Understanding the 3-1 ARM Loan Basics

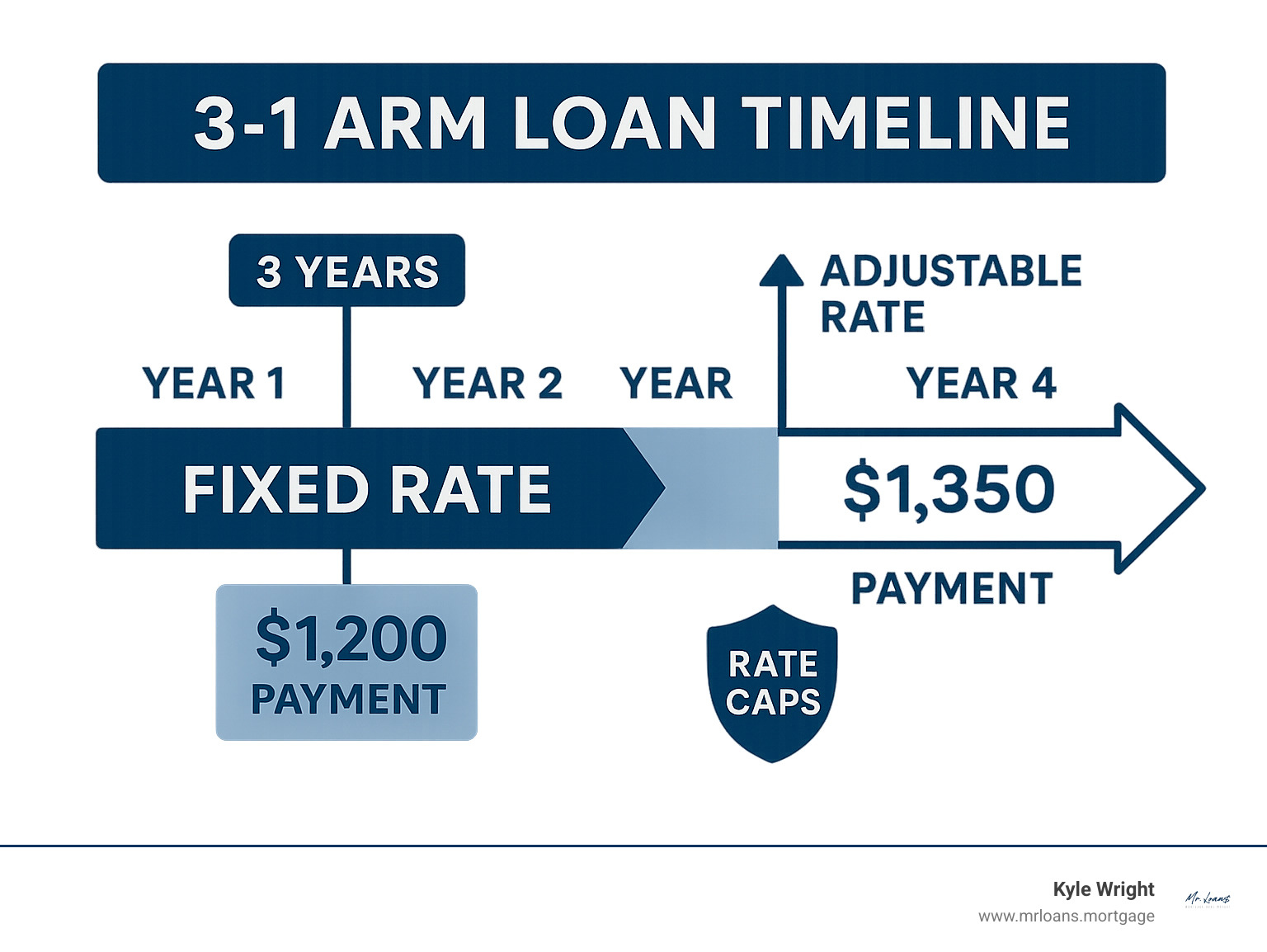

A 3-1 ARM loan is a hybrid adjustable-rate mortgage with a fixed interest rate for the first three years, which then adjusts annually for the rest of the loan term. This mortgage can provide significant initial savings but comes with future payment uncertainty.

