Why Home Loan Pre-Approval is Your First Step to Homebuying Success

Home loan pre-approval is when a lender agrees to lend you a specific amount for buying a home, based on verified financial information and a credit check. Unlike pre-qualification, it’s a conditional commitment that gives you serious buying power.

Quick Answer: What You Need to Know About Home Loan Pre-Approval

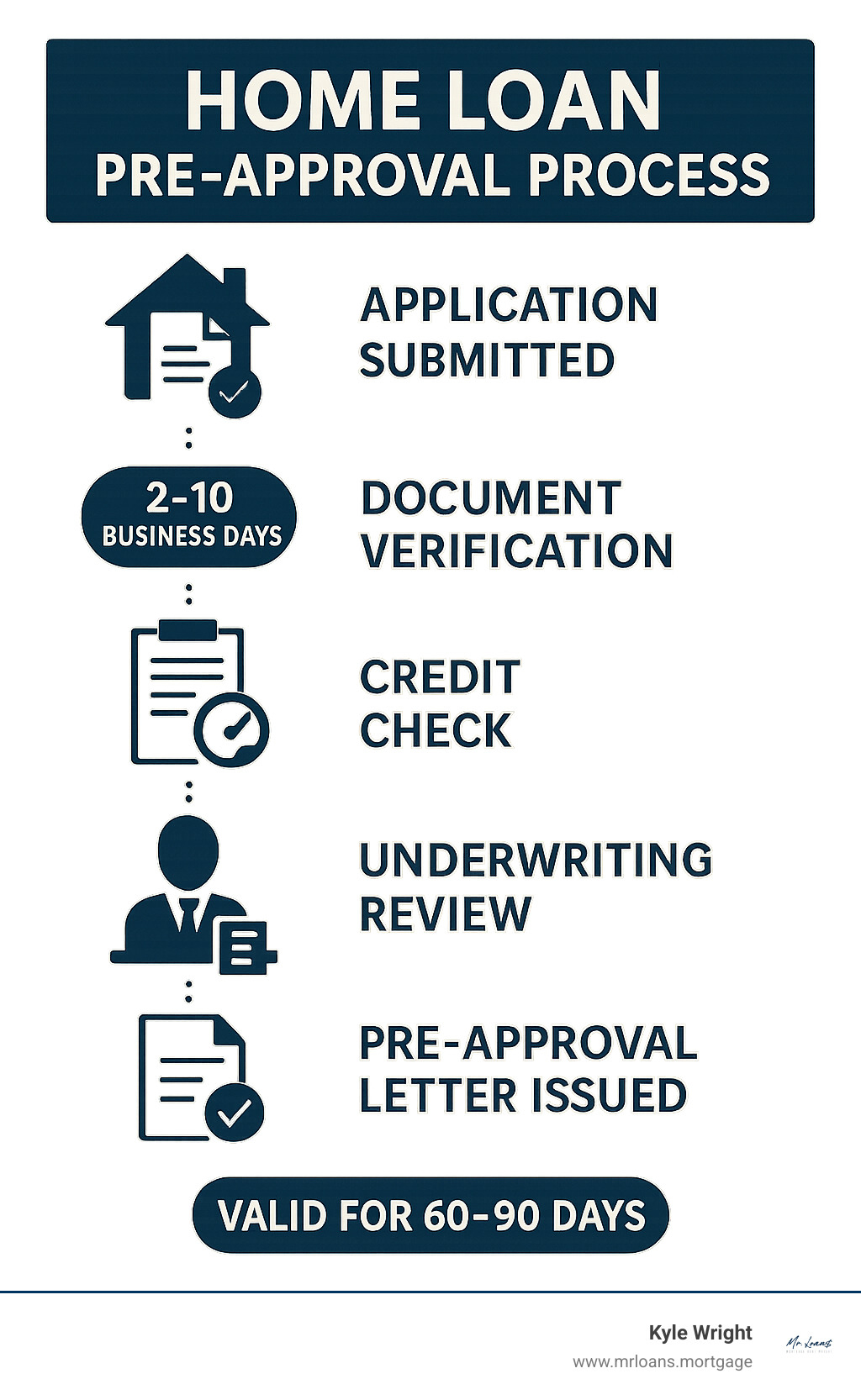

- Definition: A lender’s conditional agreement to loan you money for a home purchase

