Breaking Down the Barriers: What Arizona Offers First-Time Buyers

First time home buyer Arizona programs exist specifically to help you overcome the biggest obstacles to homeownership. In Arizona, a first-time homebuyer is typically someone who hasn’t owned a principal residence within the last three years – meaning even if you’ve owned before, you might still qualify.

Here’s what Arizona offers first-time buyers:

- Down Payment Assistance: Up to $32,099 through programs like WISH Grant (4:1 matching funds)

- Low Down Payment Options: As little as 3% down with conventional loans, 3.5% with FHA

- Forgivable Loans: Many assistance programs become grants after 3-5 years of residency

- Income Limits: Programs available for households earning up to $146,503 annually

- Credit Flexibility: Minimum scores as low as 580 (FHA) or 640 (Home Plus)

- Closing Cost Help: Most assistance can cover both down payment and closing costs

The challenge is real though. With Arizona’s median home price at $432,373 as of December 2023, and Mesa homes listing at $475,000, saving for a traditional 20% down payment feels impossible for most buyers.

But here’s what many don’t realize: You don’t need 20% down. The average down payment in 2019 was actually just 5.8%, and Arizona offers some of the most generous assistance programs in the country.

The state has recognized that the greatest challenge for new Arizona homebuyers is saving enough for a down payment. That’s why programs like Home Plus AZ offer year-round funding with no sunset dates, while specialized programs help teachers, first responders, veterans, and low-to-moderate income families.

Understanding Arizona’s First-Time Home Buyer Programs

When you’re ready to take the leap into homeownership, Arizona has your back with an impressive array of assistance programs. Whether you’re looking at first time home buyer Arizona programs at the state level, county-specific assistance, or local city programs, there’s likely help available to make your dream home more affordable.

These programs focus on tackling your biggest challenge: down payment assistance (DPA). Think of it as a financial boost that comes in different flavors – some offer forgivable loans that turn into grants after a few years, others provide outright grants you never have to repay, and many help with closing costs too.

The beauty of Arizona’s approach is the variety. You’ve got statewide programs that work anywhere in Arizona, county-specific programs with extra perks for local residents, and city programs that understand the unique needs of their communities.

Contact my team today with your down payment assistance questions!

Statewide Assistance: The Home Plus Program

The Home Plus AZ program is Arizona’s flagship assistance program, and it’s available statewide with no funding limits or sunset dates. That means you can count on it being there when you’re ready to buy, whether that’s next month or next year.

Here’s what makes Home Plus special: you get a 30-year fixed-rate mortgage paired with down payment assistance up to 5% of your loan amount. The assistance typically comes as a forgivable second mortgage with a 3-year term. Stay in your home for three years, and that “loan” becomes a gift you never have to repay.

The program also includes discounted mortgage insurance, which saves you money every month. To qualify, you’ll need a minimum credit score of 640 and your annual income can’t exceed $146,503. One borrower must complete a homebuyer education course before closing, but that’s actually a good thing – you’ll learn valuable skills for successful homeownership.

The Arizona Industrial Development Authority (AZIDA) runs this program, and you can get all the details here: Home Plus Program.

Maricopa County’s Edge: Home in Five

Living in Maricopa County or Phoenix? You’ve hit the jackpot with the Home in Five programs. These county-specific programs offer even more generous assistance than the statewide options.

The Home in Five Advantage Program provides DPA up to 6% of your loan amount. It’s especially generous to teachers, first responders, and military members – recognizing that the people who serve our communities deserve extra support in achieving homeownership.

The Home in Five Platinum Program targets first-time buyers specifically, offering up to 4% assistance as a 0% interest second mortgage. Like other programs, this assistance becomes forgivable over time, meaning you could end up never paying it back if you stay in your home.

Both programs demonstrate Maricopa County’s commitment to keeping homeownership within reach for working families.

Local Support in Major Cities: Phoenix, Tucson & Mesa

Arizona’s major cities add their own layer of support, creating programs that address local housing challenges and community needs.

Phoenix offers down payment assistance for households earning up to 80% of the Area Median Income (AMI). This income-targeted approach ensures help goes to the families who need it most in one of Arizona’s most expensive housing markets.

In Tucson and Pima County, you’ll find the Pima Tucson Homebuyer Solution (PTHS) program. This program combines a 30-year fixed-rate mortgage with assistance for both down payment and closing costs. The best part? The assistance becomes forgivable after just three years of living in your home.

Pima County also administers the City of Tucson DPA Program, which works countywide and can provide up to 20% of your home’s purchase price in assistance. That’s potentially substantial help for your home purchase.