Key Facts About 3-1 ARM Loans:

- Fixed Period: Interest rate is fixed for 3 years

- Adjustment Period: Rate adjusts annually after year 3

- Initial Benefit: Lower starting rate than 30-year fixed mortgages

- Rate Calculation: New rate = Index (e.g., SOFR) + Lender’s margin

- Protection: Rate caps limit rate increases

- Loan Term: Typically 30 years total

The appeal is clear: 3-1 ARMs often have starting rates significantly lower than traditional 30-year fixed mortgages. For instance, a 3-1 ARM might be 5.375% when a 30-year fixed rate is near 6%.

The catch is that after three years, your rate is tied to the market. Your monthly payment could jump substantially if interest rates rise.

This creates a strategic decision. Do you plan to sell or refinance before the three-year mark? Can you handle potentially higher payments? The answers determine if a 3-1 ARM is right for you.

Deconstructing the 3-1 ARM: How It Works

A 3-1 ARM loan has a 30-year term but functions in two distinct phases. For the first three years, it acts like a fixed-rate mortgage with predictable payments. Afterward, it becomes an adjustable-rate loan that changes annually based on market conditions.

The appeal of this hybrid structure is its lower initial interest rate compared to a 30-year fixed mortgage. This results in smaller monthly payments during the first few years, which helps with expenses like moving or new furniture. Payment calculation is standard, based on loan amount, rate, and term. The key difference is the interest rate becomes variable after year three.

The Initial Fixed-Rate Period: What the “3” Means

The “3” in 3-1 ARM loan signifies a three-year (36-month) introductory period where your interest rate is locked. This means no surprises or adjustments to your payment. This stability allows you to budget confidently and get comfortable with homeownership. Many use this period to build an emergency fund or pay down other debt.

Another benefit is that the lower initial rate means more of your payment goes toward the principal, helping you build equity faster in the early years. If you’re curious about how much house these lower initial payments might help you afford, our How much can I afford? calculator can give you a clearer picture.

The Annual Adjustment Period: What the “1” Means

After three years, the “1” takes effect, meaning your interest rate will adjust once per year for the remaining 27 years of the loan. On each adjustment anniversary, your rate is recalculated based on market conditions, so your payment could go up, down, or stay the same.

If interest rates have climbed, your payment will likely increase. If they’ve dropped, you might pay less. This uncertainty requires a flexible budget and extra savings. Compared to a 3/6 ARM, which adjusts every six months, the annual adjustments of a 3-1 ARM loan offer more stability between changes, which most borrowers prefer.

Understanding Your Rate: Index, Margin, and Caps

Your new rate is calculated using three key components: an index, a margin, and rate caps.

- The index is a benchmark that reflects market conditions, like the SOFR (Secured Overnight Financing Rate). Your interest rate moves up or down with this index.

- The margin is the lender’s fixed markup, added to the index to determine your rate. It remains constant for the life of the loan. For example, a 5.0% index plus a 2.5% margin equals a 7.5% rate.

- Rate caps are your safety net. The initial cap limits the first rate increase after year three (usually 2%). Periodic caps limit subsequent annual increases (often 1-2%). The lifetime cap sets the maximum rate, typically 5% above your starting rate.

For example, with a 5.5% start rate and a 2/2/5 cap structure, your rate could never exceed 10.5%. These caps provide crucial protection. For a deeper dive, the Consumer Handbook on Adjustable-Rate Mortgages offers comprehensive details.

Weighing the Pros and Cons of a 3-1 ARM

A 3-1 ARM loan has an attractive starting rate, but it’s important to weigh the pros and cons to see if it fits your financial goals and risk tolerance. A 3-1 ARM loan offers real advantages and savings, but also risks that require preparation. The key is deciding if the short-term savings are worth the long-term uncertainty for your situation.

