’re a serious buyer ready to make a move. If a seller has two identical offers, they will almost always choose the one from the buyer who has already been vetted by a lender.

Pre-Approval vs. Pre-Qualification

These terms sound similar, but they are very different. Pre-qualification is a rough estimate based on self-reported financial information. No documents are verified, so sellers don’t take it seriously.

Pre-approval is the real deal. We verify your income, check your assets, pull your credit report, and review your entire financial picture. Afterward, you get a commitment letter showing exactly how much we’re willing to lend you. We pride ourselves on delivering accurate pre-approvals, often within 24 hours, giving you a competitive edge.

Typical Requirements for an Arizona Mortgage

Getting approved for a mortgage involves a review of a few key factors: