Why Finding the Right Arizona Mortgage Lender Matters

Mortgage Lenders Arizona offer a wide range of options for homebuyers, from large national banks to local credit unions and mortgage brokers. With Arizona’s median home value at $376,369, choosing the right lender can save you thousands of dollars and reduce stress during your home buying journey.

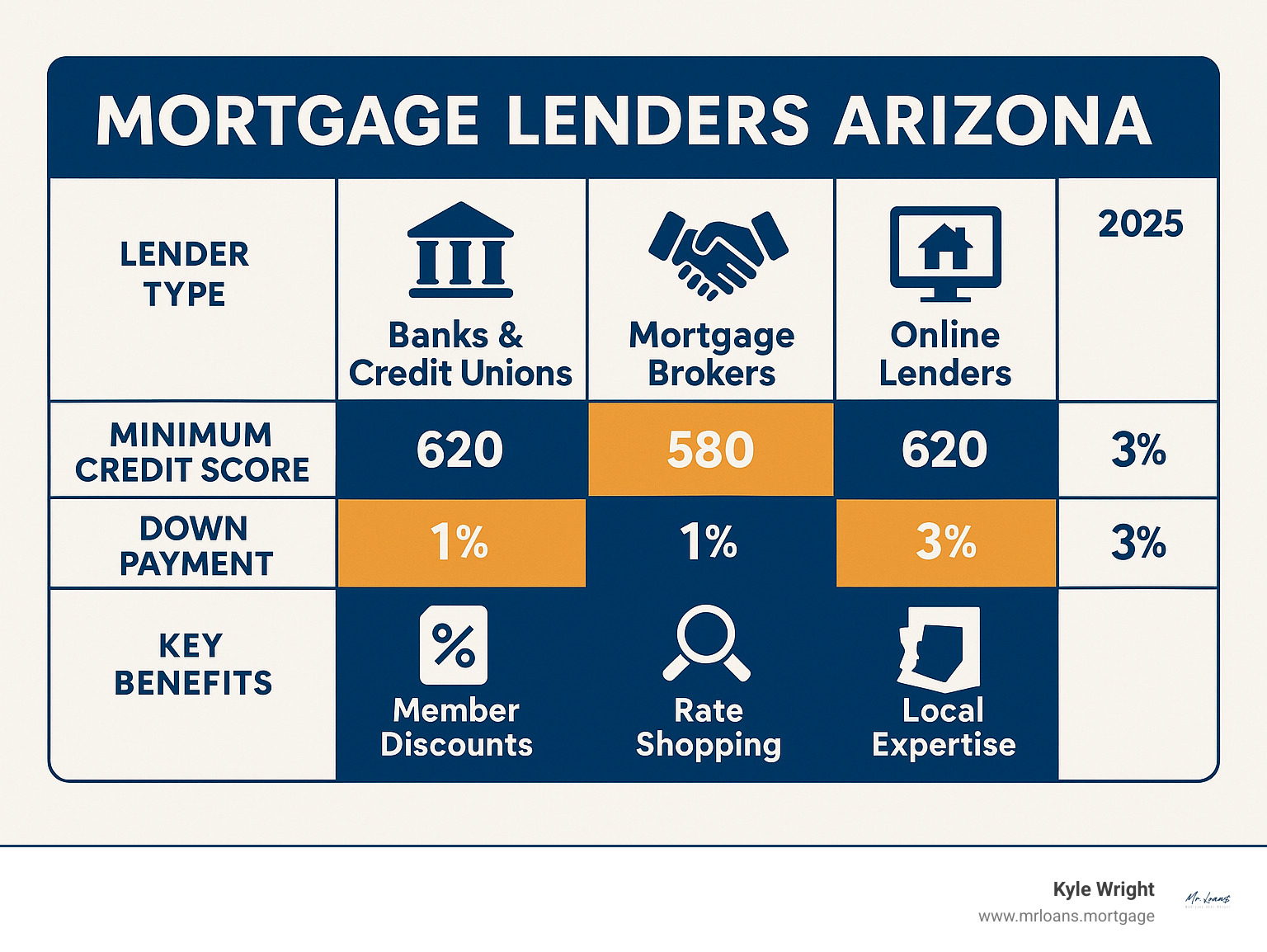

Top Arizona Mortgage Lender Options:

- Banks & Credit Unions – Many offer member discounts and closing guarantees.