The Advantages: Lower Initial Payments and Increased Buying Power

The main advantage of a 3-1 ARM loan is its lower initial interest rate, which makes homeownership more affordable for the first three years and provides real savings.

- Lower monthly costs create more room in your budget. This extra cash can be used for an emergency fund, other debts, or as a financial cushion.

- Qualifying for a larger loan is another benefit. Lower initial payments may help you get approved for a larger mortgage, giving you more buying power in competitive markets.

- Faster principal reduction is an added bonus. The lower initial rate means more of your payment reduces the loan balance, helping you build equity faster. This is valuable if you plan to sell or refinance before rates adjust.

The Disadvantages: Payment Shock and Future Uncertainty

The biggest concern with a 3-1 ARM loan is “payment shock” after the initial three-year period ends.

- Rising interest rates are the main risk. If rates climb by year four, your payment could jump dramatically, which can be a serious budget buster.

- Budgeting is challenging when your largest expense is unpredictable. Planning for other financial goals becomes difficult, which can create ongoing stress.

- Refinancing pressure is a downside. Many plan to refinance before rates adjust, but it isn’t guaranteed. You might not qualify later due to changes in your finances, home value, or higher overall interest rates.

- Risk of negative amortization, where your loan balance can grow if payments don’t cover the interest, is possible with some ARMs, though less common with standard 3-1 ARM loans.

Is a 3-1 ARM Loan the Right Choice for You?

Choosing a mortgage is a major decision. You can opt for the predictability of a fixed-rate loan or the lower initial payments and future uncertainty of a 3-1 ARM loan. The right choice depends on your unique situation. The decision boils down to your housing timeline, risk tolerance, and financial goals. Let’s review when a 3-1 ARM loan makes sense and when to avoid it.

Ideal Scenarios for a 3-1 ARM Loan

A 3-1 ARM loan can be a smart financial move if you have a clear plan to leverage the three years of lower payments.

- Short-term homeowners benefit most. If you plan to move or upgrade within a few years, you can enjoy the initial savings without facing the rate adjustment.

- Professionals expecting significant income growth are also good candidates. The initial savings help with affordability, and a higher future income can handle potential payment increases.

- House flippers and investors use ARMs to minimize carrying costs during short ownership periods, which increases profit margins.

When to Avoid a 3-1 ARM

However, a 3-1 ARM loan isn’t suitable for everyone and can be too risky in certain situations.

- Long-term homeowners should be cautious. If you plan to stay in your home for many years, the predictability of a fixed-rate mortgage is often worth the higher initial cost to avoid future payment shock.

- Those on a fixed or tight budget should avoid ARMs. If your budget is already stretched, a payment increase could cause financial strain.

- Risk-averse individuals should stick with a fixed-rate mortgage. The peace of mind that comes with predictable payments is often worth the extra cost.

Comparing the 3-1 ARM to Other Mortgages

Compared to a 30-year fixed-rate mortgage, a 3-1 ARM loan offers a lower initial rate, which can lead to significant savings in the first three years. However, the fixed-rate loan provides payment certainty for the entire term. Other ARMs, like the 5-1 or 7-1, offer longer fixed periods but with slightly higher initial rates. The 3-1 ARM loan usually has the lowest starting rate because the adjustment period begins sooner, representing a classic risk-reward trade-off.

If you’re still weighing your options, our Which Loan is Right For Me? tool can help you explore different scenarios.

Qualifying for and Managing Your 3-1 ARM

If a 3-1 ARM loan fits your financial strategy, the next step is qualification. The process is similar to other mortgages, but lenders will verify that you can handle potential payment increases after the fixed period. Managing your loan wisely during the fixed period and planning your next move is crucial. At Mr. Loans, we simplify The Loan Process for all loan types.

