Why Finding the Right Home Lender in Arizona Matters

Finding the best home lenders arizona has to offer can save you thousands of dollars and weeks of stress during your home buying journey. With Arizona’s homeownership rate at 68.7% and a median housing value of $376,369, choosing the right lender is more important than ever.

When searching for a top lender, you’ll find many options with high customer satisfaction ratings. The best lenders often provide flexible terms, such as minimum down payments as low as 1-3% and credit score requirements that accommodate a wide range of buyers, often starting in the 580-620 range.

Arizona offers unique advantages for homebuyers, including the HOME+PLUS program that provides up to 5% in down payment and closing cost assistance for eligible buyers with credit scores of 640 or higher and income limits of $112,785.

The mortgage landscape in Arizona includes everything from traditional banks and credit unions to online lenders and mortgage brokers. Each type offers different benefits – banks provide established relationships, brokers shop multiple lenders for you, and online lenders often offer faster processing times.

Whether you’re a first-time buyer looking for an FHA loan with just 3% down or a veteran seeking a VA loan with zero down payment, understanding your options will help you make the best choice for your financial situation.

Understanding the Types of Home Lenders in Arizona

Choosing the right lender for your Arizona home purchase doesn’t have to feel overwhelming. Think of it like picking the right partner for a big trip – you want someone who understands your needs and has your back throughout the journey.

The good news is that Arizona has plenty of excellent home lenders arizona buyers can choose from. Each type brings something different to the table, so understanding your options will help you find the perfect fit for your situation.

You’ll encounter direct lenders like banks and credit unions that use their own money to fund loans. These institutions often have local branches where you can sit down face-to-face with loan officers. Then there are mortgage brokers who act as your personal shopping assistant, comparing options from multiple wholesale lenders. Finally, online lenders handle most of their business digitally, often offering streamlined processes and competitive rates.

Direct Lenders: Banks and Credit Unions

Banks and credit unions represent the traditional path to homeownership financing. If you’ve been banking with the same institution for years, there’s something comforting about walking into a familiar branch and discussing your home loan with someone who knows your financial history.

These direct lenders offer in-house loan products using their own funds. Banks typically provide a wide range of mortgage options and have established relationships with their customers. You might appreciate having local branches where you can ask questions or get updates on your loan status in person.

Credit unions deserve special mention here because they’re member-owned cooperatives. This structure often translates to member benefits like slightly better rates, more flexible terms, or waived fees. They tend to take a more personal approach to lending decisions.

The trade-off with direct lenders is potentially limited options. Since they’re only offering their own loan products, you won’t see the full range of what’s available in the marketplace. It’s like shopping at one store instead of comparing prices across multiple retailers.

Mortgage Brokers: Your Personal Loan Shopper

Here’s where things get interesting – and where we at Mr. Loans come into the picture. Mortgage brokers don’t lend their own money. Instead, we have access to multiple lenders and act as your advocate in finding the best possible deal.

Think of it this way: instead of calling dozens of lenders yourself, we do all that rate shopping for you with one application. We submit your information to our network of wholesale lenders and let them compete for your business. This competition often results in better rates and terms than you’d find going directly to a single lender.

The expert guidance we provide goes beyond just finding low rates. We help you understand different loan programs, steer complex paperwork, and avoid common pitfalls that can delay your closing. Want to learn more about how smooth we make this process? Check out more info about the loan process on our website.

One thing to understand about broker compensation – we’re typically paid the same amount regardless of which lender you choose. This means our incentives align perfectly with yours: finding you the best possible deal. We succeed when you succeed, and there’s no financial reason for us to steer you toward one lender over another.

How to Choose and Compare the Best Home Lenders Arizona Offers

Finding the right mortgage lender is like finding the perfect dance partner – you need someone who moves in sync with your rhythm and won’t step on your toes when things get complicated. It’s about much more than just snagging the lowest interest rate (though that’s certainly nice!).

When you’re evaluating home lenders arizona has available, think of yourself as a detective gathering clues. You want to look at the complete picture, not just the shiny number on the interest rate. The best lender for your neighbor might not be the best fit for your unique situation.