- Mortgage Brokers – Shop your loan with hundreds of wholesale lenders to find competitive rates.

- Online Lenders – Often feature streamlined applications and low down payment options.

- Local Specialists – Provide deep market expertise and knowledge of state programs.

Key Requirements:

- Credit scores typically 580-620+ depending on loan type

- Down payments as low as 1-4%

- Income verification and debt-to-income ratios under 45%

Shopping for a mortgage in Arizona means comparing more than just interest rates. You need to evaluate loan programs, closing costs, customer service, and local market knowledge. Some lenders offer specialized programs like the HOME PLUS Down Payment Assistance Program that provides up to 5% assistance for qualified buyers.

Instead of visiting multiple lender websites and submitting separate applications, smart borrowers use strategies that create competition among lenders while protecting their credit scores.

1. Understand the Different Types of Lenders

Choosing the right Mortgage Lenders Arizona isn’t just about hunting for the lowest interest rate. It’s about finding the right match for your unique situation. In Arizona’s lending landscape, you’ll encounter different types of lenders: some use their own money to fund your loan, while others act as matchmakers, connecting you with the best deal from a network of partners.

Banks and credit unions are direct lenders who originate and fund loans with their own capital. Mortgage brokers, on the other hand, work as your personal shopping assistant, taking your application to multiple lenders to find the best deal. This creates competition that typically works in your favor.

Direct Lenders (Banks & Credit Unions)

Direct lenders handle everything in-house. If you have a long-standing relationship with your bank, this can feel like a natural next step. Credit unions deserve special attention, as they often prioritize member benefits, offering interest rate discounts or closing time guarantees. The trade-off with direct lenders is variety. Since they only offer their own loan products, you’re shopping at a single store. To compare options, you’ll need to visit multiple institutions individually, which can be time-consuming.

Mortgage Brokers

Mortgage brokers act as your advocate in the lending world. Instead of being tied to one lender’s products, we work with a vast network of wholesale lenders. The beauty of this approach is the competition we create on your behalf. We take your single application and shop it to our entire network, which often results in better interest rates and lower fees as lenders compete for your business.

Our compensation structure aligns our interests with yours; our goal is finding you the best possible deal, not pushing a specific bank’s products. This process simplifies your life considerably: one application, one credit pull, and we handle the rest. We can steer complex financial scenarios and find creative solutions that might not fit the rigid formulas of traditional banks. Plus, we understand Arizona’s unique market dynamics and can guide you through the loan process with local expertise.

2. Compare Loan Options, Rates, and Fees

That shiny low interest rate you see advertised isn’t the whole story. While a lower rate is great, the real number to focus on is the Annual Percentage Rate (APR). The APR is the “true cost” of your loan because it includes the interest rate plus other charges like origination fees and discount points.

Your game plan: ask at least three lenders for an official Loan Estimate form. The government requires all lenders to use the same standardized format, so you can compare apples to apples. When you get these Loan Estimates, pay special attention to the origination fees, mortgage points, and third-party charges, as these can vary dramatically between Mortgage Lenders Arizona.

Common Loan Programs for Arizona Homebuyers

Arizona homebuyers have access to several excellent loan programs designed for different situations.

- FHA Loans are fantastic for first-time buyers or those with less-than-perfect credit, requiring a minimum credit score of 580 and down payments as low as 3.5%.

- VA Loans are unbeatable for qualified veterans, active-duty service members, and eligible surviving spouses, offering zero down payment and no private mortgage insurance.