- Timeline: Takes 2-10 business days after submitting documents

- Validity: Lasts 60-90 days before expiring

- Requirements: Pay stubs, tax returns, bank statements, employment verification

- Credit Impact: Requires a hard credit inquiry (minor temporary score drop)

- Benefits: Stronger offers, faster closing, clear budget, seller confidence

Getting pre-approved isn’t just paperwork – it’s your ticket to shopping with confidence. In today’s competitive housing market, sellers often won’t even consider offers without a pre-approval letter. It shows you’re serious and financially ready to buy.

The process used to mean multiple trips to the bank and weeks of waiting. Now you can complete most steps online and get your letter in just a few days. But here’s what many buyers don’t know: not all pre-approvals are created equal. Some lenders offer quick “system-generated” approvals that aren’t worth much, while others do thorough reviews that sellers actually trust.

The key is understanding what makes a strong pre-approval and how to get one that actually helps you win the home you want.

Pre-Approval vs. Pre-Qualification: What’s the Real Difference?

Here’s something that trips up almost every first-time homebuyer: thinking pre-qualification and home loan pre-approval are the same thing. They’re not even close! Understanding this difference could be what separates you from other buyers in a competitive market.

Think of it this way: pre-qualification is like telling someone you probably have enough money to buy their car. Pre-approval is like showing up with cash in hand. Which seller would you take seriously?

| Feature | Pre-Qualification | Pre-Approval |

|---|---|---|

| Information Source | What you tell us (self-reported) | What we verify with documents |

| Credit Check | Soft inquiry (no score impact) | Hard inquiry (minor temporary impact) |

| Documents Needed | Little to none | Pay stubs, tax returns, bank statements |

| Lender Commitment | Just an estimate, no promises | Conditional commitment to lend |

| Seller Reaction | “We’ll see…” | “This buyer is serious!” |

| Timeline | Same day | 2-10 business days |

Want to understand the complete picture? Check out our detailed guide about the loan process to see how everything fits together.

Understanding Pre-Qualification First

Pre-qualification is your quick estimate – and that’s exactly how you should think about it. It’s like getting a rough idea of what you might afford based on a casual conversation.

Here’s how it works: you share some basic numbers with us – your income, monthly debts, and maybe how much you’ve saved. We run these through our system and give you a ballpark figure. The whole thing takes about an hour, and you can do most of it online.

The beauty of pre-qualification is that it’s a budgeting tool with no commitment from either side. We use a soft credit check, so your credit score stays untouched. It’s perfect for that “just curious” phase when you’re wondering if homeownership is even realistic.

But here’s the thing – it’s only as good as the information you give us. If you’re not sure about your exact income or forget about that student loan payment, the estimate won’t be accurate. That’s why sellers don’t put much weight on pre-qualification letters.

Why Pre-Approval Carries More Weight

Now we’re talking serious business. Home loan pre-approval means we’ve done our homework on your finances, and so have you. This isn’t based on what you think you make – it’s based on what your pay stubs actually say.

We’ll ask for recent pay stubs, tax returns, bank statements, and employment verification. Yes, it’s more paperwork, but that’s exactly why it carries stronger offer power. We’re also doing a hard credit inquiry, which gives us the full picture of your credit history. Don’t worry – while this might ding your credit score by a few points temporarily, it’s totally normal and recovers quickly.

What you get in return is pure gold: a conditional loan commitment. This tells sellers you’re not just window shopping – you’re ready to buy. In competitive markets, some sellers won’t even look at offers without a pre-approval letter. It shows seller confidence that your financing won’t fall through.