Mesa residents can access the statewide Home Plus program along with other county and federal options, ensuring multiple paths to homeownership assistance.

- El Mirage: http://www.cityofelmirage.org/

- Gilbert: https://www.gilbertaz.gov/departments/community-resources

- Mesa: https://www.mesaaz.gov/residents/housing

- Phoenix: https://www.phoenix.gov/governmentrelations/grant-program/grants-and-funding/housing

- Peoria: https://www.peoriaaz.gov/government/departments/planning-and-community-development/community-assistance/assistance-programs

- Maricopa County: https://maricopahousing.org/

- Pima County: https://www.pima.gov

- Surprise: https://www.surpriseaz.gov/1216/Assistance-Programs

- Tucson: Pima Tucson Homebuyers Solution Program (PTHS): https://pimaida.org/programs-and-impact/pima-tucson-homebuyers-solution/

- Tucson: City of Tucson DPA Program: https://www.tucsonaz.gov/Departments/Housing-and-Community-Development/Advancing-Affordable-Housing/Down-Payment-Assistance-Program

Where to Find Official Program Information

With so many programs available, knowing where to get accurate, up-to-date information is crucial. Don’t rely on outdated websites or second-hand information when making such an important financial decision.

Start with the Arizona Department of Housing for state-level programs and oversight. For federal programs and professional guidance, HUD-approved housing counseling agencies are invaluable resources. These agencies provide free or low-cost counseling, helping you understand your options and steer the application process.

USDA Rural Development offers another path if you’re considering a home in a rural area. These zero-down payment loans can be perfect for buyers who want more space and a quieter lifestyle outside the major metropolitan areas.

The most important resource might be a HUD-approved housing counselor. These professionals can review your specific situation and recommend the best combination of programs for your needs. Find a HUD-Approved Housing Counselor in Arizona.

These programs change periodically, and funding can vary. Always verify current program details and availability directly with the administering agency before making your homebuying plans.

