Why Homeowners Are Choosing Cash-Out Refinancing for Their Dream Getaways

Cash out refinance to buy vacation home has become one of the most popular strategies for homeowners who want to turn their primary residence’s equity into a second property. Instead of saving for years or taking out high-interest loans, you can tap into the wealth you’ve already built in your home.

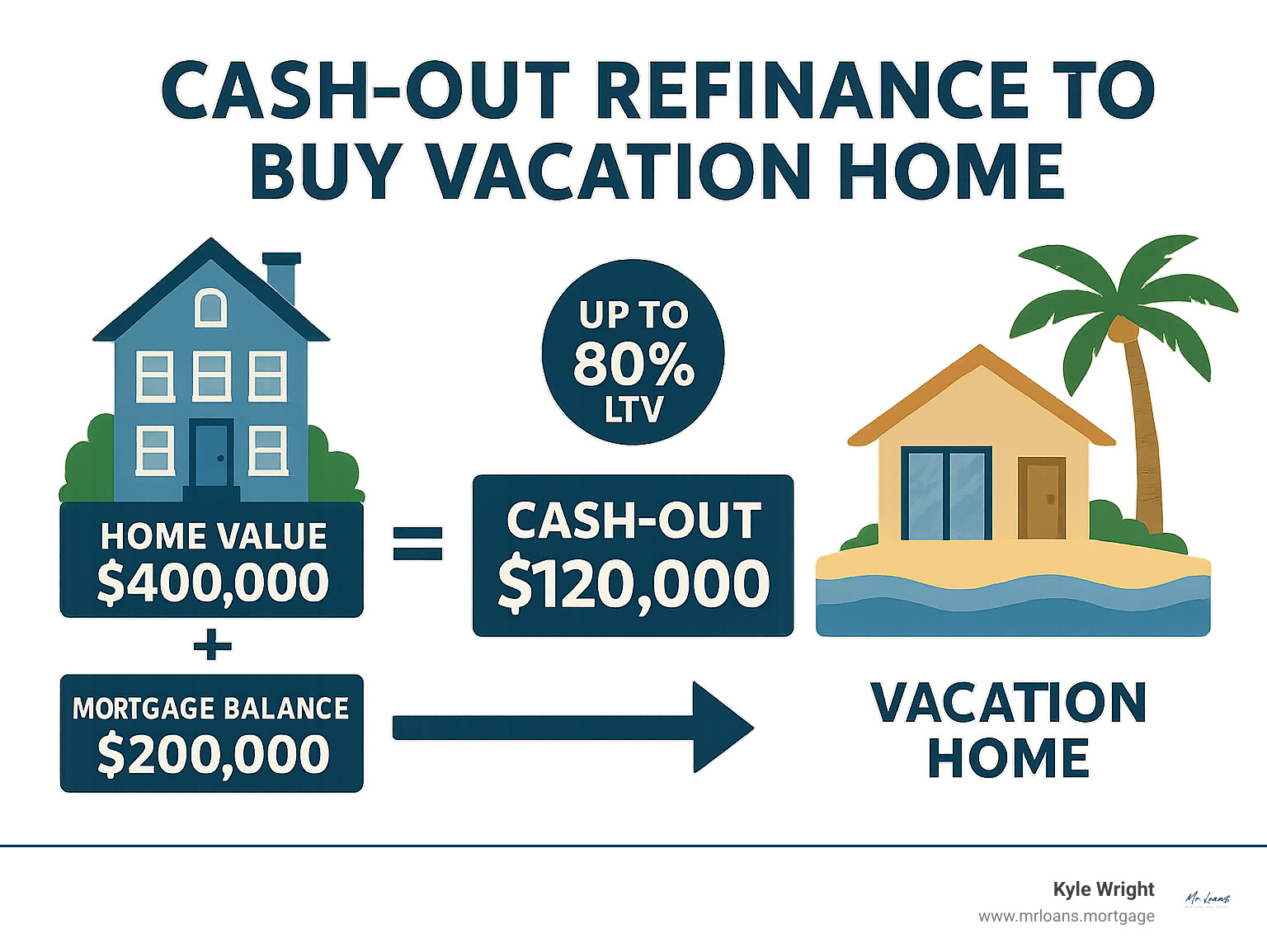

Here’s how it works in simple terms:

- Replace your current mortgage with a larger loan

- Receive the difference in cash (typically up to 80% of your home’s value)

- Use that cash for a down payment or to buy your vacation home outright

- Keep one monthly payment on your primary residence

This strategy makes sense when you have significant equity in your home and want to avoid depleting your savings or retirement accounts. With homeowners sitting on an estimated $11 trillion in home equity nationwide, many are finding they already have the key to their vacation home dreams.