The difference in lender verification also means fewer surprises later. We’ve already caught potential issues early, which makes for a smoother closing process. Plus, if you’re considering an FHA loan, having your pre-approval done gives you a clear path forward with government-backed financing options.

Think of pre-qualification as your learner’s permit and pre-approval as your actual driver’s license. Both have their place, but only one gets you where you want to go.

The Step-by-Step Guide to Your Home Loan Pre-Approval

Securing a Home loan pre-approval might seem like a daunting task, but we’ve streamlined the process to make it as straightforward as possible. It involves a few key steps, from understanding when to apply to gathering the necessary documents.

When to Start the Pre-Approval Process

Timing is everything in real estate, and that applies to your pre-approval too! We generally recommend getting pre-approved when you are about to begin seriously looking for a new home or considering putting in an offer. This means before you fall in love with a property, you’ll know exactly how much you can afford, saving you from potential heartbreak and wasted time.

In today’s competitive markets, having a pre-approval letter in hand signals to sellers that you are a serious buyer, giving you a distinct advantage. It’s particularly beneficial when you’re facing multiple offers or bidding at an auction. Think of it as a strategic move: you’re showing up to the game prepared, with your financial backing already confirmed. The Freddie Mac Primary Mortgage Market Survey can offer insights into market trends, but your individual timing should align with your readiness to seriously house hunt. Don’t wait until you find your dream home; get pre-approved first!

What Documents Do I Need for a Home Loan Pre-Approval?

To ensure a smooth and efficient pre-approval process, having your documents ready is key. The more organized you are, the faster we can get your pre-approval letter into your hands. While the exact requirements can vary slightly depending on your unique financial situation, here’s a general list of what you’ll typically need:

- Proof of Income:

- Pay stubs from the most recent 30 days

- W-2 forms for the past two years

- Tax returns for the past two years (especially important if you’re self-employed or have complex income)

- Asset Documentation:

- Bank statements for the most recent two months (checking, savings, investment accounts)

- Statements for any other liquid assets you plan to use for a down payment or closing costs

- Employment Verification:

- Contact information for your employer(s)

- Proof of continuous employment (if applicable, especially for recent job changes)

- Credit History Information:

- Your Social Security Number (for us to pull your credit report)

- A list of any outstanding debts (credit cards, car loans, student loans, etc.)

- Identification:

- Valid government-issued photo ID (e.g., driver’s license, passport)

Gathering these documents beforehand can significantly speed up the pre-approval process. We’re here to guide you through what’s needed and ensure you’re fully prepared.

What if My Application is Rejected?

It can be disappointing if your initial Home loan pre-approval application doesn’t go through as planned. But don’t despair! A rejection isn’t the end of your homeownership dream; it’s an opportunity to understand what needs improvement and to strengthen your financial position.

Common reasons for a pre-approval application to be rejected include:

- Low Credit Score: Your credit history might indicate a higher risk to lenders.

- High Debt-to-Income (DTI) Ratio: This means too much of your monthly income is already going towards debt payments.

- Inability to Prove Income: Lenders need consistent and verifiable income.

- Recent Changes in Financial Situation: A new job, significant debt, or large purchases can impact your eligibility.

- Not Meeting Specific Lending Criteria: Each lender has unique criteria, and sometimes your situation just doesn’t align with their current policies.

If your application isn’t approved, our best advice is to reach out to us immediately. We’ll explain exactly why the pre-approval wasn’t granted and provide actionable steps you can take to improve your chances. This might include:

- Reducing Debt: Focus on paying down credit card balances or other loans.

- Saving for a Larger Down Payment: A bigger down payment can offset other financial weaknesses.

- Improving Your Credit Score: Dispute any errors on your credit report and make all payments on time.

- Increasing Your Income: Explore opportunities for raises or additional income streams.