Typical Qualification Requirements

Qualifying for a 3-1 ARM loan is similar to other mortgages, but lenders must ensure you can afford payments even if rates adjust upward.

- Credit Score: A score of at least 620 is typically required, with higher scores leading to better terms.

- Debt-to-Income (DTI) Ratio: Lenders generally require your total monthly debts to be no more than 43% of your gross monthly income.

- Down Payment: A down payment of at least 5% is standard, though more can improve your rate.

- Ability to Repay Analysis: Lenders must verify you can afford payments at the maximum possible rate for the first five years, not just the low initial rate. This can make qualifying more challenging but also protects you.

The Strategic Choice: Refinancing Your 3-1 ARM Loan

Many borrowers treat a 3-1 ARM loan as a short-term tool, planning to refinance before the three-year fixed period ends. This exit strategy allows them to capture initial savings while avoiding rate adjustments. You can secure a fixed rate or potentially lower your payments if interest rates have dropped. Refinancing involves closing costs, typically 2% to 5% of the loan amount. Our Refinance Analysis Calculator can help determine if refinancing makes sense for you.

How to Compare Offers from Lenders

When shopping for a 3-1 ARM loan, look beyond the advertised interest rate to understand the complete package.

- Annual Percentage Rate (APR): Compare the APR, which includes fees and costs, for a more accurate comparison.

- Margin: Examine the lender’s margin. A lower margin means lower rates during the adjustable period.

- Rate Caps: Understand the rate caps (e.g., 2/2/5), as they are your safety net against large increases.

- Fees and Closing Costs: Ask about all fees upfront to compare the true cost of each loan.

- Prepayment Penalties: Check for penalties for paying off or refinancing your loan early.

For detailed explanations of mortgage terms, our Glossary can help.

Frequently Asked Questions about 3-1 ARM Loans

3-1 ARM loans can seem confusing. Here are answers to the most frequently asked questions.

What happens to my payment after the first three years?

After the first three years, your interest rate and payment will adjust annually. The new rate is calculated by adding a pre-set margin to a market index (like SOFR). Depending on interest rate trends, your payment could increase, decrease, or stay about the same. Your loan’s rate caps will protect you from extreme increases, but it’s wise to budget for potentially higher payments.

What’s the difference between a 3/1 ARM and a 3/6 ARM?

Both loans have a three-year fixed-rate period. The difference is the adjustment frequency afterward. A 3-1 ARM loan adjusts its rate once per year. A 3/6 ARM adjusts every six months, meaning more frequent payment changes. Most borrowers find the annual adjustments of a 3-1 ARM more manageable.

Why are 3-1 ARMs less common now?

3-1 ARM loans are less common today for a few reasons. First, regulations require lenders to qualify borrowers based on their ability to repay at a higher, adjusted rate, which can be challenging. Second, many borrowers and lenders now prefer ARMs with longer fixed periods, like 5/1 or 7/1 ARMs, which offer a balance of initial savings and longer-term stability. Finally, many consumers simply prefer the predictability of fixed-rate loans. However, for the right borrower with a clear strategy, a 3-1 ARM loan can still be an excellent choice.

Conclusion

The 3-1 ARM loan offers compelling initial savings for the right borrower but comes with payment uncertainty after the first three years. It requires careful planning and a realistic view of your financial future.

The ideal borrower for a 3-1 ARM loan has a clear plan, such as selling or refinancing before the rate adjusts, or expects significant income growth. For these individuals, the initial savings can be substantial. Conversely, those who prioritize predictability or plan to stay in their home long-term may find a fixed-rate mortgage more suitable.

Having an exit strategy is crucial. Whether you plan to sell, refinance, or are prepared for payment adjustments, knowing your next move is essential.

At Mr. Loans, we help clients in Arizona and Texas steer these decisions by understanding their unique goals. Our tools, like the APM mobile app and online prequalification, simplify the process. With the right information, you can find the perfect loan for your life. Ready to explore your options? Find out which loan is right for you and let’s begin.