The process isn’t right for everyone though. You’ll need at least 20% equity in your primary home, a credit score of 620 or higher, and the ability to handle a larger monthly mortgage payment. The biggest advantage? You’re essentially using your home’s appreciation to fund your next real estate investment.

Think of it this way: your primary home has been working for you, building value over the years. A cash-out refinance lets you put that appreciation to work immediately, rather than waiting until you sell.

Understanding the Cash-Out Refinance Process

When you’re ready to cash out refinance to buy vacation home, understanding exactly how this financial tool works is your first step toward that dream getaway. Think of a cash-out refinance as open uping the treasure chest that is your home’s equity – except instead of gold coins, you’re getting cold, hard cash to fund your next real estate trip.

Here’s what actually happens: You’re not taking out a second loan or adding another monthly payment to your budget. Instead, you’re replacing your current mortgage with a brand-new, larger one. The difference between what you owe now and your new loan amount? That comes to you as cash at closing.

Let’s say your home is worth $500,000 and you still owe $200,000 on your mortgage. With a cash-out refinance, you could potentially take out a new mortgage for $400,000. After paying off your existing $200,000 loan, you’d walk away with $200,000 in cash – enough for a serious down payment or maybe even buying that lake house outright.

The magic number here is your Loan-to-Value ratio, or LTV. Most lenders stick to the 80% LTV rule for primary residences. This means you can typically borrow up to 80% of your home’s current value, leaving you with 20% equity as a safety cushion.

Calculating your available cash is straightforward: Take your home’s appraised value, multiply by 80%, then subtract your current mortgage balance. The result is your potential cash-out amount. It’s like your home saying, “Hey, I’ve been working hard to appreciate in value – here’s your reward!”

How a cash-out refinance to buy a vacation home works step-by-step

The journey from application to keys-in-hand might seem overwhelming, but we’ve streamlined the process to make it as smooth as possible. Here’s your roadmap to vacation home ownership:

The home appraisal kicks everything off. A professional appraiser visits your primary residence to determine its current market value. This isn’t just a quick walk-through – they’re looking at recent comparable sales, your home’s condition, and local market trends. Think of it as getting a financial report card for all those years of homeownership.

Next comes the loan application phase. This is where our team really shines. We’ll help you gather all necessary documents – income verification, employment history, bank statements, and asset information. Our APM mobile app makes this step much easier than the old days of endless paperwork. You can upload documents right from your phone and track your progress in real-time.

During underwriting, our financial detectives get to work. They’re reviewing your credit score, calculating your debt-to-income ratio, and ensuring everything adds up. It might feel like they’re scrutinizing every financial decision you’ve ever made, but they’re actually working to get you approved. For a detailed look at what happens behind the scenes, check out The Loan Process on our website.

Closing day is when the magic happens. You’ll sign your new loan documents, officially replacing your old mortgage with the new, larger one. Yes, there will be closing costs involved – typically 2-5% of your loan amount – but you’re also walking away with a substantial sum of cash.

Within a few business days of closing, the funds hit your account. Now you’re holding the keys to your vacation home dreams, whether you’re making a strong cash offer or putting down a hefty down payment that sellers can’t ignore.

Primary Residence vs. Second Home Refinancing

Here’s where things get a bit more complex – and why using your primary residence for the cash-out makes so much financial sense. When lenders look at second homes, they see dollar signs, but not necessarily in a good way.

Second homes come with stricter requirements across the board. Lenders know that when financial trouble hits, homeowners prioritize their primary residence over their vacation getaway. This reality translates into higher interest rates – often 1-2% higher than what you’d get on your main home. Your beach house mortgage might carry a rate that makes you wince a little.

