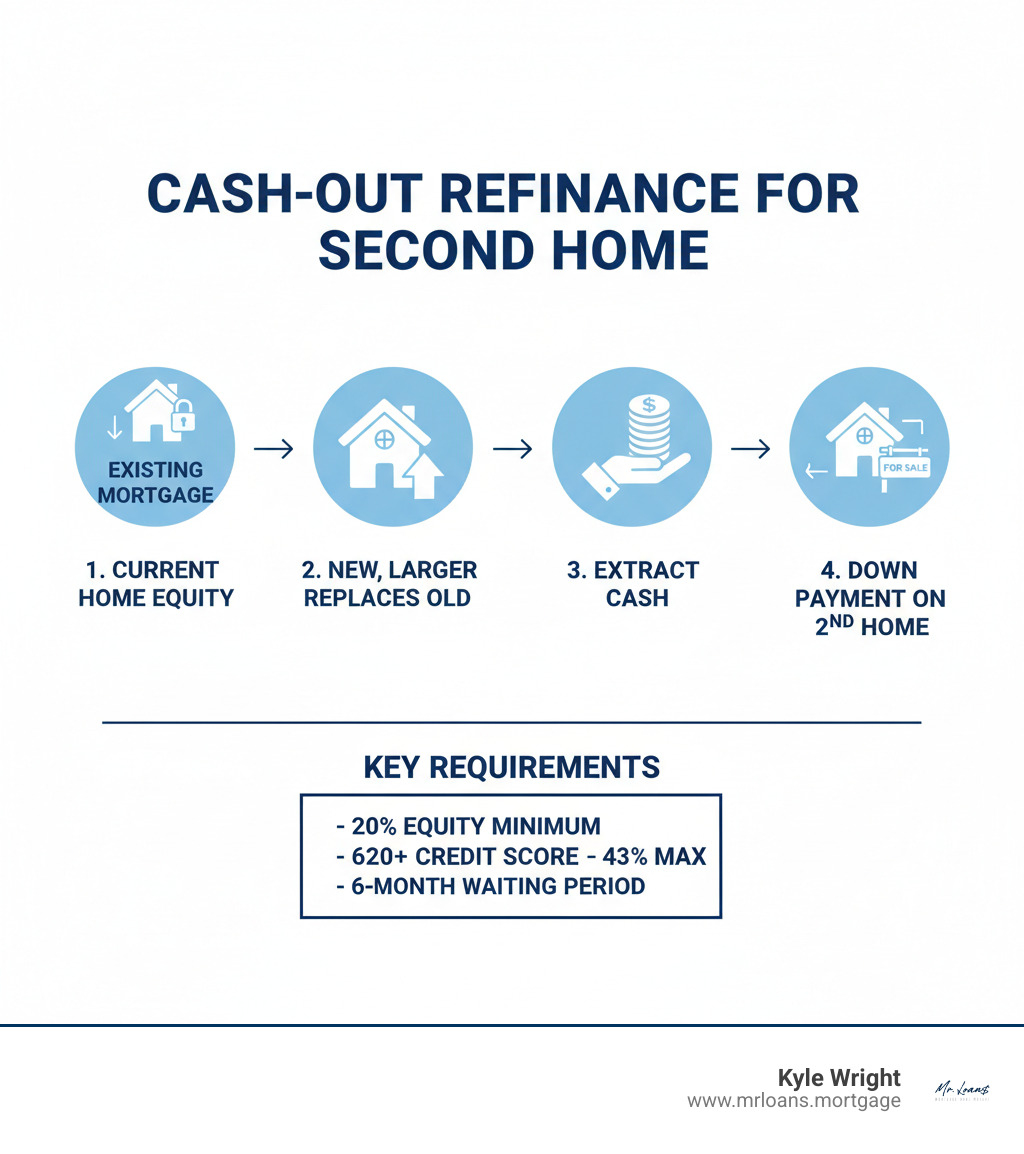

A cash-out refi lets you use your current home’s equity to buy a second home. You do this by replacing your existing mortgage with a larger loan, and the extra cash from the new loan is used to finance your next property.

Key Requirements:

- At least 20% equity in your current home

- Credit score of 620 or higher

- Debt-to-income ratio of 43% or less

- 6-month waiting period after your original mortgage closing

How Much Cash Can You Access?

- Most lenders allow up to an 80% loan-to-value ratio

- Example: $400,000 home value – $250,000 current mortgage = up to $70,000 cash out

- Closing costs typically range from 2-5% of the loan amount

Timeline: The process usually takes 30-60 days to complete

Many homeowners find that their primary residence holds the key to their second home dreams. With home equity appreciating significantly, more people have substantial equity to leverage. The strategy is simple: replace your existing mortgage with a larger one, pocket the cash difference, and use it for a down payment on a vacation home, rental property, or retirement residence. While this puts your primary home as collateral, it can offer lower interest rates than other financing options and consolidate payments. Understanding the mechanics, requirements, and risks is crucial to deciding if it’s the right move for you.

What is a Cash-Out Refinance and How Does It Work?

