Wondering about the difference between a home equity loan vs. HELOC? They are both powerful ways to tap into your home’s value. If you have home equity and need cash for a renovation, debt consolidation, or another major expense, a home equity loan or HELOC can provide the funds you need.

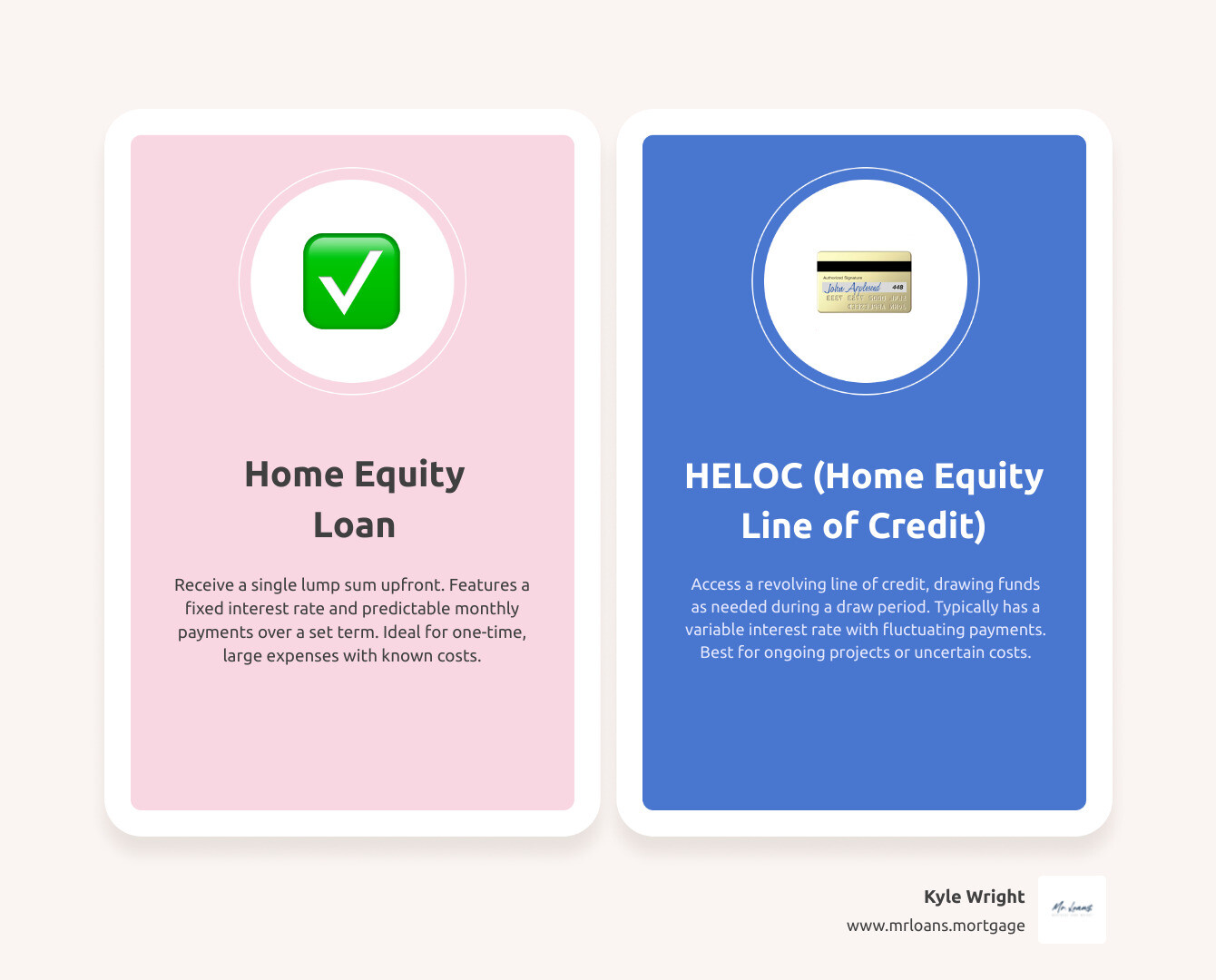

Here is a quick look at a home equity loan vs. HELOC.

Quick Answer:

| Feature | Home Equity Loan | HELOC |

|---|---|---|

| Funds | Lump sum at closing | Draw as needed up to limit |

| Interest Rate | Fixed | Variable (usually) |

| Payments | Fixed monthly amount | Fluctuate based on balance |

| Best For | One-time large expense | Ongoing or uncertain costs |

A home equity loan is a second mortgage that gives you a lump sum upfront. You repay it with fixed monthly payments over a set term (5 to 30 years), offering a predictable payment schedule.

A HELOC (Home Equity Line of Credit) is a revolving line of credit secured by your home. You can draw from it as needed during a “draw period” (typically 5-10 years) and only pay interest on what you use.