The occupancy rules matter more than you might think. For your property to qualify as a “second home” rather than an investment property, you need to actually use it. The IRS requires you to occupy it for at least 14 days per year or 10% of the days it’s rented out, whichever is greater. If you’re purely buying for rental income, you’ve crossed into investment property territory – which means even tougher lending requirements.

LTV limits reflect this increased caution. While you might access up to 80% of your primary home’s value through a cash-out refinance, second home cash-out refinances typically max out at 75% LTV. Lenders want to see you have more skin in the game when it comes to non-primary residences.

This is exactly why using your primary residence’s equity to fund your vacation home purchase is such a smart strategy – you get the better rates and terms on the cash-out, then use that money to buy your second home with more favorable positioning.

Do You Qualify? Key Requirements for Approval

Ready to find out if your dream vacation home is within reach? The good news is that qualifying for a cash out refinance to buy vacation home isn’t as complicated as you might think. We just need to check a few key boxes to make sure you’re in great shape for this exciting financial move.

Think of these requirements as your roadmap to paradise. Each one builds on the others to create a complete picture of your financial readiness. Let’s walk through what lenders are looking for so you can confidently move forward with your plans.

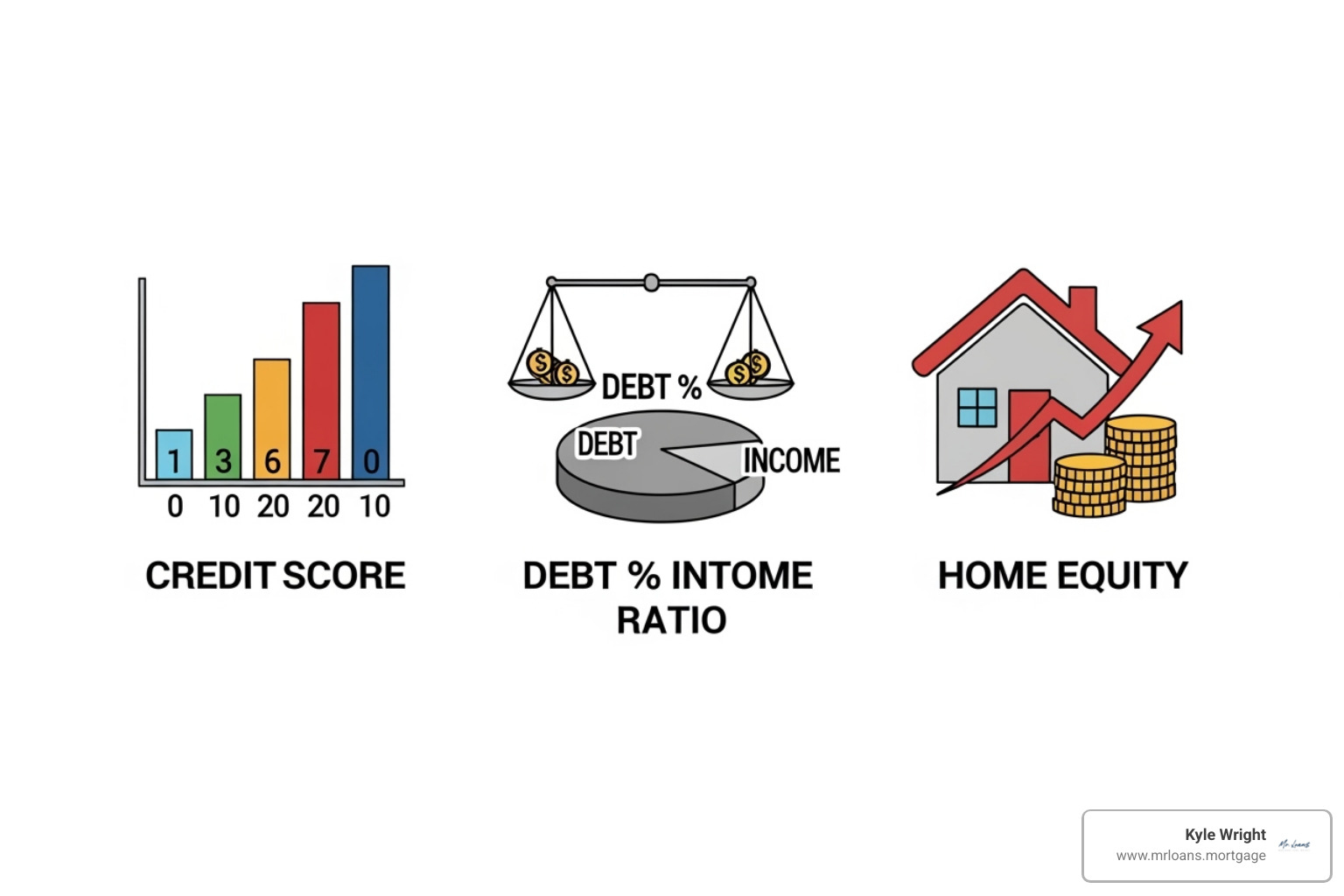

Equity and Loan-to-Value (LTV)

Your home’s equity is the foundation of this entire strategy. It’s what makes the magic happen! To qualify for a cash-out refinance, you’ll need at least 20% equity in your primary home. This cushion protects both you and the lender, ensuring your home retains value even after you’ve tapped into it.

Here’s how the math works: most lenders follow an 80% LTV rule for primary residences. This means your new mortgage can’t exceed 80% of your home’s current value. So if your home appraises for $500,000, you could potentially borrow up to $400,000 total.

Calculating your available cash is straightforward once you know these numbers. Take that maximum loan amount ($400,000 in our example), subtract what you currently owe (let’s say $200,000), and you’re left with $200,000 in cash. Not bad for equity you’ve been building without even thinking about it!

The appraisal is crucial here because it determines your home’s current market value. Your home might have appreciated significantly since you bought it, which could mean more available cash than you initially expected. It’s like finding hidden treasure in your own backyard.