A cash-out refi to buy a second home lets you access your home equity. You create a new mortgage that’s larger than your current one, pay off the existing mortgage, and receive the difference as a lump-sum cash payment. This allows you to tap into assets built through mortgage payments and home appreciation without selling your current home. You’re leveraging your primary residence’s wealth to fund your second home.

The Basic Mechanics

The process starts with a home appraisal to determine your property’s market value and available equity. Next, the loan-to-value (LTV) ratio is calculated. Most lenders allow borrowing up to 80% of your home’s value when using cash for a down payment on a second home, requiring you to keep at least 20% equity. The process involves replacing your loan with a new, larger mortgage. After paying off the old loan, you are receiving funds to use for your second home.

For example, if your home is worth $400,000 and you owe $200,000, an 80% LTV allows a new loan of $320,000. After paying off the $200,000 mortgage, you’d receive $120,000 in cash.

Second Home vs. Investment Property

Lenders view second properties differently. Understanding the distinction between a vacation home and a rental property is key to choosing the right financing path.

A vacation home is a personal retreat. Lender guidelines require personal use for at least 14 days a year or 10% of the days it’s rented, whichever is greater. While occasional rentals are allowed, it’s primarily for personal enjoyment, and occupancy rules reflect this.

An investment property is for generating income, like a rental house or duplex. These face stricter requirements, higher interest rates, and larger down payments. Tax implications also differ, so review the IRS rules for vacation properties.

Your choice impacts your interest rate and down payment, so decide on the property’s intended use before refinancing.

How to Use a Cash-Out Refi to Buy a Second Home

Using a cash-out refi to buy a second home is a step-by-step process. With careful financial planning and a proper loan application, you can turn your home equity into a second property. We’ll walk you through the mortgage process so you know what to expect.

Step 1: Check Your Eligibility and Equity

First, confirm your eligibility. The main home equity requirement is retaining at least 20% minimum equity after the refinance. For example, on a $500,000 home, you can borrow up to $400,000. If you owe $300,000, you could get $100,000 in cash.

You’ll also need a credit score of at least a 620 minimum score; higher scores secure better rates. Your debt-to-income (DTI) ratio must be 43% DTI or less, calculated with the new, larger mortgage payment. If your DTI is higher, you’ll need significant cash reserves. Finally, most lenders have a 6-month rule, a waiting period after your original mortgage closing before you can do a cash-out refinance.

Want to see what you might qualify for? Check out our affordability calculator to get a realistic picture of your options.

Step 2: Determine How Much Cash You Can Access

The amount of cash you can access is guided by the 80% LTV rule (sometimes 75% for second homes). Here’s an example calculation for calculating your maximum loan: a home appraised at $400,000 with an 80% LTV allows a new loan of $320,000. If your current mortgage is $250,000, you could access $70,000 in cash.

However, remember to factor in closing costs, which are typically 2-5% of the loan amount. For a $320,000 loan, this means $6,400 to $16,000 in fees, reducing your net cash. Use our payment calculator to see how your new mortgage payment will look.

Step 3: Steer the Application and Closing Process

The application process requires standard financial documents:

- W-2s and pay stubs from the last two years

- Bank statements covering the past 60 days

- Tax returns for the previous two years

- Details about any other properties you own

A property appraisal will be ordered to confirm your home’s value, which determines your cash-out amount. During underwriting, the lender verifies all your information to ensure you can handle the new loan. The closing timeline is typically 30-60 days. Staying organized and responsive to your lender’s requests is key to a smooth process. Before you know it, you’ll have the funds for your second home.

Weighing the Pros and Cons for Your Second Home Purchase

A cash-out refi to buy a second home is a strategy with opportunities and responsibilities. It allows you to leverage your biggest asset to grow your real estate portfolio, but it requires careful consideration. This approach turns home equity into purchasing power, but your primary home becomes collateral, amplifying both rewards and risks. Let’s weigh the pros and cons for your financial future.

Benefits of a cash-out refi to buy a second home

- Access to a large sum of cash: Tap into built-up equity for a substantial down payment without years of saving.

- Potentially lower interest rates: Borrow at mortgage rates, which are typically lower than personal loans or credit cards.

- Single loan payment: Consolidate your primary home’s financing into one mortgage payment, simplifying your finances.

- Avoid PMI on your second home: Use the cash for a 20% down payment on the new property to eliminate private mortgage insurance.

- Flexible use of funds: The lump sum can cover the down payment, closing costs, improvements, or cash reserves.

- Portfolio expansion: Accelerate your real estate investment timeline by leveraging existing equity to buy a vacation rental or future retirement home.

Risks of a cash out refi to buy second home

- Larger mortgage balance and higher monthly payments: Your primary mortgage payment will increase, and you’ll add a second mortgage payment, raising your total monthly housing costs.

- Risk of foreclosure: Your primary residence secures the new, larger loan. Defaulting could mean losing your home.

- Closing costs: Fees of 2% to 5% of the loan amount reduce the cash you receive. A $300,000 refinance could cost $6,000 to $15,000.

- Resetting your loan term: Starting a new 30-year loan means you’ll pay interest for a longer period, potentially increasing your total interest paid over time.