Both options let you borrow against your home’s equity (the difference between its value and your mortgage balance). Because your home is collateral, they typically offer lower interest rates than credit cards or personal loans. The right choice depends on whether you need a known amount for a fixed cost or flexible access to funds over time.

What Are Home Equity Loans and HELOCs?

Think of your home equity as the financial reward for your mortgage payments. It’s the portion of your home that’s truly yours—the difference between its current value and what you owe. As your mortgage balance shrinks and your home’s value grows, your equity builds like a savings account you can borrow against.

Both home equity loans and HELOCs let you tap into this equity, but they work very differently.

What is a Home Equity Loan?

A home equity loan provides a lump-sum disbursement at closing. It’s a second mortgage with a fixed interest rate and a set repayment term, typically from 5 to 30 years. This means you get predictable, fixed monthly payments that cover both principal and interest, making budgeting straightforward. Because your home is used as collateral, lenders can offer lower rates than unsecured loans. We offer competitive home equity loans to help you access your home’s value without guesswork.

What is a HELOC (Home Equity Line of Credit)?

A HELOC works like a credit card backed by your home. You’re approved for a maximum credit limit and can draw from this revolving credit line as needed. The key benefit is flexibility: you only pay interest on the amount you use.

A HELOC has two phases:

- The Draw Period (5-10 years): You can borrow funds as needed. Payments are often interest-only, keeping them low.

- The Repayment Period (10-20 years): You can no longer draw funds. Your payments will increase to cover both principal and interest on the outstanding balance.

HELOCs usually have a variable interest rate, so your payments can change with market conditions. It’s crucial to understand both phases before committing. For more details, the Consumer Financial Protection Bureau offers a guide to understand how HELOCs work.

Key Differences: Home Equity Loan vs. HELOC

While both options let you tap into your home’s value, how they work day-to-day can make a huge difference in your financial life.

| Feature | Home Equity Loan | HELOC |

|---|---|---|

| Fund Disbursement | Single lump sum upfront | Revolving line of credit; draw as needed up to a limit |

| Interest Rate | Fixed, stable throughout the loan term | Variable, fluctuates with market rates (e.g., Prime Rate) |

| Payment Structure | Fixed monthly payments (principal + interest) | Variable monthly payments; often interest-only during draw period |

| Loan Term | Fixed repayment period (e.g., 5-30 years) | Two phases: Draw period (5-10 years) + Repayment period (10-20 years) |

| Flexibility | Less flexible; receive all funds at once | Highly flexible; borrow, repay, and re-borrow as needed |

| Interest Paid On | Entire lump sum from day one | Only on the amount of money you actually use |

The biggest decision point is whether you need all your funds now for a specific purpose or prefer the flexibility to draw money over time.

Payment Structures: Home Equity Loan vs. HELOC

How you repay the money significantly impacts your monthly budget.

A home equity loan offers simplicity. You make the same amortized payment (principal and interest) every month. Your payment in month one is the same as your payment in year five, making budgeting predictable.

A HELOC is more complex. During the draw period, many allow interest-only payments, which keeps monthly costs low. However, you aren’t paying down the principal. When the repayment period begins, your payment will jump to include both principal and interest, a “payment shock” that can strain budgets. This makes budgeting more complex, but our what will my monthly payment be? calculator can help you prepare.

Interest Rates: Home Equity Loan vs. HELOC

The interest rate structure is another major difference.

Home equity loans offer fixed-rate stability. The rate you lock in at closing is yours for the life of the loan, protecting you from market fluctuations.

HELOCs typically have variable rates tied to the Prime Rate. When the Federal Reserve adjusts rates, your HELOC rate and payment can change. This variable-rate risk means your payment could increase based on economic conditions.

Both options usually have lower rates than unsecured debt like credit cards because your home serves as collateral. The choice depends on your comfort with risk versus your need for predictability.

Pros, Cons, and When to Choose Each Option

Deciding between a Home Equity Loan vs. HELOC comes down to your financial situation, risk tolerance, and the type of expense you’re planning to tackle.

Both are powerful tools for home improvement projects, debt consolidation, education expenses, or emergency situations. The key is matching the right tool to your needs.

When a Home Equity Loan is the Better Choice

A home equity loan is ideal for a large, one-time expense with a known cost, like a major home renovation with a contractor bid or consolidating a specific amount of debt. The benefits include:

- Predictability: A fixed interest rate and consistent monthly payments make budgeting simple and protect you from rising rates.

- Lump-Sum Funding: You receive all the money at once, allowing you to pay for your project immediately.

- Spending Discipline: Receiving a finite amount for a specific purpose can help prevent overspending, unlike the temptation of a revolving credit line.

When a HELOC is the Better Choice

A HELOC’s flexibility is its main advantage, making it perfect for ongoing projects or uncertain costs. Consider a HELOC if you:

- Need Funds Over Time: For projects like a DIY renovation or multi-year tuition payments, you can draw money as expenses arise.

- Want to Save on Interest: You only pay interest on what you use, which can save you money compared to a lump-sum loan where you pay interest on the full amount from day one.