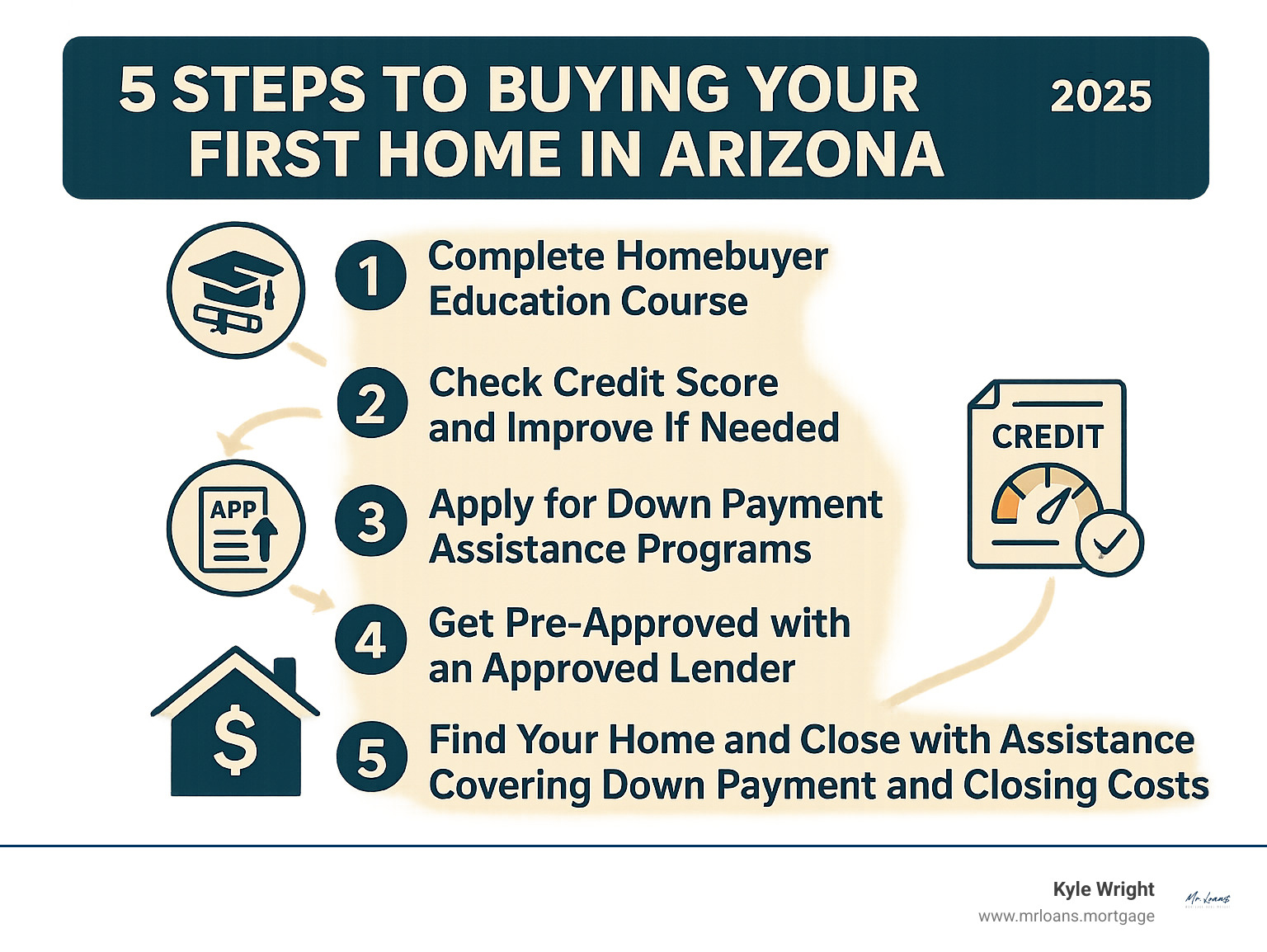

Your Financial Checklist: Qualifying for a First Home

Ready to turn those Arizona homebuying dreams into reality? Here’s the thing – knowing about all these amazing programs is just the first step. The real magic happens when you get your financial house in order. Think of it like training for a marathon – you wouldn’t just show up on race day without preparation, right?

Every first time home buyer Arizona program has its own financial requirements, but they all look at the same basic things: your credit score, how much money you make versus what you owe, and whether you’ve completed homebuyer education. It’s not about being perfect – it’s about being prepared.

The good news? These requirements aren’t designed to keep you out. They’re actually there to help ensure you succeed as a homeowner. Let’s break down what you need to know.

Credit Score: The Key to Opening Loans

Your credit score is basically your financial reputation in three digits. It tells lenders how you’ve handled money in the past, and honestly, it can make or break your homebuying journey. But here’s what many people don’t realize – you don’t need perfect credit to buy a home in Arizona.

The Home Plus program requires a minimum credit score of 640, which is pretty reasonable. But if your score isn’t quite there yet, don’t panic. FHA loans are specifically designed for people with less-than-perfect credit, often accepting scores as low as 580. Some FHA lenders will even work with scores around 500 if you can put down a larger down payment.

Conventional loans typically want to see at least 620, but remember – the higher your score, the better your interest rate will be. Even a small improvement in your credit score can save you thousands over the life of your loan.

Need to boost your credit? The most effective strategies are surprisingly simple. Paying bills on time is absolutely crucial – it’s the biggest factor in your credit score. Reducing your credit card balances below 30% of your limits makes a huge difference too. And whatever you do, avoid opening new credit accounts or making big purchases like a car while you’re in the homebuying process.

Here’s a pro tip: get a free copy of your credit report and look for errors. You’d be surprised how often there are mistakes that can be disputed and removed.

Income and Debt: Meeting Program Limits

Every assistance program has income limits, but before you worry about making “too much” money, know that Arizona’s limits are quite generous. The HOME+Plus program allows annual incomes up to $146,503, which covers a lot of households.

These limits are based on your Area Median Income (AMI), which varies by county and household size. It’s not about keeping successful people out – it’s about making sure assistance goes where it’s needed most.

Your debt-to-income ratio (DTI) is equally important. This is simply your total monthly debt payments divided by your gross monthly income. Most lenders want to see this below 43%, though some programs are more flexible.

Don’t stress about calculating this yourself – we’ve made it easy with our How Much Can I Afford Calculator. It takes the guesswork out of figuring out what you can comfortably afford.

The goal isn’t just to qualify for the biggest loan possible. It’s to find a payment that fits comfortably in your budget so you can actually enjoy your new home.

The Mandatory Step: Homebuyer Education for a First Time Home Buyer in Arizona

We get it – when you’re excited about buying a house, the last thing you want to do is sit through a class. But here’s the truth: homebuyer education is one of the best investments you’ll make in your homebuying journey.

Nearly every first time home buyer Arizona program requires completion of a homebuyer education course, including Home Plus AZ and most down payment assistance programs. These aren’t boring lectures designed to waste your time – they’re practical workshops that can save you thousands of dollars and major headaches.

The courses cover everything you need to know: how to create a realistic household budget that includes all the hidden costs of homeownership, understanding different mortgage products and how interest rates work, navigating the entire process from application to closing, and what it really means to be a homeowner beyond just making mortgage payments.