- Conventional loans are the most common type. They typically require credit scores of 620 or higher, but you can put down as little as 3%. With 20% down, you’ll avoid PMI entirely.

- Jumbo loans are for homes above the conventional loan limit of $766,550, requiring excellent credit and larger down payments.

- HELOC options let existing homeowners tap into their home’s equity for renovations, debt consolidation, or other major expenses.

Using Online Tools to Your Advantage

The internet has revolutionized mortgage shopping. Start with mortgage calculators to determine how much house you can afford. Rate comparison websites give you a starting point for market trends, but your actual rate will depend on your specific financial situation.

Online reviews offer valuable insight into a lender’s communication, closing times, and overall customer experience. Online applications have also made the process more convenient. Our APM mobile app, for example, lets you apply anytime, track your loan progress, and upload documents right from your phone. The key is to use these tools strategically to set your budget and understand your options before working with a trusted lender.

3. Evaluate Lender Reputation and Customer Service

A mortgage is a long-term relationship, so excellent customer service is non-negotiable when choosing from Mortgage Lenders Arizona. A reputable lender will communicate clearly, answer your questions promptly, and guide you through the process without adding unnecessary stress.

The best lenders are your advocates. They explain complex terms simply, keep you updated, and are available when you need them. Look for lenders with a strong history of success and a local presence in Arizona. Some lenders even offer closing time guarantees, which can be a major advantage in a competitive market.

At Mr. Loans, we believe getting a home loan should be easy, fast, and exciting. We act as your advocate, simplifying the process and ensuring consistent communication every step of the way.

How to Vet Reputable Mortgage Lenders in Arizona

Before committing to a lender, do your homework. Here are the key steps:

- Verify Licensing: Use the NMLS Consumer Access database to check a lender or loan officer’s license and disciplinary history. Any legitimate lender will have an NMLS ID.

- Read Reviews: Dive into online testimonials on Google, Zillow, and the Better Business Bureau. Look for patterns in feedback regarding responsiveness, transparency, and closing on time.

- Check the BBB: The Better Business Bureau website can provide insight into how a company handles customer issues and their commitment to satisfaction.

- Ask for References: A confident, reputable lender will be happy to provide references from recent clients.

- Meet the Team: Get to know the people you’ll be working with. Check out Our Staff at Mr. Loans. Our executive team brings over 28 years of mortgage experience, ensuring you’re in capable hands.

4. Seek Out Local Expertise and Arizona-Specific Programs

When you choose Mortgage Lenders Arizona with deep local roots, you get a partner who understands the nuances of the state’s communities. A lender who lives and works here knows local property values, neighborhood trends, and the quirks of Arizona’s real estate market. With a median home value of $376,369, that local insight is invaluable.

We’re proud to have local offices in Chandler, giving us a front-row seat to the market. But where local knowledge really pays off is with Arizona-specific homebuyer programs. These programs can save you thousands, but many out-of-state lenders don’t know they exist. A local expert will ensure you don’t miss out.

Key Assistance Programs for Arizona Homebuyers

Arizona has fantastic programs to make homeownership more accessible. The trick is knowing about them.

The HOME PLUS Down Payment Assistance Program is Arizona’s premier homebuyer assistance program. It offers eligible buyers up to 5% for down payment and closing costs. This assistance is a second mortgage that may be completely forgiven over three years. To qualify, you’ll typically need a credit score of 640 or higher and meet household income limits.

Beyond HOME PLUS, Arizona offers other down payment and closing cost assistance programs through local housing authorities, often as grants or other forgivable loans. Some lenders also offer their own innovative programs, like 0% down payment options for qualified buyers, sometimes with no income limits. Many of these programs also feature reduced mortgage insurance, making your monthly payments more manageable.

We are committed to exploring every available option to make your Arizona homeownership dream a reality. We know these programs inside and out and will work to get you every dollar of assistance you qualify for.