- Desire an Emergency Fund: A HELOC can serve as a financial safety net for unexpected expenses. If you don’t use it, you don’t pay interest.

- Value Flexibility: The ability to borrow, repay, and re-borrow during the draw period offers significant control, but it requires financial discipline to manage the variable rate and prepare for the repayment period.

Qualifying for Home Equity Financing

Qualifying for a home equity loan or HELOC involves a similar process for both. At Mr. Loans, we’ve designed the loan process to be straightforward. The journey begins with a home appraisal to determine your home’s current market value, followed by submitting application documents like proof of income (pay stubs, W-2s, tax returns). For a detailed list, Experian offers a helpful guide on requirements for a home equity loan or HELOC.

Common Qualification Requirements

Lenders evaluate several key factors:

- Home Equity: You’ll typically need to retain at least 15–20% equity after the loan. Lenders look at your Combined Loan-to-Value (CLTV) ratio, which is your total mortgage debt divided by your home’s value. Most cap the CLTV at 80-85%.

- Credit Score: A score of 680-700 or higher is often preferred. A higher score can lead to better rates. You can monitor your credit with services like a free myEquifax™account.

- Debt-to-Income (DTI) Ratio: This compares your total monthly debt payments to your gross monthly income. Lenders generally look for a DTI under 43-50% to ensure you can comfortably handle another payment.

Calculating Your Potential Loan Amount

Here’s a simple way to estimate how much you might borrow:

- Determine Maximum Loan Value: Multiply your home’s current value by the lender’s allowed CLTV (e.g., 85%).

- Example: $400,000 (Home Value) x 0.85 = $340,000

- Calculate Tappable Equity: Subtract your current mortgage balance from the maximum loan value.

- Example: $340,000 – $200,000 (Mortgage Balance) = $140,000 (Potential Loan Amount)

This is your tappable equity. To get a personalized estimate, use our how much can I afford? calculator. Remember to borrow only what you need and can comfortably repay.

Risks, Alternatives, and Other Considerations

Tapping into your home equity is a major decision. It’s crucial to understand the risks and alternatives before committing. While there are benefits of using home equity, it’s important to be aware of the potential downsides.

Understanding the Risks of Home Equity Borrowing

Both home equity loans and HELOCs use your home as collateral, which comes with significant risks:

- Foreclosure Risk: If you cannot make your payments, the lender can foreclose on your home, even if your primary mortgage is current.

- Falling Home Values: If the market declines, you could end up “underwater,” owing more than your home is worth. This makes selling or refinancing difficult.

- HELOC Rate Increases: The variable rate on a HELOC can rise with market conditions, leading to unpredictable and potentially much higher payments.

- Temptation to Overspend: The easy access to funds with a HELOC can lead to accumulating more debt than intended. Financial discipline is essential.

Alternatives to Home Equity Loans and HELOCs

If you’re hesitant to use your home as collateral, consider these options:

- Personal Loans: These are unsecured, meaning your home is not at risk. Interest rates are typically higher, but they offer peace of mind for those who prefer not to leverage their home.

- Cash-Out Refinance: This replaces your current mortgage with a new, larger one, and you receive the difference in cash. Our refinance solutions can help you explore this option, which consolidates your debt into a single monthly payment, usually with a fixed rate. The main drawback is that you restart your mortgage term.

Are Home Equity Loans and HELOCs Tax-Deductible?

The interest you pay may be tax-deductible, but only under specific IRS rules. Generally:

- The funds must be used to “buy, build, or substantially improve” the home securing the loan. Using the money for debt consolidation or a vacation means the interest is likely not deductible.

- You must itemize deductions on your tax return.

- There are limits on the total amount of debt for which you can deduct interest.

Tax laws are complex and can change. We strongly recommend consulting a tax professional for personalized advice. For official guidance, see the IRS page on the topic.

Conclusion

Choosing between a Home Equity Loan vs. HELOC depends on your financial goals and comfort with risk.

A home equity loan is ideal if you value stability. With a lump-sum payment, a fixed interest rate, and predictable monthly payments, it’s perfect for large, one-time expenses like a major renovation or debt consolidation.

A HELOC offers flexibility. It’s a revolving line of credit that lets you draw funds as needed, paying interest only on what you use. This makes it great for ongoing projects or as an emergency fund, but you must be comfortable with a variable interest rate and potential payment changes.

Both options leverage the equity you’ve built and typically offer lower rates than unsecured loans. The right choice is the one that aligns with your financial needs.

At Mr. Loans, we’re here to help you decide. Serving clients in Chandler, across Arizona, and Texas, we understand the importance of making the right financial choice for your home. Our APM mobile app and online prequalification tools simplify the process, giving you the confidence to move forward.

Wise financial management starts with informed decisions. Take your time, and know that we’re here to guide you. Ready to explore how your home equity can work for you? Contact us today and let’s talk about your goals.