Your due diligence now will pay off big time later. A few hours of research can save you thousands of dollars and countless headaches down the road. Let’s explore what really matters when making this important decision.

Key Factors Beyond the Interest Rate

A low interest rate makes your heart sing, but there’s so much more to consider when choosing among the home lenders arizona offers. Think of the interest rate as just one ingredient in a complex recipe.

Loan products offered should be your first consideration. Does this lender actually offer what you need? Maybe you’re eyeing an FHA Loans because you’re working with a smaller down payment, or perhaps you’re a veteran looking into VA Loans. Some lenders specialize in certain types of loans while others offer a buffet of options.

Customer service and communication can make or break your experience. You want a lender who treats you like a real person, not account number 47,382. Look for lenders who explain things clearly, return your calls promptly, and make you feel comfortable asking questions. Trust us – you’ll have plenty of questions during this process.

Technology and online tools matter more than ever. Can you upload documents easily? Do they have a mobile app to track your progress? We’ve found that borrowers love being able to check their loan status at 11 PM in their pajamas. At Mr. Loans, our APM mobile app lets you manage everything from your phone, because who has time to drive to a bank branch these days?

Closing speed guarantees can be a game-changer, especially in Arizona’s competitive market. Some lenders promise specific timelines, which gives you confidence when making offers. Fast closings aren’t just convenient – they can help you win bidding wars against other buyers.

Ready to win? Contact my team today!

How to Compare Mortgage Rates and Fees from Arizona Lenders

Here’s where things get a bit tricky, but stick with us. Don’t just look at that interest rate and call it a day. The Annual Percentage Rate (APR) is your real friend here – it includes the interest rate plus fees, giving you the true cost of borrowing.

When you apply for a mortgage, lenders must give you a Loan Estimate document within three business days. This little piece of paper is pure gold for comparison shopping. It breaks down everything in black and white.

Pay close attention to origination fees – that’s what the lender charges to process your loan. Some lenders have low rates but high fees, while others might be the opposite. Discount points let you pay money upfront to lower your interest rate, but only do this if you plan to stay in the home for several years.

Don’t forget about closing costs – these include appraisal fees, title insurance, and other necessary expenses. And here’s a red flag to watch for: prepayment penalties. These nasty little fees punish you for paying off your mortgage early. They’re less common now, but always ask about them.

Get Loan Estimates from several different lenders so you can compare apples to apples. Some lenders make you jump through hoops to see their rates, but the good ones are upfront about their pricing.

Verifying a Lender’s Legitimacy and Reputation

In the age of online reviews, you have a powerful tool at your fingertips. Customer reviews and online ratings tell the real story about what it’s like to work with a lender. Don’t just look at the star rating – dig into the actual comments to see what people loved and what drove them crazy.

Look for patterns in the testimonials. Do people consistently praise their communication? Do they complain about surprise fees? These patterns tell you what to expect from your own experience.

Now here’s the really important part: make sure your lender is legitimate. Every mortgage lender must have an NMLS ID (that’s the Nationwide Mortgage Licensing System). This unique number is like their license plate in the mortgage world.

Licensing verification is simple but crucial. Head over to the official site and Verify a lender’s license here. Just plug in their NMLS ID and you’ll see their licensing status, any disciplinary actions, and other important details. It takes two minutes and could save you from a nightmare.