We’re committed to helping you achieve your homeownership goals. Even if your initial attempt isn’t successful, we can work with you to create a plan to get you mortgage-ready. Our APM mobile app and online prequalification services are designed to simplify this journey, no matter where you are in Chandler AZ, Arizona, or Texas. Don’t hesitate to get in touch with us for personalized guidance: More info about how to get in touch

Open uping Your Buying Power: The Key Benefits of Pre-Approval

Securing a Home loan pre-approval isn’t just about getting a piece of paper; it’s about open uping significant advantages in your homebuying journey. It empowers you in ways that cash buyers typically enjoy, even if you’re financing your purchase.

Why a Home Loan Pre-Approval Gives You a Competitive Edge

Picture this: you’re in a room with ten other potential buyers, all eyeing the same beautiful home. The seller has to choose between multiple offers. Who do you think they’ll pick? The buyer with a serious offer backed by verified financing, or someone who says “I think I can get a loan”?

Your pre-approval letter instantly separates you from the pack. It tells sellers you’re not just window shopping – you’re financially ready to commit. This matters more than you might think, especially if sellers have been burned before by deals that fell through due to financing problems.

When bidding wars break out, your pre-approval becomes your ace in the hole. Even if your offer isn’t the highest dollar amount, sellers often choose the pre-approved buyer because it promises a smoother, more reliable closing. Nobody wants to start the whole selling process over again because a buyer couldn’t secure financing.

For private sales, your pre-approval gives you real negotiating power. You can make firm offers and demonstrate that you’re ready to move quickly. This confidence often translates into better terms and a faster agreement.

Here’s the cherry on top: because much of your financial verification happened during pre-approval, your final loan approval moves much faster. Sellers love this because it means fewer delays and less stress for everyone involved.

Whether you’re exploring conventional loans or specialized programs like VA Loans, having your pre-approval ready puts you in the driver’s seat.

Shop with Confidence and a Clear Budget

Remember the last time you went grocery shopping when you were really hungry? You probably bought way more than you needed and spent more than you planned. House hunting without pre-approval feels a lot like that, except the stakes are much higher.

Your Home loan pre-approval gives you something invaluable: crystal-clear boundaries. You’ll know exactly how much lender is willing to loan you, which means you can focus your search on homes that actually fit your budget. No more falling in love with a $500,000 house when you can afford $350,000.

This clarity saves you serious time and heartache. Instead of spending weekends touring homes that are financially out of reach, you and your real estate agent can laser-focus on properties that make sense. Your house-hunting becomes efficient and purposeful.

But it goes deeper than just knowing your price range. With your loan amount confirmed, you can calculate your actual monthly payments – including principal, interest, taxes, and insurance. This lets you budget realistically for your new life as a homeowner.

Think about it: wouldn’t you rather know upfront that your dream home will cost $2,800 per month instead of finding this after you’ve already imagined yourself living there? Pre-approval gives you this power to plan and budget with confidence.

At Mr. Loans, we want you to shop with complete confidence. That’s why we help you understand your borrowing power and explore different options that fit your unique situation: More info about different loan types

You’re Pre-Approved! Now What?

Congratulations on securing your Home loan pre-approval! This is a huge milestone that puts you ahead of many other buyers in today’s market. But here’s something important to remember: your pre-approval letter isn’t quite the finish line yet. Think of it more like a VIP pass that gets you into the exclusive club of serious homebuyers.

Your pre-approval is what we call a conditional approval. It means we’ve looked at your finances, run the numbers, and said “Yes, we’re ready to lend you this amount!” But there are still a few boxes to check before you get the keys to your new home.

The good news? You’re now in the driver’s seat. You can shop with confidence, make competitive offers, and negotiate from a position of strength. Just keep in mind that this golden ticket does come with some time limits and conditions.

How Long Does a Pre-Approval Last?

Your Home loan pre-approval won’t last forever – think of it like a carton of milk with an expiration date. Most pre-approvals are valid for 60 to 90 days, though some lenders might extend this window slightly longer.