5. Get Pre-Approved to Strengthen Your Offer

In Arizona’s competitive market, a pre-approval letter is essential. It tells sellers you’re not just window shopping—you’re a serious buyer ready to make a move. If a seller has two identical offers, they will almost always choose the one from the buyer who has already been vetted by a lender.

Pre-Approval vs. Pre-Qualification

These terms sound similar, but they are very different. Pre-qualification is a rough estimate based on self-reported financial information. No documents are verified, so sellers don’t take it seriously.

Pre-approval is the real deal. We verify your income, check your assets, pull your credit report, and review your entire financial picture. Afterward, you get a commitment letter showing exactly how much we’re willing to lend you. We pride ourselves on delivering accurate pre-approvals, often within 24 hours, giving you a competitive edge.

Typical Requirements for an Arizona Mortgage

Getting approved for a mortgage involves a review of a few key factors:

- Credit Score: While some government programs like FHA accept scores as low as 580, most conventional loans prefer 620 or higher. A better score means a better interest rate.

- Income & Asset Verification: You’ll need to provide documents like pay stubs, W-2s, tax returns, and bank statements to prove your income and show you have funds for a down payment and closing costs.

- Debt-to-Income (DTI) Ratio: This compares your monthly debt payments to your gross monthly income. Most lenders prefer a DTI of 43% or lower, though some programs are more flexible.

Common Pitfalls

Once you start the mortgage process, avoid financial moves that could derail your approval.

- Don’t make large purchases. A new car or furniture can wait until after closing.

- Avoid changing jobs. Lenders value stability. If a job change is unavoidable, talk to us immediately.

- Don’t open or close credit lines. This can impact your credit score and DTI ratio.

- Keep making all your payments on time. Any late payments will raise red flags.

Getting pre-approved puts you in the driver’s seat when you’re ready to Purchase a Home. You’ll know what you can afford and have the confidence that a lender is ready to work with you.

Frequently Asked Questions about Mortgage Lenders Arizona

What is a typical closing time for a mortgage in Arizona?

Most Mortgage Lenders Arizona close loans in 21 to 45 days, with 30 days being a common target. The timeline can be affected by your lender’s efficiency, the loan type, and how quickly you provide necessary documents. Some lenders even offer closing guarantees. At Mr. Loans, we work hard to keep things moving smoothly to hit your target closing date.

Should I choose a mortgage broker or a direct lender in Arizona?

This depends on your preference. Direct lenders (banks, credit unions) can be a good choice if you value an existing relationship and a one-stop-shop experience. Mortgage brokers shop your single application to hundreds of wholesale lenders, creating competition that often results in better rates and terms. As brokers, our goal is to find you the best deal, not push a specific product. We can also help with complex situations that may not fit a traditional bank’s criteria.

What credit score do I need to buy a house in Arizona?

It depends on the loan program. FHA loans may accept scores as low as 580, while conventional loans typically require 620 or higher. Some specialized programs might require a 700+ FICO score. A higher credit score doesn’t just help you qualify—it saves you money with a lower interest rate. We can review your credit situation and help you understand which loan programs are the best fit.

Conclusion

Finding the right Mortgage Lenders Arizona doesn’t have to be stressful. With the right preparation and guidance, the process can be an exciting journey toward your destination.

By now, you know the essential steps: understand the different lender types, compare loan options beyond the interest rate, vet lender reputations, seek local expertise, and get pre-approved. This diligence ensures you find a great loan and have a smoother path to owning your Arizona home.

This preparation is about ensuring a smoother, more enjoyable path to homeownership. Whether you’re eyeing a home in Tucson or Scottsdale, the right lender is your trusted partner in making it happen.

Ready to take the next step? The team at Mr. Loans is here to simplify the process and help you find the perfect financing for your new home. We believe getting a mortgage should be easy, fast, and exciting.