The Arizona Mortgage Gauntlet: Requirements, Programs, and Timelines

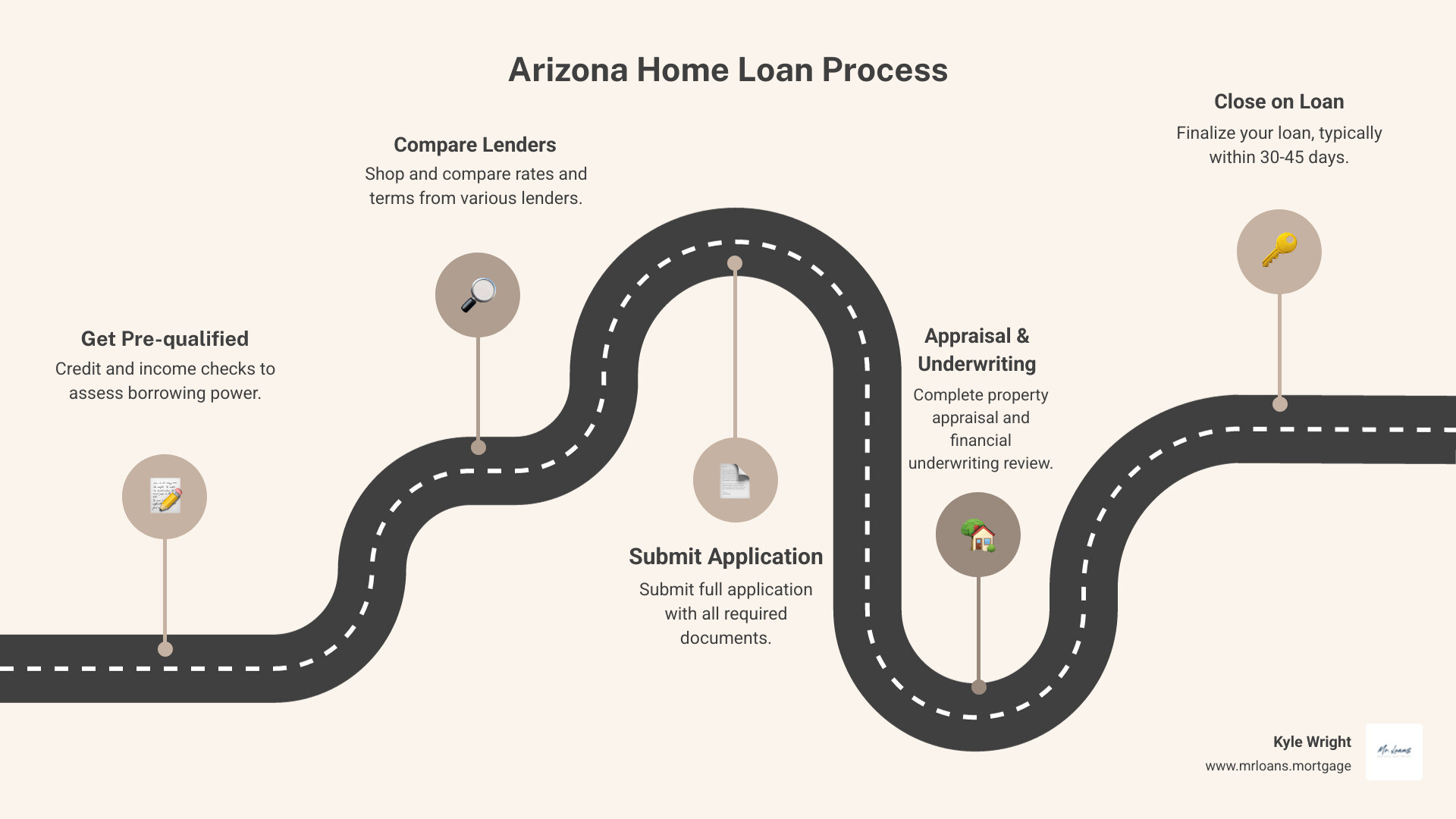

Getting a mortgage in Arizona doesn’t have to feel like running an obstacle course blindfolded! While the process involves several steps – from application to underwriting to final approval – understanding what’s expected can turn this “gauntlet” into a manageable journey. Arizona’s strong housing market and robust job growth actually work in your favor, giving home lenders arizona confidence in the local economy.

The current economic climate in Arizona is actually pretty favorable for homebuyers. While national trends like Federal Reserve decisions set the baseline for rates, Arizona’s healthy job market and continued population growth help keep lending standards reasonable and programs available.

What are the requirements for obtaining a mortgage with home lenders arizona?

Most home lenders arizona residents work with look for similar things when reviewing your application. The good news? The requirements aren’t as scary as they might seem at first glance.