Think about it this way – you’re about to make the biggest purchase of your life. Spending a few hours learning how to do it right is pretty smart, don’t you think?

The education requirement isn’t just a box to check. It’s designed to set you up for long-term success as a homeowner. You’ll learn about maintenance, property taxes, insurance, and all those other costs that can surprise new homeowners.

You can find detailed information about homebuyer education requirements through the Home Plus program here: Home Plus Home Buyer Education Information.

The bottom line? Getting your finances ready isn’t about jumping through hoops – it’s about setting yourself up for success. When you’re financially prepared, you’ll not only qualify for better programs and rates, but you’ll also feel confident and excited about your purchase instead of stressed and worried.

Choosing Your Loan: The Foundation of Your Purchase

Once you’ve got your finances in order and understand the assistance programs available, it’s time to tackle one of the most important decisions in your homebuying journey: choosing the right mortgage loan. Think of this as picking the foundation for your dream home – it needs to be solid, reliable, and perfectly suited to your situation.

The mortgage world can feel overwhelming at first, but it really comes down to understanding a few key options. You’ll hear terms like fixed-rate and adjustable-rate mortgages thrown around. A fixed-rate mortgage is like having a steady, dependable friend – your monthly payment stays exactly the same for the entire loan term, usually 15 or 30 years. This predictability makes budgeting a breeze.

An adjustable-rate mortgage (ARM) starts with a lower interest rate that seems tempting, but then adjusts periodically based on market conditions. While ARMs can offer lower initial payments, they’re a bit like a roller coaster – you never know if your payment will go up or down. For most first time home buyer Arizona situations, the peace of mind that comes with a fixed-rate loan is worth its weight in gold.

Here’s a quick comparison of the most common loan types:

| Loan Type | Down Payment | Minimum Credit Score | Mortgage Insurance |

|---|---|---|---|

| FHA Loans | 3.5% | 580 | Required (MIP) |

| VA Loans | 0% | Varies (often 620) | Not required |

| Conventional Loans | 3% – 20%+ | 620 | Required (PMI) if less than 20% down |

Government-Backed Loans for the First Time Home Buyer in Arizona

Government-backed loans are like having Uncle Sam as your co-signer – they’re designed specifically to help people achieve homeownership when traditional financing might be out of reach. These loans often come with more forgiving requirements, especially when it comes to down payments and credit scores.

FHA Loans are the workhorses of first-time homebuying. Backed by the Federal Housing Administration, these loans require just 3.5% down and accept credit scores as low as 580. They’re incredibly popular because they understand that not everyone has perfect credit or a huge savings account. The trade-off is that you’ll pay mortgage insurance premiums (MIP) both upfront and monthly, which adds to your costs. But for many buyers, this small price is worth the opportunity to own a home sooner rather than later. FHA Loans can be an excellent stepping stone to homeownership.

VA Loans are hands-down one of the best deals in real estate – if you qualify. Available to veterans, active-duty service members, and eligible surviving spouses, these loans offer zero down payment and typically no ongoing mortgage insurance. It’s a well-deserved benefit for those who’ve served our country. Credit requirements are generally reasonable, often around 620, though this can vary by lender. If you’re eligible, VA loans are tough to beat. Learn more about VA Loans and how they can work for your situation.

USDA Loans are the hidden gem for buyers looking outside major cities. Backed by the U.S. Department of Agriculture, these loans offer zero down payment for eligible properties in designated rural areas. They’re designed for low-to-moderate income families and have specific income limits and location requirements. If you’re dreaming of a home with some elbow room, USDA loans might be your ticket there.

Conventional Loans: A Path for Stronger Credit

Conventional loans aren’t backed by the government, but don’t let that scare you away. These loans, which follow guidelines set by Fannie Mae and Freddie Mac, have evolved significantly over the years.

Gone are the days when you needed 20% down for a conventional loan. Programs like the Conventional 97 allow you to put down as little as 3%, making them competitive with FHA loans. The difference? If you put down less than 20%, you’ll pay Private Mortgage Insurance (PMI), but here’s the good news – you can cancel PMI once you reach 20% equity in your home. That’s different from FHA’s MIP, which often sticks around for the life of the loan.

Conventional loans typically prefer higher credit scores (usually 620 or above) and lower debt-to-income ratios than FHA loans. But if you have strong credit, a conventional mortgage could offer more competitive interest rates and greater flexibility in your home purchase.

The beauty of having options is that there’s likely a perfect fit for your unique situation. Choosing between these loan types doesn’t have to be a guessing game. We’re here to help you compare options and find the mortgage that aligns perfectly with your financial situation and homeownership goals: Which Loan is Right For Me?.