Credit Score and Debt-to-Income (DTI) Ratio

Your credit score tells the story of how you handle money, and lenders pay close attention. The minimum credit score is typically 620, but that’s just the starting line. If you want the best rates and smoothest approval process, aim for 680 or higher. Think of it this way: a higher credit score is like having VIP access to better loan terms.

Your debt-to-income ratio needs to stay under 43% for most lenders. This ratio shows how much of your monthly income goes toward debt payments. To figure out your DTI, add up all your monthly debt payments (including your current mortgage, car loans, and credit card minimums) and divide by your gross monthly income.

Let’s say your monthly debts total $2,500 and you earn $6,000 per month. Your DTI would be about 42% – right in the sweet spot. Your new mortgage payment will be higher after the cash-out refinance, so factor that into your planning. Our What Will My Monthly Payment Be Calculator can help you see exactly how this affects your budget.

Income, Employment, and Waiting Periods

Lenders want to see that you have stable, reliable income to handle your new mortgage payment. They’ll typically look for steady employment history – usually two years or more in the same job or field. This doesn’t mean you can’t change jobs, but consistency shows you’re a safe bet.

There’s also something called a seasoning period you need to know about. Most lenders require you to wait at least six months after your last mortgage transaction before you can do a cash-out refinance. If you just bought your home or recently refinanced, you’ll need to be patient a bit longer.

Here’s an important detail that surprises some homeowners: there’s typically a one-year occupancy requirement after your cash-out refinance. This means you need to continue living in your primary home for at least a year after closing. You can’t immediately pack up and move to your new vacation home full-time – though weekend getaways are definitely encouraged!

The documentation process is thorough but straightforward. You’ll need to provide income verification, tax returns, bank statements, and employment history. It might feel like a lot of paperwork, but it’s all designed to make sure you’re set up for success with your new financial arrangement.

Weighing the Pros and Cons of This Financial Strategy

Let’s be honest – using a cash out refinance to buy vacation home isn’t a decision you should make over your morning coffee. Like any major financial move, it comes with both exciting opportunities and serious responsibilities that deserve your full attention.