Why the time limit? Your financial picture can change, interest rates fluctuate, and lending policies evolve. What looked good three months ago might need a fresh look today. If you got a raise, paid off a credit card, or unfortunately lost your job, these changes affect your loan eligibility.

Don’t panic if your house hunt takes longer than expected! If your pre-approval expires before you find the perfect home, we can usually refresh it pretty easily. You’ll need to provide updated documents like recent pay stubs and bank statements, but since we already know you, the process is typically much faster the second time around.

The key is staying in touch with us throughout your search. If anything significant changes in your financial life, give us a heads up. It’s much better to address changes proactively than to find issues right before closing.

Does Pre-Approval Guarantee a Loan?

Here’s where we need to be crystal clear: a Home loan pre-approval is not a guarantee of final loan approval. We know this might sound confusing, but stick with us – it makes perfect sense once you understand the process.

Pre-approval means we’ve thoroughly reviewed your financial situation and said “You’re approved for up to this amount.” But we haven’t seen the house you want to buy yet! Final approval happens only after we’ve completed a few more critical steps.

The property appraisal needs to confirm the home is worth what you’re paying for it. We also need a clean title search to make sure there are no hidden liens or ownership issues. Our underwriting team will do a final review of everything, including the specific property details.

Most importantly, your financial situation needs to stay stable between pre-approval and closing. Taking on new debt, changing jobs, or making major purchases can throw a wrench in the works. We’ve seen buyers lose their final approval because they financed a new car right before closing – don’t let that be you!

Think of pre-approval as us saying “We trust you with our money.” Final approval is us saying “We trust you with our money for this specific house.” It’s an important distinction, but one that rarely causes problems when you work with experienced professionals like our team.

For additional peace of mind, you can always verify our licensing and credentials through NMLS Consumer Access. We believe in complete transparency throughout your homebuying journey.

Frequently Asked Questions about Mortgage Pre-Approval

We get it – the Home loan pre-approval process can feel overwhelming, especially when you’re navigating it for the first time. That’s why we’ve gathered the most common questions our clients ask us. These answers should help clear up any confusion and give you the confidence to move forward.

Does getting a home loan pre-approval affect my credit score?

A pre-approval typically requires a ‘hard’ credit inquiry, which can cause a minor, temporary dip in your credit score. This is a standard part of the lending process.

How long does it take to get pre-approved for a mortgage?

The timeline can vary, but once you submit all required documentation, it typically takes a few business days to receive a pre-approval letter from the lender.

Can I get pre-approved with multiple lenders?

While possible, it’s not recommended to apply with many lenders at once, as multiple hard inquiries in a short period can negatively impact your credit score more significantly.

Take the Next Step Towards Homeownership

Getting your Home loan pre-approval isn’t just checking a box on your homebuying to-do list. It’s like getting your golden ticket to the real estate show. You’ve armed yourself with the confidence to walk into any home showing knowing exactly what you can afford, and sellers will take your offers seriously from day one.

Think about it – you’re no longer the buyer who “thinks” they can afford a home. You’re the buyer who knows they can close the deal. That’s a game-changer in today’s market.

The preparation you’ve done by gathering documents, understanding your budget, and securing that pre-approval letter puts you miles ahead of other buyers who are still figuring things out. You can move fast when you find the right home, and in competitive markets, speed often wins.

We at Mr. Loans understand that the mortgage world can feel overwhelming. That’s why we’ve designed our process to be as straightforward as possible. Our APM mobile app keeps everything at your fingertips, and our online prequalification gets you started without the hassle of multiple office visits.

Whether you’re looking in Chandler, Arizona, Texas, or anywhere else we serve, we’re here to guide you through every step. We’ve helped countless families move from renters to homeowners, and we’d love to help you join them.

Your dream home is out there waiting for you. The question isn’t whether you can afford it – your pre-approval already answered that. The question is: are you ready to make it yours?