Credit scores typically need to be in the 580-620 range depending on the loan type. FHA loans are the most forgiving, accepting scores as low as 580, while conventional loans usually want to see 620 or higher. If you’re looking at a jumbo loan for a pricier Arizona home, expect lenders to want 680 or better.

Down payment requirements have become much more reasonable over the years. You can get started with as little as 1-4% down on many loan programs. FHA loans need just 3.5% down, conventional loans often accept 3%, and if you’re a veteran, VA loans require zero down payment. Even jumbo loans, while requiring more, typically ask for 10-20% rather than the old standard of 20% across the board.

Your debt-to-income ratio is another key factor lenders examine closely. This compares your monthly debt payments to your gross monthly income. Most lenders want to see this ratio below 43% for conventional loans, though FHA loans can be more flexible, sometimes accepting ratios up to 50%.

Employment history matters too – lenders typically want to see two years of stable work history. They’re not necessarily looking for you to have stayed at the same job, but they want to see consistent income and career progression.

The paperwork requirements include recent pay stubs, tax returns from the past two years, bank statements, and documentation of any other income sources. It sounds like a lot, but your loan officer will walk you through exactly what’s needed for your situation.

My team excels with paperwork and we are here to make your mortgage experience seamless.

Arizona-Specific Homebuyer Assistance Programs

Here’s where Arizona really shines for homebuyers! The state offers some fantastic programs that can make homeownership much more achievable, especially for first-time buyers.

The star of the show is the HOME+PLUS Program, which provides down payment and closing cost assistance that can be a real game-changer. This program offers up to 5% of your loan amount to help cover these upfront costs – money that many buyers struggle to save while also paying rent.

To qualify for HOME+PLUS, you’ll need a credit score minimum of 640 and meet certain income limits (currently around $112,785 for most areas). The assistance typically comes as a forgivable second mortgage, which means if you stay in the home for three years, you won’t have to pay it back. However, if you sell or refinance within that period, you’ll need to repay the assistance.

This program pairs beautifully with FHA, VA, or conventional first mortgages, essentially allowing many buyers to get into a home with very little money out of pocket. You can learn more about the specifics at the HOME PLUS Down Payment Assistance Program website.

What are the typical closing times for mortgages in Arizona?

Most Arizona mortgages close within 30-45 days from the time you submit your complete application. This timeline has actually improved over the past few years as lenders have streamlined their processes and acceptd better technology.

Several factors can influence how quickly your loan closes. The appraisal process can sometimes create delays, especially during busy seasons when appraisers are backed up. Underwriting conditions – additional documentation or clarifications the underwriter needs – can also extend the timeline if not addressed quickly.

Here’s where you have real control: buyer responsiveness makes a huge difference. The faster you provide requested documents and answer questions, the smoother your process will be. Being organized from the start and staying on top of your loan officer’s requests can easily shave a week or more off your closing time.

Different loan types can also affect timing. FHA and VA loans sometimes take slightly longer due to additional government requirements and inspections, while conventional loans often move a bit faster.

At Mr. Loans, we pride ourselves on making the closing process as fast and stress-free as possible. Our APM mobile app helps you track your loan’s progress and upload documents quickly, keeping everything moving smoothly toward your closing day.

If you’re already a homeowner looking to tap into your equity or lower your rate, you can learn how to refinance your home with us as well. The refinance process is often even faster than a purchase loan since there’s no purchase contract timeline to meet.

Frequently Asked Questions about Arizona Home Lenders

We know you’ve got questions about choosing home lenders arizona, and we’re here to provide clear, straightforward answers that actually make sense.

What is the difference between a mortgage broker and a retail lender in Arizona?

This is probably the most important question you can ask, and honestly, it’s one that can save you thousands of dollars once you understand it!

A retail lender (that’s me) is like a restaurant buffet that only serves a variety of options. We use our own money to make loans with in-house and specialty programs. Where APM is different, is we also have the option to broker loans—so you get the best of both words—innovative mortgage solutions AND the ability to get the best rate and term.