Think of it this way: you’re essentially asking your primary home to help fund your dream getaway. Your house has been quietly building value over the years, and now you want to put that equity to work. But just like lending money to a friend, there are benefits and risks to consider.

| Pros of Cash-Out Refinance for a Vacation Home | Cons of Cash-Out Refinance for a Vacation Home |

|---|---|

| Access to a large lump sum of cash | Larger mortgage on your primary home |

| Funds a down payment or outright purchase | Higher monthly mortgage payment |

| Potentially lower interest rates than other loans | Significant closing costs (2-5% of loan) |

| Builds wealth through new asset appreciation | Primary home used as collateral |

| Potential for rental income from vacation home | Risk of foreclosure if payments are missed |

| Keeps savings intact for other needs | Can extend your loan term, increasing total interest |

| Streamlined with one primary mortgage payment | Interest rates can be higher than rate-and-term refis |

The Benefits of Using a Cash-Out Refinance

The biggest advantage? Access to a large sum of cash without depleting your savings account or touching your retirement funds. Instead of waiting years to save up for a vacation home down payment, you can tap into the wealth you’ve already built in your primary residence.

This strategy opens doors you might not have considered. Maybe you can fund a down payment on that mountain cabin, or if you have substantial equity, perhaps even buy the property outright in cash. Imagine walking into a real estate negotiation with cash in hand – sellers love that confidence, and you might even score a better deal.

Here’s something many homeowners don’t realize: cash-out refinance rates are often potentially lower than other loan options. While they might be slightly higher than a simple rate-and-term refinance (we’re talking maybe 0.25% to 0.5% more), they’re typically much lower than personal loans or credit cards. You’re essentially borrowing at mortgage rates, which is pretty smart money management.

The wealth-building potential is real too. Your vacation home isn’t just a place to relax – it’s building wealth through appreciation while potentially generating rental income when you’re not using it. Your primary home helped you buy an asset that could work for you financially. That’s what we call making your money work harder, not just harder work for your money.

The Risks and Considerations

Now for the reality check. The most immediate change you’ll notice is a larger mortgage on your primary home, which means a higher monthly payment. This isn’t Monopoly money – it’s a real financial commitment that needs to fit comfortably in your budget, even during leaner months.

Closing costs are another reality that catches some homeowners off guard. We’re talking about 2% to 5% of your loan amount in fees. On a $400,000 loan, that could be anywhere from $8,000 to $20,000. You can learn more about what these costs include and who typically pays them through the Consumer Financial Protection Bureau’s guidance on closing costs.

Here’s the big one that keeps me up at night for our clients: your primary home becomes collateral for this larger loan. If life throws you a curveball and you can’t make payments, you’re not just risking your vacation home – you’re risking the roof over your family’s head. That’s serious stuff, and it’s why we always stress the importance of having stable income and emergency savings.

The risk of foreclosure isn’t something we mention to scare you, but rather to ensure you’re making this decision with your eyes wide open. Your dream vacation home should improve your life, not threaten your financial security.

Tax Implications to Consider

The tax side of things can get a bit tricky, so let’s break it down simply. The good news? The cash you receive from your refinance isn’t considered taxable income because it’s technically a loan, not earnings.

The mortgage interest deduction is where things get more complex. For the interest to be tax-deductible, the IRS requires that you use the funds to “buy, build, or improve” the home that secures the loan. The IRS provides detailed rules for deductibility that spell out exactly what qualifies.

When you use cash-out refinance funds to buy a second home, the deductibility rules can vary depending on how you use that property. Is it purely for family vacations, or will you rent it out part of the year? The IRS treats these situations differently, and the rules can affect your tax benefits.

Here’s my strongest recommendation: consult a tax professional before you move forward. Tax laws change, everyone’s situation is unique, and you want to make sure you’re maximizing any benefits while staying compliant. A few hundred dollars spent on professional tax advice could save you thousands down the road.

Frequently Asked Questions

We get these questions a lot, and honestly, they’re great ones! Let’s explore the details so you can move forward with confidence.

How much cash can I get from a cash-out refinance for a second home?

The magic number here is 80% of your primary home’s value, minus what you still owe on your current mortgage. That difference becomes your cash to pursue that dream vacation property.