- Potential for higher interest rates: Cash-out refi rates are often slightly higher than standard refis, and second home mortgage rates are higher still.

Honestly assess if the benefits outweigh these risks. Your home’s equity is a valuable asset; use it wisely for long-term growth without overextending yourself.

Alternatives to a Cash-Out Refinance

A cash-out refi to buy a second home isn’t your only option, especially if you have a great mortgage rate you want to keep.

Home Equity Loan vs. Bridge Loan

A Home Equity Loan (HEL) is a second mortgage on your home. You add another loan instead of replacing your existing one, meaning two monthly payments, but you keep your current mortgage rate. HELs typically offer fixed interest rates and a lump sum of cash.

Here’s how they stack up against each other:

| Feature | Cash-Out Refinance | Home Equity Loan (HEL) |

|---|---|---|

| Loan Type | Replaces your existing primary mortgage with a new, larger one. | A second mortgage, separate from your primary mortgage. |

| How Funds are Received | Lump sum, after old mortgage is paid off. | Lump sum. |

| Interest Rate Type | Typically fixed (can be variable). | Fixed rate. |

| Best For | Accessing a large amount of cash, potentially lowering overall interest rate, consolidating into one payment. | Accessing a specific lump sum without changing your primary mortgage, if your current rate is very low. |

| Key Consideration | Resets your primary mortgage term, higher closing costs, higher monthly payment on primary. | Adds a second monthly payment, closing costs, interest may not be tax-deductible for second home purchase. |

A Home Equity Line of Credit (HELOC) is a revolving line of credit backed by your home’s equity. You draw funds as needed, offering flexibility for uncertain costs. The main drawback is that variable interest rates can cause your payments to change.

Bridge loans are short-term loans that bridge the gap between buying a new home and selling your old one. They provide cash for a down payment while you wait for your sale to close. They typically have higher interest rates and fees, but can be structured with no monthly payments during the loan term.

Other Funding Options

- Personal loans: These are unsecured, so your home isn’t at risk. However, they come with higher interest rates and lower borrowing limits, making them suitable for smaller funding needs.

- 401(k) loans: Borrow from your retirement savings and pay interest back to yourself. Be aware of the risks: leaving your job can trigger immediate repayment, and failure to repay results in taxes and penalties. Review the IRS rules for 401(k) loans.

- Private lending: Offers more flexible terms than traditional banks but usually at higher interest rates. This can be an option for unique financial situations.

Match the financing choice to your situation. A home equity loan may be better if you have a low mortgage rate, while a HELOC offers flexibility. Each option has its place.

Frequently Asked Questions

We know that choosing to use a cash out refi to buy second home brings up plenty of questions. Here are the answers to the most common concerns we hear from homeowners considering this financial strategy.

Is the interest on a cash-out refinance tax-deductible when buying a second home?

The tax deductibility of interest from a cash-out refinance depends on how the funds are used. According to the IRS, mortgage interest is generally deductible only when used to “buy, build, or substantially improve” the home securing the loan.

When you use a cash out refi to buy second home, the interest on the cash-out portion is typically not tax-deductible because the funds are for a different property. However, the interest on the original mortgage balance may still be deductible.

The rules are complex and can change, so it’s crucial to consult a tax professional for advice specific to your situation. For more details, see IRS Publication 936 on Home Mortgage Interest Deduction.

Can I use future rental income from the second home to qualify?

Whether you can use future rental income to qualify depends on whether the property is a second home or an investment property. For a second home (personal use), lenders generally do not allow you to use potential rental income for qualification. Your existing income must be sufficient to cover both mortgage payments.

For an investment property (primarily for rental income), lenders may consider projected rental income. You’ll need to provide documentation like a lease agreement or a rental analysis. Lenders typically count only a percentage (e.g., 75%) of this income to account for vacancies and expenses. For more details, see the Fannie Mae rental income guidelines.

How soon can I buy another house after a cash-out refinance?

The timing depends on the type of property you’re buying. For a second home or investment property, you can purchase it as soon as your cash-out refinance closes and the funds are available. There is no waiting period.

However, if you plan to buy a new primary residence, you must adhere to occupancy requirements. Lenders enforce a one-year rule, meaning you must intend to live in your refinanced primary residence for at least 12 months after closing. This rule prevents mortgage fraud. Violating it can lead to serious consequences, like having to repay the loan immediately. Be transparent with your lender about your intentions to ensure you comply with all agreements.

Is This the Right Move for You?

Deciding on a cash-out refi to buy a second home means aligning your financial strategy with your long-term goals. This strategy can open up your home’s equity for real estate investment, but it’s a significant decision. It involves higher monthly payments and increased debt responsibility, as your primary home serves as collateral. You must be comfortable with the increased obligations and have a stable financial picture.

At Mr. Loans, we provide expert guidance custom to your unique situation. We prioritize transparency, ensuring you understand all aspects of leveraging your home equity. Our APM mobile app and online prequalification tools simplify the process, empowering you to explore options confidently.

With the right planning and a clear understanding of the risks and rewards, your home’s equity can be the key to your next property. Ready to explore what’s possible? Explore your refinance options today and let’s help turn your real estate dreams into reality.