A mortgage broker doesn’t lend their own money. Instead, they connect you with a network of wholesale lenders, shopping your loan to find a lender that will work with your specific scenario.

Here’s why this matters: when we shop your loan to multiple lenders, they compete for your business. This competition often results in better rates and terms than you’d get walking into a single bank. Plus, you only fill out one application and get one credit pull, which protects your credit score while still giving you access to hundreds of loan options.

How does the current economic climate in Arizona affect mortgage rates?

Mortgage rates are influenced by both national trends and what’s happening right here in Arizona, and understanding both can help you time your home purchase better.

On the national level, the Federal Reserve’s decisions set the stage for mortgage rates. When they adjust the federal funds rate or make announcements about economic policy, it ripples through the entire lending market. Things like inflation, job growth, and economic uncertainty all play a role in where rates land.

But Arizona has its own economic personality that affects mortgage rates too. Our state has a strong job market and continues attracting new residents, which creates high housing demand. This local demand can influence how lenders price their loans and what products they offer.

The good news? Arizona’s robust economy often works in borrowers’ favor. Lenders see our state as a stable market, which can translate to competitive rates and more loan options for buyers like you.

What online tools can help me find and compare home lenders in Arizona?

The internet has made comparing lenders so much easier than it used to be! You don’t have to drive from bank to bank anymore, and you can do most of your research in your pajamas if you want to.

Mortgage calculators are your first stop. These help you estimate monthly payments and see how different interest rates affect your budget. Most lender websites offer these, and they’re incredibly helpful for setting realistic expectations.

Pre-qualification tools let you see how much you might qualify for without hurting your credit score. We offer online prequalification that gives you a clear picture of your borrowing power, so you can shop for homes with confidence.

Review sites and directories like those found through various online platforms provide ratings and real customer experiences. Reading what other borrowers say about their experience can give you valuable insights into how a lender actually treats their clients.

Mobile apps have become game-changers in the mortgage world. Our APM mobile app lets you manage your entire loan process from your phone – check your loan status, upload documents, and stay connected throughout the process.

One crucial step: always verify any lender’s credentials through the NMLS Consumer Access website. Every legitimate mortgage lender has an NMLS ID that you can look up to confirm they’re properly licensed in Arizona. This simple check can save you from potential headaches down the road.

While these tools are fantastic for research, nothing replaces having a knowledgeable mortgage professional guide you through the process and answer your specific questions.

Your Next Step to Arizona Homeownership

You’ve made it through the complete guide to finding the best home lenders arizona has to offer – and that’s no small feat! From understanding the different types of lenders to comparing rates and fees, from Arizona-specific assistance programs to typical closing timelines, you now have all the tools you need to make an informed decision.

The most important thing to remember is that research is your best friend. Don’t just go with the first lender who gives you a quote. Take the time to compare your options, and remember that the lowest interest rate isn’t always the whole story. Look at the bigger picture – customer service, technology, closing speed, and overall experience matter just as much.

Understanding the process is half the battle. When you know what to expect at each stage, from pre-qualification to closing day, the whole journey becomes much less stressful. You’ll be prepared for the documentation requests, the appraisal process, and even those last-minute underwriting conditions that sometimes pop up.

Here’s the thing – we know that shopping for a mortgage the traditional way can feel overwhelming and frankly, a bit broken. That’s exactly why we created Mr. Loans. We believe that getting a home loan should be simple, transparent, and maybe even a little exciting.

Our approach is different. We use expert guidance combined with smart technology to make your mortgage journey as smooth as possible. With tools like our APM mobile app, you can track your loan progress, upload documents, and stay connected throughout the process. Our online prequalification gets you started quickly, so you can make confident offers when you find that perfect Arizona home.

Whether you’re buying your first home, moving up to something bigger, or looking to leverage your home equity, we’re here to simplify what can otherwise be a complex process. We serve communities throughout Arizona and beyond, always with the same goal – making home financing easy and stress-free.

Ready to turn all this knowledge into action? Your Arizona homeownership dreams are closer than you think.