Let’s walk through a real example to make this crystal clear. Say your home just appraised for $400,000 (congratulations, by the way!). You can typically borrow up to 80% of that value, which equals $320,000 for your new mortgage. If you currently owe $150,000 on your existing mortgage, you’d receive $170,000 in cash after paying off the old loan.

Here’s the simple math: New loan amount ($320,000) minus current mortgage balance ($150,000) equals your cash-out ($170,000). That’s a substantial chunk of change that could either cover a hefty down payment on your vacation home or, depending on the market you’re shopping in, potentially buy the property outright.

The actual amount you qualify for depends on your home’s current market value, which is why that appraisal is so important. Your home might have appreciated more than you think!

Can I use rental income from the new vacation home to help me qualify?

This is where we have to deliver some not-so-great news, but it’s important to be upfront about it. Generally, no – lenders won’t consider future or potential rental income from your new vacation home when qualifying you for the cash out refinance to buy vacation home.

Think about it from the lender’s perspective: that rental income is purely speculative at this point. There’s no guarantee you’ll find reliable tenants, that they’ll pay on time, or that the property will stay rented consistently. Lenders need to see proven, stable income streams.

Your qualification will be based entirely on your current financial picture – your regular job income, credit score, and existing debt-to-income ratio. It’s actually a good thing in some ways because it ensures you’re not overextending yourself based on optimistic projections.

The one exception? If you already own rental properties with a documented history of rental income (shown on your tax returns), lenders might consider that established income. But for a brand-new vacation home purchase, you’re on your own financially until you build that rental track record.

How long does the cash-out refinance process take?

Plan for 30 to 45 days from the time you submit your application until you’re holding those keys to your vacation home. That’s pretty standard across the industry, though we always aim to move things along as quickly as possible.

Several factors can influence this timeline, and knowing them helps you plan better. The appraisal is often the biggest variable – it needs to be scheduled, completed, and reviewed, and busy markets can sometimes create delays. Your documentation plays a huge role too. The faster you can provide all the required paperwork, the smoother everything flows.

Market conditions can also impact timing. During busy refinance periods, everyone’s working at capacity, which might add a few extra days here and there. The complexity of your financial situation matters as well – straightforward applications move faster than those requiring extra underwriting review.

Our advice? Give yourself a little buffer time when planning your vacation home purchase. While 30-45 days is typical, having a 60-day window ensures you’re not stressed if any small delays pop up. We’ll keep you updated throughout the entire process so you always know where things stand.

Ready to Find Your Paradise?

Congratulations! You’ve now got all the pieces to understand how a cash out refinance to buy vacation home can work for you. It’s not just about getting cash from your home’s equity – it’s about creating a smart financial strategy that turns your primary residence into the key to your dream getaway.

Think about it: your home has been quietly building value over the years. Now you know how to put that appreciation to work, whether it’s funding a down payment on that mountain cabin or buying a beach house outright. The process might seem complex at first, but it really comes down to leveraging what you already own to get what you want.

The key takeaways are straightforward. You need at least 20% equity in your home, a credit score of 620 or higher (though 680+ gets you better rates), and the financial stability to handle a larger mortgage payment. The 80% LTV rule means you can typically access a significant chunk of your home’s value, and the whole process takes about 30-45 days from start to finish.

Remember the golden rule: your primary home becomes the collateral for this strategy. That’s why careful financial planning isn’t just smart – it’s essential. You want your vacation home dreams to improve your life, not create stress about your primary residence.

At Mr. Loans, we’ve helped countless homeowners steer this exact journey. We understand that every situation is unique, and that’s why we take the time to understand your specific goals and financial picture. Our APM mobile app and online prequalification tools make it easier to explore your options without the pressure.

Whether you’re dreaming of weekend getaways or planning for rental income potential, we’re here to help you make informed decisions. Ready to see what your home’s equity could do for you? Contact Us to speak with one of our experienced loan officers who can walk you through your specific situation.

Or if you’re ready to dive in, Start your refinance journey today with our online tools. Your paradise might be closer than you think – and it might already be sitting in your home’s equity, just waiting to be open uped.