Frequently Asked Questions about Buying Your First Home in Arizona

When you’re ready to take the leap into homeownership, it’s natural to have questions. We’ve helped countless Arizona families steer their home buying journey, and these are the questions that come up time and time again.

Can I get assistance if I’ve owned a home before?

Here’s something that surprises many people: you might still qualify for first time home buyer Arizona programs even if you’ve owned a home before! The term “first-time buyer” doesn’t necessarily mean you’ve never owned property.

Most Arizona programs define a first-time homebuyer as someone who hasn’t owned a principal residence within the last three years. So if you sold your home four years ago, or went through a divorce and haven’t owned a home since, you could still be eligible for these valuable programs.

This three-year rule opens doors for many people who thought they were out of luck. Whether you owned a home in Arizona, California, or anywhere else, what matters is that three-year window. Programs like the Home in Five Advantage in Maricopa County specifically welcome both first-time and repeat buyers who meet their criteria.

Don’t assume you’re disqualified just because you’ve owned before. It’s worth checking with a housing counselor or your lender to see if you meet the current definition.

Can down payment assistance be used for closing costs?

This is one of our favorite questions to answer because the news is usually great! Yes, most Arizona down payment assistance programs are flexible enough to cover closing costs too.

Think about it – if you’re struggling to save for a down payment, you’re probably also worried about closing costs. These typically run 2% to 5% of your home’s purchase price and include things like loan origination fees, appraisal costs, title insurance, and attorney fees. On a $400,000 home, that could mean $8,000 to $20,000 in additional costs.

The good news is that programs like Home Plus AZ understand this challenge. Their assistance can be used for your down payment, closing costs, or a smart combination of both. This flexibility can dramatically reduce what you need to bring to the closing table.

Every program has its own rules, so always confirm the specifics with your lender or program administrator. But this feature is common across Arizona’s assistance programs because they want to remove as many barriers as possible.

What is a Mortgage Credit Certificate (MCC)?

A Mortgage Credit Certificate might sound complicated, but it’s actually a pretty sweet deal that many first time home buyer Arizona families overlook. Think of it as the government’s way of giving you a yearly thank-you for being a homeowner.

An MCC is a federal tax credit that reduces your income tax liability dollar-for-dollar based on a portion of the mortgage interest you pay each year. The credit is typically capped at $2,000 annually, but that’s real money back in your pocket every tax season.

Here’s how it works: Let’s say you pay $12,000 in mortgage interest during the year, and your MCC gives you a 20% credit rate. You’d get a $2,000 tax credit (since that’s the typical cap). That’s not a deduction – it’s a direct reduction of the taxes you owe.

This ongoing benefit can make your monthly budget more manageable and your tax refunds more substantial. It’s like getting a bonus for being a responsible homeowner, and it continues for as long as you live in the home and have the mortgage.

Not every lender or program offers MCCs, so ask about them when you’re exploring your options. They’re another tool in Arizona’s toolkit to make homeownership more affordable for families just starting out.

Conclusion: Your Journey to Arizona Homeownership Starts Now

We’ve covered a lot of ground together today, haven’t we? From exploring the generous first time home buyer Arizona programs like Home Plus AZ and Home in Five, to working through your financial checklist and finding the perfect loan for your situation. Here’s what it all boils down to: Arizona truly wants you to succeed as a homeowner.

The biggest barrier – that intimidating down payment – doesn’t have to stop you. With programs offering up to 6% assistance, forgivable loans that can turn into grants, and flexible options that cover both down payments and closing costs, you’re not facing this mountain alone.

Think about it: you could be holding keys to your own Arizona home sooner than you imagined. Maybe it’s a cozy place in Phoenix with mountain views, or a charming home in Tucson where you can finally paint the walls any color you want. Homeownership isn’t just about having a place to sleep – it’s about building something that’s truly yours, creating equity for your future, and having the stability that comes with putting down roots.

The Arizona housing market might seem challenging with median prices around $432,373, but remember – the average down payment nationwide is just 5.8%. You don’t need that traditional 20% that your parents might have saved for decades ago.

Expert guidance makes all the difference in this journey. The mortgage process can feel like learning a new language, but you don’t have to figure it out alone. At Mr. Loans, we’ve helped countless Arizona families steer these programs and find their perfect home financing solution. Our APM mobile app simplifies the entire process, and we’re here to help you confidently make offers when you find “the one.”

Your dream home in the Grand Canyon State is waiting. Take that first step today – complete a homebuyer education course, check your credit score, or simply reach out to learn which programs might work best for your situation.

The hardest part is often just getting started. Once you do, you’ll be amazed at how many doors open up.